Tuesday, September 29

Monday, September 28

Nifty Technical View

Hi All,

Seasons Greetings to all Blog Reader

The Week gone by was an expiry week and Nifty ended up the week at just 0.33% up.In absolute terms we have outperformed our peers where all Asian markets were down between 1-3% we were up by 0.33%.Till how long this out performance can continue?

China's Market is in a downtrend and if one remember Aug 07 china went into downtrend and we follow up in jan.The rally which we are witnessing is a Liquidity driven rally which if starts cooling off the sell off will be quiet ferocious.

We need a correction for a healthy market.

Technically speaking as per my analysis the upside is quiet minimum at max if 5016 is crossed we may see 5150 5300 levels.Down side risk remains and is quiet substantial.

From the Daily Charts which are attached above We have close below 5EMA last friday 4964 but such whip saws can be ignored.

For the coming Trading Session Levels are as follows:

Pivot Levels:4964

Resistance:4991 5024 5055

Support:4929 4898 4865

Weekly Pivot:4966

Weekly Resistance:5029 5099

Weekly Support:4897 4834

An important observation to ponder upon:

Inspite of a huge FII in flow of almost 9800 Cr in just 7 trading days (even if a good part of is taken as bulk deals / private placement, even then the remaining can only be sizable) the effect on nifty is just an abysmal 184 pts - most of it on 'gap up' openings.

Seasons Greetings to all Blog Reader

The Week gone by was an expiry week and Nifty ended up the week at just 0.33% up.In absolute terms we have outperformed our peers where all Asian markets were down between 1-3% we were up by 0.33%.Till how long this out performance can continue?

China's Market is in a downtrend and if one remember Aug 07 china went into downtrend and we follow up in jan.The rally which we are witnessing is a Liquidity driven rally which if starts cooling off the sell off will be quiet ferocious.

We need a correction for a healthy market.

Technically speaking as per my analysis the upside is quiet minimum at max if 5016 is crossed we may see 5150 5300 levels.Down side risk remains and is quiet substantial.

From the Daily Charts which are attached above We have close below 5EMA last friday 4964 but such whip saws can be ignored.

For the coming Trading Session Levels are as follows:

Pivot Levels:4964

Resistance:4991 5024 5055

Support:4929 4898 4865

Weekly Pivot:4966

Weekly Resistance:5029 5099

Weekly Support:4897 4834

An important observation to ponder upon:

Inspite of a huge FII in flow of almost 9800 Cr in just 7 trading days (even if a good part of is taken as bulk deals / private placement, even then the remaining can only be sizable) the effect on nifty is just an abysmal 184 pts - most of it on 'gap up' openings.

Sunday, September 27

Short-term trading and survival

Hi Readers,

Happy Dussera to alll.

For all my readers i am presenting maxims which if implemented can be a great help.

1. It's all about survival.

No platitudes here, speculating is very dangerous business. It is not about winning or losing, it is about surviving the lows and the highs. If you don't survive, you can't win.

The first requirement of survival is that you must have a premise to speculate upon. Rumors, tips, full moons and feelings are not a premise. A premise suggests there is an underlying truth to what you are taking action upon. A short-term trader's premise may be different from a long-term player's but they both need to have proven logic and tools. Most investors and traders spend more time figuring out which laptop to buy than they do before plunking down tens of thousands of dollars on a snap decision, or one based upon totally fallacious reasoning.

There is some rhyme and reason to how, why and when markets move - not enough - but it is there. The problem is that there are more techniques that don't work, than there are techniques that do. I suggest you spend an immense and inordinate amount of time and effort learning these critical elements before entering the foray of financial frolics.

So, you have money management under control, have a valid system, approach or premise to act upon - you still need control of yourself.

2. Ultimately this is an emotional game - always has been, always will be.

Anytime money is involved - your money - blood boils, sweaty hands prevail, and mental processes are shortcircuited by illogical emotions. Just when most traders buy, they should have sold! Or, fear, a major emotion, scares them away from a great trade/investment. Or, their bet is way too big. The money management decision becomes an emotional one, not one of logic.

3. Greed prevails - proving you are more motivated by greed than fear and understanding the difference.

The mere fact you are a speculator means you have less fear than a 'normal' person does. You are more motivated by making money. Other people are more motivated by not losing.

Greed is the trader's Achilles' heel. Greed will keep hopes alive, encourage you to hold on to losing trades and nail down winners too soon. Hope is your worst enemy because it causes you to dream of great profits, to enter an unreal world. Trust me, the world of speculating is very real, people lose all they have, marriages are broken up, families tossed asunder by either enormous gains or losses.

My approach to this is to not take any of it very seriously; the winnings may be fleeting, always pursued by the taxman, lawyers and nefarious investment schemes.

How you handle greed is different than I do, so I cannot give an absolute maxim here, but I can tell you this, you must get it in control or you will not survive.

4. Fear inhibits risk taking - just when you should take risk.

Fear causes you to not do what you should do. You frighten yourself out of trades that are winners in deference to trades that lose or go nowhere. Succinctly stated, greed causes you to do what we should not do, fear causes us to not do what we should do.

Fear, psychologists say, causes you to freeze up. Speculators act like a deer caught in the headlights of a car. They can see the car - a losing trade, coming at them - at 120 miles per hour - but they fail to take the action they should.

Worse yet, they take a pass on the winning trades. Why, I do not know. But I do know this: the more frightened I am of taking a trade the greater the probabilities are it will be a winning trade. Most investors scare themselves out of greatness.

5. Money management is the creation of wealth.

Sure, you can make money as a trader or investor, have a good time, and get some great stories to tell. But, the extrapolation of profits will not come as much from your trading and investing skills as how you manage your money.

I'm probably best known for winning the Robbins World Cup Trading Championship, turning $10,000 into $1,100,000.00 in 12 months. That was real money, real trades, and real time performance. For years people have asked for my trades to figure out how I did it. I gladly oblige them, they will learn little there - what created the gargantuan gain was not great trading ability nearly as much as the very aggressive form of money management I used. The approach was to buy more contracts when I had more equity in my account, cut back when I had less. That's what made the cool million smackers - not some great trading skill.

Ten years later my 16-year-old daughter won the same trading contest taking $10,000 to $110,000.00 (The second best performance in the 20-year history of the championship). Did she have any trading secret, any magical chart, line, and formula? No. She simply followed a decent system of trading, backed with a superior form of money management.

6. Big money does not make big bets.

You have probably read the stories of what I call the swashbuckler traders, like Jesse Livermore, John 'bet a millions' Gates, Niederhoffer, Frankie Joe and the like. They all ultimately made big bets and lost big time.

Smart money never bets big. Why should it? You can win big on small bets, see #5 above, but eventually if you bet big you will lose - and you will lose big.

It's like Russian Roulette. You may well spin the chamber holding the bullet many times and never lose. But spin it often enough and there can be only one result: death. If you make big bets you are destined to be a big loser. Plunging is a loser's game; it can only set you up for failure. I never bet big (I used to - been there and done that and trust me, it is no way to live). I bet a small percent of my account, bankroll if you will. That way I have controlled loss. There can be no survival without damage control.

7.God may delay but God does not deny.

I never know when during a year I will make my money. It may be on the first trade of the year, or the last (though I hope not). Victory is there to be grasped, but you must be prepared to do battle for a long period of time.

Additionally, while far from a religious person, I think the belief in a much higher power, God, is critical to success as a trader. It helps puts wins and losses into perspective, enables you to persevere through lots of pain and punishment when you know that ultimately all will be right or rewarded in some fashion.

God and the markets is not a fashionable concept - I would never abuse what little connection I have with God to pray for profits. Yet that connection is what keeps people going in times of strife, in fox holes and commodity pits.

8. I believe the trade I'm in right now will be a loser.

This is my most powerful belief and asset as a trader. Most would be wannabes are certain they will make a killing on their next trade. These folks have been to some 'Pump 'em up, plastic coat their lives' motivational meeting where they were told to think positive thoughts. They took lessons in affirming their future would be great. They believe their next trade will be a winner.

Not me! I believe at the bottom of my core it will be a loser. I ask you this question - who will have their stops in and take right action, me or the fellow pumped up on an irrational belief he's figured out the market? Who will plunge, the positive affirmer or me?

If you have not figured that one out - I'll tell you; I will succeed simply because I am under no delusion that I will win. Accordingly, my action will be that of an impeccable warrior. I will protect myself in all fashion, at all times - I will not become run away with hope and unreality.

9. Your fortune will come from your focus - focus on one market or one technique.

A jack of all trades will never become a winning tradee. Why? Because a trader must zero in on the markets, paying attention to the details of trading without allowing his emotions to intervene.

A moment of distraction is costly in this business. Lack of attention may mean you don't take the trade you should, or neglect a trade that leads to great cost.

Focus, to me, means not only focusing on the task at hand but also narrowing your scope of trading to either one or two markets or to the specific approach of a trading technique.

Have you ever tried juggling? It's pretty hard to learn to keep three balls in the area at one time. Most people can learn to watch those 'details' after about 3 hours or practice. Add one ball, one more detail to the mess, and few, very few, people can make it as a juggler. It's precisely that difficult to keep your eyes on just one more 'chunk' of data.

Look at the great athletes - they focus on one sport. Artists work on one primary business, musicians don't sing country & western and opera and become stars. The better your focus, in whatever you do, the greater your success will become.

10. When in doubt, or all else fails - go back to Rule One.

Happy Dussera to alll.

For all my readers i am presenting maxims which if implemented can be a great help.

1. It's all about survival.

No platitudes here, speculating is very dangerous business. It is not about winning or losing, it is about surviving the lows and the highs. If you don't survive, you can't win.

The first requirement of survival is that you must have a premise to speculate upon. Rumors, tips, full moons and feelings are not a premise. A premise suggests there is an underlying truth to what you are taking action upon. A short-term trader's premise may be different from a long-term player's but they both need to have proven logic and tools. Most investors and traders spend more time figuring out which laptop to buy than they do before plunking down tens of thousands of dollars on a snap decision, or one based upon totally fallacious reasoning.

There is some rhyme and reason to how, why and when markets move - not enough - but it is there. The problem is that there are more techniques that don't work, than there are techniques that do. I suggest you spend an immense and inordinate amount of time and effort learning these critical elements before entering the foray of financial frolics.

So, you have money management under control, have a valid system, approach or premise to act upon - you still need control of yourself.

2. Ultimately this is an emotional game - always has been, always will be.

Anytime money is involved - your money - blood boils, sweaty hands prevail, and mental processes are shortcircuited by illogical emotions. Just when most traders buy, they should have sold! Or, fear, a major emotion, scares them away from a great trade/investment. Or, their bet is way too big. The money management decision becomes an emotional one, not one of logic.

3. Greed prevails - proving you are more motivated by greed than fear and understanding the difference.

The mere fact you are a speculator means you have less fear than a 'normal' person does. You are more motivated by making money. Other people are more motivated by not losing.

Greed is the trader's Achilles' heel. Greed will keep hopes alive, encourage you to hold on to losing trades and nail down winners too soon. Hope is your worst enemy because it causes you to dream of great profits, to enter an unreal world. Trust me, the world of speculating is very real, people lose all they have, marriages are broken up, families tossed asunder by either enormous gains or losses.

My approach to this is to not take any of it very seriously; the winnings may be fleeting, always pursued by the taxman, lawyers and nefarious investment schemes.

How you handle greed is different than I do, so I cannot give an absolute maxim here, but I can tell you this, you must get it in control or you will not survive.

4. Fear inhibits risk taking - just when you should take risk.

Fear causes you to not do what you should do. You frighten yourself out of trades that are winners in deference to trades that lose or go nowhere. Succinctly stated, greed causes you to do what we should not do, fear causes us to not do what we should do.

Fear, psychologists say, causes you to freeze up. Speculators act like a deer caught in the headlights of a car. They can see the car - a losing trade, coming at them - at 120 miles per hour - but they fail to take the action they should.

Worse yet, they take a pass on the winning trades. Why, I do not know. But I do know this: the more frightened I am of taking a trade the greater the probabilities are it will be a winning trade. Most investors scare themselves out of greatness.

5. Money management is the creation of wealth.

Sure, you can make money as a trader or investor, have a good time, and get some great stories to tell. But, the extrapolation of profits will not come as much from your trading and investing skills as how you manage your money.

I'm probably best known for winning the Robbins World Cup Trading Championship, turning $10,000 into $1,100,000.00 in 12 months. That was real money, real trades, and real time performance. For years people have asked for my trades to figure out how I did it. I gladly oblige them, they will learn little there - what created the gargantuan gain was not great trading ability nearly as much as the very aggressive form of money management I used. The approach was to buy more contracts when I had more equity in my account, cut back when I had less. That's what made the cool million smackers - not some great trading skill.

Ten years later my 16-year-old daughter won the same trading contest taking $10,000 to $110,000.00 (The second best performance in the 20-year history of the championship). Did she have any trading secret, any magical chart, line, and formula? No. She simply followed a decent system of trading, backed with a superior form of money management.

6. Big money does not make big bets.

You have probably read the stories of what I call the swashbuckler traders, like Jesse Livermore, John 'bet a millions' Gates, Niederhoffer, Frankie Joe and the like. They all ultimately made big bets and lost big time.

Smart money never bets big. Why should it? You can win big on small bets, see #5 above, but eventually if you bet big you will lose - and you will lose big.

It's like Russian Roulette. You may well spin the chamber holding the bullet many times and never lose. But spin it often enough and there can be only one result: death. If you make big bets you are destined to be a big loser. Plunging is a loser's game; it can only set you up for failure. I never bet big (I used to - been there and done that and trust me, it is no way to live). I bet a small percent of my account, bankroll if you will. That way I have controlled loss. There can be no survival without damage control.

7.God may delay but God does not deny.

I never know when during a year I will make my money. It may be on the first trade of the year, or the last (though I hope not). Victory is there to be grasped, but you must be prepared to do battle for a long period of time.

Additionally, while far from a religious person, I think the belief in a much higher power, God, is critical to success as a trader. It helps puts wins and losses into perspective, enables you to persevere through lots of pain and punishment when you know that ultimately all will be right or rewarded in some fashion.

God and the markets is not a fashionable concept - I would never abuse what little connection I have with God to pray for profits. Yet that connection is what keeps people going in times of strife, in fox holes and commodity pits.

8. I believe the trade I'm in right now will be a loser.

This is my most powerful belief and asset as a trader. Most would be wannabes are certain they will make a killing on their next trade. These folks have been to some 'Pump 'em up, plastic coat their lives' motivational meeting where they were told to think positive thoughts. They took lessons in affirming their future would be great. They believe their next trade will be a winner.

Not me! I believe at the bottom of my core it will be a loser. I ask you this question - who will have their stops in and take right action, me or the fellow pumped up on an irrational belief he's figured out the market? Who will plunge, the positive affirmer or me?

If you have not figured that one out - I'll tell you; I will succeed simply because I am under no delusion that I will win. Accordingly, my action will be that of an impeccable warrior. I will protect myself in all fashion, at all times - I will not become run away with hope and unreality.

9. Your fortune will come from your focus - focus on one market or one technique.

A jack of all trades will never become a winning tradee. Why? Because a trader must zero in on the markets, paying attention to the details of trading without allowing his emotions to intervene.

A moment of distraction is costly in this business. Lack of attention may mean you don't take the trade you should, or neglect a trade that leads to great cost.

Focus, to me, means not only focusing on the task at hand but also narrowing your scope of trading to either one or two markets or to the specific approach of a trading technique.

Have you ever tried juggling? It's pretty hard to learn to keep three balls in the area at one time. Most people can learn to watch those 'details' after about 3 hours or practice. Add one ball, one more detail to the mess, and few, very few, people can make it as a juggler. It's precisely that difficult to keep your eyes on just one more 'chunk' of data.

Look at the great athletes - they focus on one sport. Artists work on one primary business, musicians don't sing country & western and opera and become stars. The better your focus, in whatever you do, the greater your success will become.

10. When in doubt, or all else fails - go back to Rule One.

Saturday, September 26

Murphy's laws of technical trading

John Murphy

Murphy's laws of technical trading

Introduction

John Murphy's ten laws of technical trading explain the main ideas to beginners and streamline the trading methodology for experienced practitioners. The precepts define the key tools of technical analysis and show how to use them to identify buying and selling opportunities.

1. Map the trends.

Study long-term charts. Begin a chart analysis with monthly and weekly charts spanning several years. A larger scale 'map of the market' provides more visibility and a better long-term perspective on a market. Once the long-term has been established, then consult daily and intra-day charts. A short-term view alone can often be deceptive. Even if you only trade the very short term, you will do better if you're trading in the same direction as the intermediate and longer term trends.

2. Determine the trend and follow it.

Market trends come in many sizes - long-term, intermediate-term and short-term. First, determine which one you're going to trade and use the appropriate chart. Make sure you trade in the direction of that trend. Buy dips if the trend is up. Sell rallies if the trend is down. If you're trading the intermediate trend, use daily and weekly charts. If you're day trading, use daily and intra-day charts. But in each case, let the longer range chart determine the trend, and then use the shorter term trend for timing.

3. Find the low and high of it.

The best place to buy a market is near support levels. That support is usually a previous reaction low. The best place to sell a market is near resistance levels. Resistance is usually a previous peak. After a resistance peak has been broken, it will usually provide support on subsequent pullbacks. In other words the old 'high' becomes the new 'low'. In the same way, when a support level has been broken it will usually produce selling on subsequent rallies - the old 'low'becomes the new 'high'.

4. Know how far to backtrack.

Measure percentage retracements. Market corrections up or down usually retrace a significant portion of the previous trend. You can measure the corrections in an existing trend in simple percentages. A fifty percent retracement of a prior trend is most common. A minimum retracement is usually one-third of the prior trend. The maximum is usually two-thirds. Fibonacci retracements of 38% and 62% are also worth watching. During a pullback in an uptrend, therefore, initial buy points are in the 33-38% retracement area.

5. Draw the line.

Draw trend lines. Trend lines are one of the simplest and most effective charting tools. All you need is a straight edge and two points on the chart. Up trend lines are drawn along two successive lows. Down trend lines are drawn along two successive peaks. Prices will often pull back to trend lines before resuming their trend. The breaking of trend lines usually signals a change in trend. A valid trend line should be touched at least three times. The longer a trend line has been in effect, and the more times it has been tested, the more important it becomes.

6. Follow that average.

Follow moving averages. Moving averages provide objective buy and sell signals. They tell you if existing trend is still in motion and help confirm a trend change. Moving averages do not tell you in advance, however, that a trend change is imminent. A combination chart of two moving averages is the most popular way of finding trading signals. Some popular futures combinations are 4 and 9 day moving averages, 9 and 18 day, 5 and 20 day. Signals are given when the shorter average crosses the longer. Price crossings above and below a 40 day moving average also provide good trading signals. Since moving average chart lines are trend-following indicators, they work best in a trending market.

7. Learn the turns.

Track oscillators. Oscillators help identify overbought and oversold markets. While moving averages offer confirmation of a market trend change, oscillators often help warn us in advance that a market has rallied or fallen too far and will soon turn. Two of the most popular are the Relative Strength Index (RSI) and Stochastics. They both work on a scale of 0 to 100. With the RSI, readings over 70 are overbought while readings below 30 are oversold. The overbought and oversold values for stochastics are 80 and 20. Most traders use 14 days or weeks for stochastics and either 9 or 14 days or weeks for RSI. Oscillator divergences often warn of market turns. Those tools work best in a trading market range. Weekly signals can be used as filters on daily signals. Daily signals can be used for intra-day charts.

8. Know the warning signs.

Trace MACD. The Moving Average Convergence Divergence (MACD) indicator (developed by Gerald Appel) combines a moving average crossover system with the overbought/oversold elements of an oscillator. A buy signal occurs when the faster line crosses above the slower and both lines are below zero. A sell signal takes place when the faster line crosses below the slower from above the zero line. Weekly signals take precedence over daily signals. An MACD histogram plots the difference between the two lines and gives even earlier warnings of trend changes. It's called a histogram because vertical bars are used to show the difference between the two lines on the chart.

9. Trend or not a trend?

Use ADX. The Average Directional Movement Index (ADX) line helps determine whether a market is in a trending or a trading phase. It measures the degree of trend or direction in the market. A rising ADX line suggests the presence of a strong trend. A falling ADX line suggests the presence of a trading market and the absence of a trend. A rising ADX line favors moving averages; a falling ADX line favors oscillators. By plotting the direction of the ADX line, one is able to determine which trading style and which set of indicators are most suitable for the current market environment.

10. Know the confirming signs.

Include volume and open interest. Volume and open interest are important confirming indicators in futures markets. Volume precedes price. It's important to ensure that heavier volume is taking place in the direction of the prevailing trend. In an uptrend, heavier volume should be seen on up days. Rising open interest confirms that new money is supporting the prevailing trend. Declining open interest is often a warning that the trend is near completion. A solid price uptrend should be accompanied by rising volume and rising open interest.

Murphy's laws of technical trading

Introduction

John Murphy's ten laws of technical trading explain the main ideas to beginners and streamline the trading methodology for experienced practitioners. The precepts define the key tools of technical analysis and show how to use them to identify buying and selling opportunities.

1. Map the trends.

Study long-term charts. Begin a chart analysis with monthly and weekly charts spanning several years. A larger scale 'map of the market' provides more visibility and a better long-term perspective on a market. Once the long-term has been established, then consult daily and intra-day charts. A short-term view alone can often be deceptive. Even if you only trade the very short term, you will do better if you're trading in the same direction as the intermediate and longer term trends.

2. Determine the trend and follow it.

Market trends come in many sizes - long-term, intermediate-term and short-term. First, determine which one you're going to trade and use the appropriate chart. Make sure you trade in the direction of that trend. Buy dips if the trend is up. Sell rallies if the trend is down. If you're trading the intermediate trend, use daily and weekly charts. If you're day trading, use daily and intra-day charts. But in each case, let the longer range chart determine the trend, and then use the shorter term trend for timing.

3. Find the low and high of it.

The best place to buy a market is near support levels. That support is usually a previous reaction low. The best place to sell a market is near resistance levels. Resistance is usually a previous peak. After a resistance peak has been broken, it will usually provide support on subsequent pullbacks. In other words the old 'high' becomes the new 'low'. In the same way, when a support level has been broken it will usually produce selling on subsequent rallies - the old 'low'becomes the new 'high'.

4. Know how far to backtrack.

Measure percentage retracements. Market corrections up or down usually retrace a significant portion of the previous trend. You can measure the corrections in an existing trend in simple percentages. A fifty percent retracement of a prior trend is most common. A minimum retracement is usually one-third of the prior trend. The maximum is usually two-thirds. Fibonacci retracements of 38% and 62% are also worth watching. During a pullback in an uptrend, therefore, initial buy points are in the 33-38% retracement area.

5. Draw the line.

Draw trend lines. Trend lines are one of the simplest and most effective charting tools. All you need is a straight edge and two points on the chart. Up trend lines are drawn along two successive lows. Down trend lines are drawn along two successive peaks. Prices will often pull back to trend lines before resuming their trend. The breaking of trend lines usually signals a change in trend. A valid trend line should be touched at least three times. The longer a trend line has been in effect, and the more times it has been tested, the more important it becomes.

6. Follow that average.

Follow moving averages. Moving averages provide objective buy and sell signals. They tell you if existing trend is still in motion and help confirm a trend change. Moving averages do not tell you in advance, however, that a trend change is imminent. A combination chart of two moving averages is the most popular way of finding trading signals. Some popular futures combinations are 4 and 9 day moving averages, 9 and 18 day, 5 and 20 day. Signals are given when the shorter average crosses the longer. Price crossings above and below a 40 day moving average also provide good trading signals. Since moving average chart lines are trend-following indicators, they work best in a trending market.

7. Learn the turns.

Track oscillators. Oscillators help identify overbought and oversold markets. While moving averages offer confirmation of a market trend change, oscillators often help warn us in advance that a market has rallied or fallen too far and will soon turn. Two of the most popular are the Relative Strength Index (RSI) and Stochastics. They both work on a scale of 0 to 100. With the RSI, readings over 70 are overbought while readings below 30 are oversold. The overbought and oversold values for stochastics are 80 and 20. Most traders use 14 days or weeks for stochastics and either 9 or 14 days or weeks for RSI. Oscillator divergences often warn of market turns. Those tools work best in a trading market range. Weekly signals can be used as filters on daily signals. Daily signals can be used for intra-day charts.

8. Know the warning signs.

Trace MACD. The Moving Average Convergence Divergence (MACD) indicator (developed by Gerald Appel) combines a moving average crossover system with the overbought/oversold elements of an oscillator. A buy signal occurs when the faster line crosses above the slower and both lines are below zero. A sell signal takes place when the faster line crosses below the slower from above the zero line. Weekly signals take precedence over daily signals. An MACD histogram plots the difference between the two lines and gives even earlier warnings of trend changes. It's called a histogram because vertical bars are used to show the difference between the two lines on the chart.

9. Trend or not a trend?

Use ADX. The Average Directional Movement Index (ADX) line helps determine whether a market is in a trending or a trading phase. It measures the degree of trend or direction in the market. A rising ADX line suggests the presence of a strong trend. A falling ADX line suggests the presence of a trading market and the absence of a trend. A rising ADX line favors moving averages; a falling ADX line favors oscillators. By plotting the direction of the ADX line, one is able to determine which trading style and which set of indicators are most suitable for the current market environment.

10. Know the confirming signs.

Include volume and open interest. Volume and open interest are important confirming indicators in futures markets. Volume precedes price. It's important to ensure that heavier volume is taking place in the direction of the prevailing trend. In an uptrend, heavier volume should be seen on up days. Rising open interest confirms that new money is supporting the prevailing trend. Declining open interest is often a warning that the trend is near completion. A solid price uptrend should be accompanied by rising volume and rising open interest.

Friday, September 25

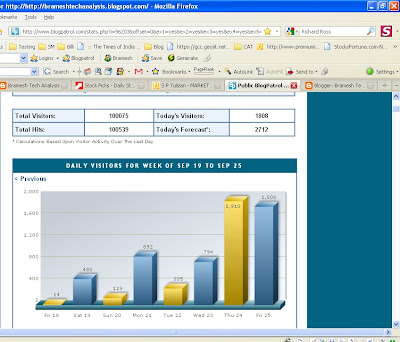

Bramesh's Blog has now 1 Lakh Hits

As I look back , remember with heart full of gratitude the instrumental hands that shaped it up ,motivated and encouraged me with kind & critical inputs.

Thanks all for showing your interest in the Blog.This milestone will help me in working harder and give my best in the coming days.

My readers, those who interacted with me with their comments and also those who have been silent readers have contributed to this blog in a consistent manner. You made me stretch my limits and you made me feel very special....

Thank you all for making this blog hit the elusive levels of 1 Lakh Hits in such a small stretch of time.

I would like to dedicate this 1 Lakh hits to some one special in my life whom i trust a lot. Thanks for the support you have given me in this journey.

Thursday, September 24

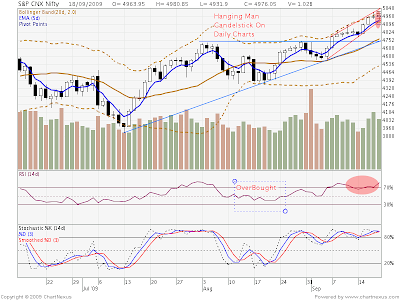

NIfty Technical View

CLICK ON IMAGE TO ENLARGE

Nifty after taking support at 4906 today made an intra day high of 5016.It has keep it head above 5MA at 4984 but in the process broke the Channel in which it was trading.

Now Scenario which is emerging is it can break the today's low and can take support at 4856 4812.Trend line support is around 4780.

Tuesday, September 22

Sunday, September 20

Nifty Weekly Technical View

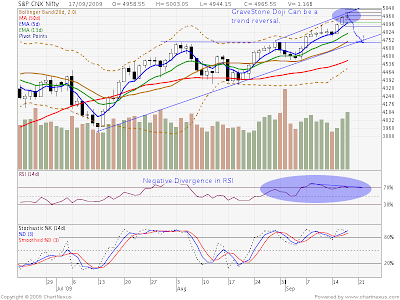

Nifty continue its upward journey and scaled 5k Mark which was an elusive level from 28 May 2008.FII are on buying spree from past 2 sessions Is this the moment of irrational exuberance which is again visible in the Indies.Small Caps and Mid caps running like there is no tomorrow.Well this is a liquidity fueled rally and Bears were slaughtered.I have to admit i too was short and my stops were taken out.But now the Risk to Reward Ratio is Favor of Bears again.Upside is capped till 5150 as per my analysis.Looking at the Weekly Charts one can Easily see the Huge Negative Divergence seen in RSI Well RSI is negative from past 3-4 Weeks but market is still going up so i would advise readers to be cautious and i will not be amazed to see a Big Red candle in coming days.Well on thing TA through out the World are amazed is too see a Drop in intra day volatility.It is just one way ride.

Well Now lets have a look at the Daily Charts

On Last Friday we made a Hanging Man Candlestick on Daily Charts.

Def of Hanging Man:

The Hanging Man is a bearish reversal pattern that can also mark a top or resistance level. Forming after an advance, a Hanging Man signals that selling pressure is starting to increase. The low of the long lower shadow confirms that sellers pushed prices lower during the session. Even though the bulls regained their footing and drove prices higher by the finish, the appearance of selling pressure raises the yellow flag. As with the Hammer, a Hanging Man requires bearish confirmation before action. Such confirmation can come as a gap down or long black candlestick on heavy volume.

Now lets have a look at Daily Charts: Channel in which we are now has support at 4920 and top around 5133.

Trend line support around 4720-43.Any close below that would be a party for bears

Weekly Pivotal Support:4840 4704 4623

Weekly Pivotal Resistance:5057 5138 5274

Friday, September 18

Thursday, September 17

Wednesday, September 16

STRASSBURG’S TEN COMMANDMENTS FOR SUCCESSFUL INVESTING

1. Thou shall not attempt to Time the Market.

Market Timing - Don't try to guess it. To the little investor, market

timing is like a random walk (that is, every movement, up or down, of

the market almost every minute of every day, is like a unpredictable/

chance event). Most people only recognize the correct direction after

it is too late to take advantage of it. One exception to this is

"Bottom Feeding" ---an approach to buying stock which you want in your

portfolio and place an open order to purchase you selected stock below

the current price. Thus, you wait until the market takes a down-turn

before it is purchased (the old buy-low sell- high philosophy), the

down-side of this is that you may never get into the stock you wanted

at the low ball price. –see Commandment 6

2. Thou shall not attempt to Out-Guess the Market.

Market Psychology - Don't try to guess it. What catches the

imagination of the market is ephemeral (short-lived), what is IN one

day, one month, one year, is OUT the next. Most people only recognize

the market psychology after it has become apparent to almost everyone

else, and is too late to act on. For example, if investment in

Technology appears to be in vogue today, you may be too late to take

advantage of the trend. Thus, in this instance, one should only invest

in technology as part of a long-term balanced approach. --see

Commandment 7

3. Thou shall stay in the Market for the Long Haul.

Do invest for the long haul. Almost all scholars of the market, and

studies of the market show that stock investing should be part of a

long-term strategy, lasting 5-10-15, even 20 years or longer. Beware

that not every year will result in a positive return on your

investment, however over time, the Plus years will most likely out-

number the negative years considerably. One of the oldest most

successful brokers in the market who at the age of 90+ was asked

whether he was still in the market, answered "I am in for the long

haul", this was also the advice of Merrill the founder of Merrill-

Lynch, the person who predicted the 1929 crash.

This commandment helps you observe commandment #1

4. Thou shall not act on Brokers who Advise moving in and out of the

market, and avoid Tips.

Brokers advice, if not based on sound long-term principles (such as

value investing) don’t take. Think about it! many brokers make their

living on having their clients constantly move in and out of

positions, thus garnering commissions. This is diametrically opposed

to Commandments 1, 2, 3. If they knew what they were doing they would

be doing it for themselves and not wasting their time holding their

clients hands. For such Brokers, their advise is likely to be as good

as monkeys throwing darts at stock listings on a wall. Only accept

advice if the person has your financial interest as their first

priority, and is not making a living on selling, i.e. commissions. And

of course never buy from someone who calls you.

Tips - don't take tips, most are likely to be as good as blind monkeys

throwing darts at stock listings on a wall –many won’t even hit the

wall.

Taking Tips is in violation of commandments 1,2,6,10.

5. Thou shall invest in Blue Chips.

Do invest in companies which are considered to be Blue Chips. This not

only includes the Dow Jones Industrial 30, but many others as well.

Only invest in established companies which have good track records.

Beware that not every Blue Chip will increase after you buy it, and

that even Blue Chips have their good months/years and bad months/

years, but over time, the PLUS periods will most likely out number the

NEGATIVE periods considerably. Also invest in companies which have a

good record of declaring dividends (and hopefully of increasing

dividends each year).

Several variations of this are to pick the "Dogs of the Dow" (first

list 5 or 10 of the Dow stocks with the highest dividends, and then

order them according to price starting with lowest price as number 1,

then purchase several of the highest ranked ones) you can do this

anytime and rotate your holdings yearly or just once and stay in for

the long hall.

This commandment will help you to observe commandment #4

6. Thou shall invest on a regular basis over time.

A corollary to this is that "Investing should never be done in a panic

or treated as an Emergency." Purchasing your selected stocks or mutual

funds is best accomplished at a steady rate over time, so as to avoid

the ups and downs of the market. This method is also known as "Dollar

Cost Averaging" and it is one of the most stable approaches to

investing. You can accomplish this in several ways. You can purchase

small amounts of stock on a regular basis, however you must pay a

commission on each purchase. You can also purchase directly from the

company for many stocks, usually without commission, this is known as

DRIPS. DRIPS (stands for Dividend Reinvestment Programs, but also

apply to Direct Stock/mutual fund investment plans) - Do invest in

your selected stocks slowly and consistently over time. You can set up

automatic purchase programs via your bank. Once started, you should be

consistent and continue regardless whether the price goes up or down,

and do this as long as possible.

This commandment helps you to observe commandment #1

7. Thou shall diversify thy portfolio.

Do diversify your portfolio, both within your selected areas and

between them. For example, for stocks, don’t invest only in Technology

because it happens to be in vogue today, but consider other areas/

industries as well (See commandment 2). Divide your holdings between

stocks (Blue Chips/Mutuals), bonds, savings (CDs), and real estate.

Don't place all your eggs in one basket, although younger investors

can be more aggressive, that is, be more invested in the Stock Market.

Never pay loads for mutual funds and minimize commissions on all other

investments.

8. Thou shall not invest in Options or on Margin

Options - Almost every knowledgeable financial advisor will tell you

the same thing, ----if you are lucky enough to win in options, and

continue to play options, it will eventually take it all back, and

more. Playing Options is in violation of commandments 1,2 and 3. Never

use margin to buy stocks or bonds, you should not invest in money you

don’t have.

9. Thou shall honor the power of time –i.e. compound interest/return.

Power of compound Interest – someone said that after the power of

nuclear energy, the greatest power in the universe is compound

interest. Just work it out yourself --- If you invested $100,000 at 7%

compound interest for 30 years you would have over $700,000 from that

$100,000.

Differing tax on profit is both legal and one of the best ways to

compound your return on investment and thus increase your earning

leverage.

Invest to the maximum all Keoghs, IRAs and other deferred compensation

retirement plans. There is no better deal around. You invest and any

return on your money continues to be reinvested, including what you

would have paid taxes on.

Stocks for the long haul. If you don't sell a stock, you will not have

to pay taxes on the gain (i.e., taxes are deferred). Thus, you

continue to get a return on money which you would have paid taxes on.

Thus, stocks can act like a KEOGH/IRA as long as you don’t sell them.

10. Thou shall not watch/listen to the Stock Market on a daily/weekly

basis

Do not listen or pay attention to the news, financial wizards, or the

daily, weekly movements of the stock market. Remember, invest as if

you intend to not look at anything for 2-3 years, ----although knowing

human nature ---one is most likely to take frequent peaks. Remember

Commandments 1 & 4

Market Timing - Don't try to guess it. To the little investor, market

timing is like a random walk (that is, every movement, up or down, of

the market almost every minute of every day, is like a unpredictable/

chance event). Most people only recognize the correct direction after

it is too late to take advantage of it. One exception to this is

"Bottom Feeding" ---an approach to buying stock which you want in your

portfolio and place an open order to purchase you selected stock below

the current price. Thus, you wait until the market takes a down-turn

before it is purchased (the old buy-low sell- high philosophy), the

down-side of this is that you may never get into the stock you wanted

at the low ball price. –see Commandment 6

2. Thou shall not attempt to Out-Guess the Market.

Market Psychology - Don't try to guess it. What catches the

imagination of the market is ephemeral (short-lived), what is IN one

day, one month, one year, is OUT the next. Most people only recognize

the market psychology after it has become apparent to almost everyone

else, and is too late to act on. For example, if investment in

Technology appears to be in vogue today, you may be too late to take

advantage of the trend. Thus, in this instance, one should only invest

in technology as part of a long-term balanced approach. --see

Commandment 7

3. Thou shall stay in the Market for the Long Haul.

Do invest for the long haul. Almost all scholars of the market, and

studies of the market show that stock investing should be part of a

long-term strategy, lasting 5-10-15, even 20 years or longer. Beware

that not every year will result in a positive return on your

investment, however over time, the Plus years will most likely out-

number the negative years considerably. One of the oldest most

successful brokers in the market who at the age of 90+ was asked

whether he was still in the market, answered "I am in for the long

haul", this was also the advice of Merrill the founder of Merrill-

Lynch, the person who predicted the 1929 crash.

This commandment helps you observe commandment #1

4. Thou shall not act on Brokers who Advise moving in and out of the

market, and avoid Tips.

Brokers advice, if not based on sound long-term principles (such as

value investing) don’t take. Think about it! many brokers make their

living on having their clients constantly move in and out of

positions, thus garnering commissions. This is diametrically opposed

to Commandments 1, 2, 3. If they knew what they were doing they would

be doing it for themselves and not wasting their time holding their

clients hands. For such Brokers, their advise is likely to be as good

as monkeys throwing darts at stock listings on a wall. Only accept

advice if the person has your financial interest as their first

priority, and is not making a living on selling, i.e. commissions. And

of course never buy from someone who calls you.

Tips - don't take tips, most are likely to be as good as blind monkeys

throwing darts at stock listings on a wall –many won’t even hit the

wall.

Taking Tips is in violation of commandments 1,2,6,10.

5. Thou shall invest in Blue Chips.

Do invest in companies which are considered to be Blue Chips. This not

only includes the Dow Jones Industrial 30, but many others as well.

Only invest in established companies which have good track records.

Beware that not every Blue Chip will increase after you buy it, and

that even Blue Chips have their good months/years and bad months/

years, but over time, the PLUS periods will most likely out number the

NEGATIVE periods considerably. Also invest in companies which have a

good record of declaring dividends (and hopefully of increasing

dividends each year).

Several variations of this are to pick the "Dogs of the Dow" (first

list 5 or 10 of the Dow stocks with the highest dividends, and then

order them according to price starting with lowest price as number 1,

then purchase several of the highest ranked ones) you can do this

anytime and rotate your holdings yearly or just once and stay in for

the long hall.

This commandment will help you to observe commandment #4

6. Thou shall invest on a regular basis over time.

A corollary to this is that "Investing should never be done in a panic

or treated as an Emergency." Purchasing your selected stocks or mutual

funds is best accomplished at a steady rate over time, so as to avoid

the ups and downs of the market. This method is also known as "Dollar

Cost Averaging" and it is one of the most stable approaches to

investing. You can accomplish this in several ways. You can purchase

small amounts of stock on a regular basis, however you must pay a

commission on each purchase. You can also purchase directly from the

company for many stocks, usually without commission, this is known as

DRIPS. DRIPS (stands for Dividend Reinvestment Programs, but also

apply to Direct Stock/mutual fund investment plans) - Do invest in

your selected stocks slowly and consistently over time. You can set up

automatic purchase programs via your bank. Once started, you should be

consistent and continue regardless whether the price goes up or down,

and do this as long as possible.

This commandment helps you to observe commandment #1

7. Thou shall diversify thy portfolio.

Do diversify your portfolio, both within your selected areas and

between them. For example, for stocks, don’t invest only in Technology

because it happens to be in vogue today, but consider other areas/

industries as well (See commandment 2). Divide your holdings between

stocks (Blue Chips/Mutuals), bonds, savings (CDs), and real estate.

Don't place all your eggs in one basket, although younger investors

can be more aggressive, that is, be more invested in the Stock Market.

Never pay loads for mutual funds and minimize commissions on all other

investments.

8. Thou shall not invest in Options or on Margin

Options - Almost every knowledgeable financial advisor will tell you

the same thing, ----if you are lucky enough to win in options, and

continue to play options, it will eventually take it all back, and

more. Playing Options is in violation of commandments 1,2 and 3. Never

use margin to buy stocks or bonds, you should not invest in money you

don’t have.

9. Thou shall honor the power of time –i.e. compound interest/return.

Power of compound Interest – someone said that after the power of

nuclear energy, the greatest power in the universe is compound

interest. Just work it out yourself --- If you invested $100,000 at 7%

compound interest for 30 years you would have over $700,000 from that

$100,000.

Differing tax on profit is both legal and one of the best ways to

compound your return on investment and thus increase your earning

leverage.

Invest to the maximum all Keoghs, IRAs and other deferred compensation

retirement plans. There is no better deal around. You invest and any

return on your money continues to be reinvested, including what you

would have paid taxes on.

Stocks for the long haul. If you don't sell a stock, you will not have

to pay taxes on the gain (i.e., taxes are deferred). Thus, you

continue to get a return on money which you would have paid taxes on.

Thus, stocks can act like a KEOGH/IRA as long as you don’t sell them.

10. Thou shall not watch/listen to the Stock Market on a daily/weekly

basis

Do not listen or pay attention to the news, financial wizards, or the

daily, weekly movements of the stock market. Remember, invest as if

you intend to not look at anything for 2-3 years, ----although knowing

human nature ---one is most likely to take frequent peaks. Remember

Commandments 1 & 4

Monday, September 14

Nifty Giving a Reversal Signal

Nifty has formed a Tri-star doji at the TOP over last 3 days, same was also observed at 6000 TOP of Jan 2008.. Bearish Doji Tri-Star: Indicate the end of a uptrend and beginning of downtrend.

The requirements is that it should be formed after a significant uptrend.

This pattern indicates stop of the prior trend. This is a significant reversal indicator.

Any fall below 4780, can lead to target of 4740 4700 4680 4600. SL 4850.

Sunday, September 13

Nifty Weekly View

‘Throw-over’ from rising wedge pattern is not happening since past two sessions. Is this an indication that ‘throw-over’ is

failed? In such a case, Nifty is at its weakest point. Already from medium-term point, we are in a ‘5th wave failure’

pattern.

Weekly Technically Weekly Pivot 4800

Weekly Resistance:4859 4890 4924

Weekly Support:4795 4761 4730

Friday, September 11

5 REASONS THE RALLY IS BUILT ON QUICKSAND

From the desk of David Rosenberg this morning:

1. This remains a hope-based rally (with strong technicals). I say that because during this six-month 50%+ rally in the S&P 500, the U.S. economy has shed 2.4 million jobs, which is almost as many as we lost during the entire 2001-02 tech wreck — in just six months. The market’s ability to shrug off the loss of 2.4 million jobs is either a sign that it is treating this as old news or sees the cost-cutting as good news for profits. Either way, what we are seeing transpire is without precedent — the magnitude of the employment slide versus the magnitude of the market advance. Truly fascinating stuff.

It’s remarkable to add that jobless claims were 550K this morning – a staggering number this deep into a recession. But fear not – it was “better than expected”.

2. Companies have not really been beating their earnings estimates — only the very final estimates heading into the reporting quarter. For example, the consensus view for 3Q EPS at the start of the year was $21.00, last we saw the estimates were down to just over $14.00. But there is a deeply rooted belief that earnings are coming in better than expected. This is a psychology that is difficult to break. It is completely unknown (for some reason) that corporate revenues are running at a -25% YoY rate, which compares to the -10% we saw at the worst part of the 2001-02 bear market and the -3% trend at the most negative point in 1991.

It’s also interesting to note the very real weakness in corporate revenues. The bottom line can be manipulated, but revenues never lie….

3. Valuation is a poor timing device but even on “normalized” trailing 10-year earnings, the S&P 500 is trading near 18x, which is now above the historical average of 16x.

Market value matters less to me at this juncture. If we were to get a much stronger than expected recovery you could easily argue that the market is cheap. PE ratios are a moving target based on guesses. That is what makes them poor market timing indicators.

4. All the growth we are seeing globally this year is due to fiscal stimulus; not just here in Canada and the U.S., but also in Korea, China, the U.K., and Continental Europe too. For 2010, the government’s share of global growth, by our estimates, will be 80%. In other words, there are still very few signs that organic private sector activity is stirring. For a Keynesian, government stimulus is necessary, but the question for an investor is the multiple one attaches to a global economy that is still relying on a defibrillator. The problem is that governments do not create income or wealth, and today’s stimulus is really a future tax liability. Curiously, that future tax liability is likely going to pose a roadblock for the return to a “normalized” $80 operating EPS estimate that strategists are now starting to pen in for 2011.

This will become a major concern in mid-2010 when the stimulus is done. Whether the U.S. consumer can carry the torch has yet to be seen.

5. While Mr. Market may be pricing in a fine future for the U.S., but when the 3-month Treasury-bill yield is 13bps north of zero, which is completely abnormal, you know that there are still substantial fundamental imbalances that need to be worked through.

I should also add that the credit markets have recovered substantially from their extremely low levels. Nonetheless, the bond market does continue to forecast a very weak recovery. Perhaps weaker than the one the equity market has priced in….

Source: Gluskin Sheff

1. This remains a hope-based rally (with strong technicals). I say that because during this six-month 50%+ rally in the S&P 500, the U.S. economy has shed 2.4 million jobs, which is almost as many as we lost during the entire 2001-02 tech wreck — in just six months. The market’s ability to shrug off the loss of 2.4 million jobs is either a sign that it is treating this as old news or sees the cost-cutting as good news for profits. Either way, what we are seeing transpire is without precedent — the magnitude of the employment slide versus the magnitude of the market advance. Truly fascinating stuff.

It’s remarkable to add that jobless claims were 550K this morning – a staggering number this deep into a recession. But fear not – it was “better than expected”.

2. Companies have not really been beating their earnings estimates — only the very final estimates heading into the reporting quarter. For example, the consensus view for 3Q EPS at the start of the year was $21.00, last we saw the estimates were down to just over $14.00. But there is a deeply rooted belief that earnings are coming in better than expected. This is a psychology that is difficult to break. It is completely unknown (for some reason) that corporate revenues are running at a -25% YoY rate, which compares to the -10% we saw at the worst part of the 2001-02 bear market and the -3% trend at the most negative point in 1991.

It’s also interesting to note the very real weakness in corporate revenues. The bottom line can be manipulated, but revenues never lie….

3. Valuation is a poor timing device but even on “normalized” trailing 10-year earnings, the S&P 500 is trading near 18x, which is now above the historical average of 16x.

Market value matters less to me at this juncture. If we were to get a much stronger than expected recovery you could easily argue that the market is cheap. PE ratios are a moving target based on guesses. That is what makes them poor market timing indicators.

4. All the growth we are seeing globally this year is due to fiscal stimulus; not just here in Canada and the U.S., but also in Korea, China, the U.K., and Continental Europe too. For 2010, the government’s share of global growth, by our estimates, will be 80%. In other words, there are still very few signs that organic private sector activity is stirring. For a Keynesian, government stimulus is necessary, but the question for an investor is the multiple one attaches to a global economy that is still relying on a defibrillator. The problem is that governments do not create income or wealth, and today’s stimulus is really a future tax liability. Curiously, that future tax liability is likely going to pose a roadblock for the return to a “normalized” $80 operating EPS estimate that strategists are now starting to pen in for 2011.

This will become a major concern in mid-2010 when the stimulus is done. Whether the U.S. consumer can carry the torch has yet to be seen.

5. While Mr. Market may be pricing in a fine future for the U.S., but when the 3-month Treasury-bill yield is 13bps north of zero, which is completely abnormal, you know that there are still substantial fundamental imbalances that need to be worked through.

I should also add that the credit markets have recovered substantially from their extremely low levels. Nonetheless, the bond market does continue to forecast a very weak recovery. Perhaps weaker than the one the equity market has priced in….

Source: Gluskin Sheff

Wednesday, September 9

The Two Reasons it’s Time to Short U.S. Stocks

Good Food For thought

By Martin Hutchinson

Contributing Editor

Money Morning

The stock market is up 51% from its March 9 lows. The leading economic indicators have turned sharply positive, showing gains for each of the last four months. Manufacturing is on the rebound. And banks are promising to pay record bonuses, as their earnings have rebounded.

With this recent rush of upbeat economic news, it’s no wonder commentators are trumpeting the rebound of the U.S. economy.

But I think it’s time to short U.S. stocks.

Shocked?

Don’t be.

What most experts see as a strengthening U.S. rebound, I see as an increasingly dangerous “false dawn” – for these two key reasons:

* An overly expansive monetary policy that’s almost certain to spawn inflation.

* And a record-level budget deficit that will cause interest rates to spike, crimping economic growth.

A Foundation for Trouble

U.S. policies that were intended to combat the financial crisis that broke last year – as well as the recession that’s been plaguing us since December 2007 – have actually inflicted a lot of weakness upon our economic system.

For instance, the federal government has made $11.6 trillion in financing commitments, many of which will saddle us with debt for generations – some of it forever. Outlays of that magnitude in a $14 trillion economy are bound to have lasting implications: Think of the consumer who has a series of maxxed-out credit cards – he’ll make the minimum payments, but the actual balance will never get paid down.

And the foundation for this financial fiasco was actually constructed several years ago.

After the bursting of the 1996-2000 “dot-com” bubble, the U.S. Federal Reserve re-inflated the money supply. That caused stocks to resume their upward march, and as we now know, also inflated a housing bubble of such enormous size that it caused a general financial-system crash when that real estate bubble burst in 2007-08.

This time around, the Fed has been even more expansive. The benchmark Federal Funds Rate was 1.0% in 2002-04. This time it is 0.25%. What’s more, this time around we’ve had a $2 trillion expansion of the Fed balance sheet, a doubling of the monetary base and $300 billion worth of direct central bank purchases of government debt. Given this orgy of Fed expansionism, it’s likely that the onset of inflation – whether it’s in consumer prices or asset prices – will be correspondingly worse. In fact, we’re already seeing that gold prices are once again making a run at their all-time high. And crude oil hovers at about $70 per barrel, a level that would have been unimaginable before 2004.

Now that he’s been nominated for reappointment, U.S. Federal Reserve Chairman Ben S. Bernanke says he will tighten monetary policy in good time. But why should we believe him? If he tries to tighten significantly, he will incur the wrath of the Obama administration and the Democrats in Congress.

Even back during the 2001-04 time frame – when there was an administration in place that claimed to believe in monetary stringency – the Fed didn’t tighten. Bernanke himself was among the most aggressive opponents of tightening. Back in 2002, in fact, when inflation was running at a perfectly respectable 2%, Bernanke actually spun myths about the imminent onset of “deflation.”

Given what we know, it seems that if the current economic bounce shows even the slightest signs of faltering, Bernanke won’t tighten – he’ll pump even more money into the U.S. financial system. Rest assured that the administration, Congress, and much of the media will be cheering his move.

Borrow Now, Hurt Later

If an overly expansive monetary policy was the only problem we faced, it might not be so bad. Unfortunately, there’s more.

Lots more.

Unlike in 2002 – in fact, unlike any other time in U.S. history – this country now has a budget deficit in excess of 10% of gross domestic product (GDP). For fiscal 2009, that was forgivable: We’ve had a major recession, and a shattering financial crisis, which the federal government has tried to battle with aggressive bailout programs.

Here’s the problem, however: The projected deficit remains above 10% of GDP for fiscal 2010, even though no additional bailouts are contemplated and the Obama administration is projecting a modest-but-steady economic recovery.

The result is harder to predict – this country hasn’t travelled down this particular path before. This strategy bears some resemblance to the position Japan found itself in during its so-called “Lost Decade” of the 1990s. But even Japan’s deficit never reached this 10% threshold.

In Japan, the effect seems to have been the gradual abandonment of small business finance, and the resulting starvation of the most critical factor in economic growth – entrepreneurship.

The small-business sector creates most of the new jobs in the U.S. economy. But in a challenging environment, it’s easy to see why this sector gets overlooked. Without political connections or large contracts to hand out, the small-business sector ends up being last in line in the financing queue when the economy faces strong headwinds. Why should banks or other people lend to small businesses when the U.S. government bond market stands as such as huge, safe parking place for their cash?

Interest rates will also become an issue. With the inflationary pressures we expect to see from the overly expansive monetary policy we’ve described, long-term interest rates are likely going to rise anyway. As was the case in Japan’s decade-long malaise, these forces will combine to spark high default rates in the banking system, low or zero economic growth, and a general downward trend in the stock market.

All of this will make it tough for small businesses to obtain the cash they need to grow, meaning this key job-creation engine will have to sputter along.

It’s still early in the game, and there are many factors to consider, so the future economic picture remains a bit murky right now. But my guess is that the bubble in asset prices will be largely confined to commodities, that economic growth after this current initial burst will relapse, and that U.S. stocks will prove to be the same generally unattractive investment that they were in 1970s – the era of the so-called “Nifty Fifty.” If the stock market bubble gets even more exuberant from here, the relapse will be correspondingly more painful.

By Martin Hutchinson

Contributing Editor

Money Morning

The stock market is up 51% from its March 9 lows. The leading economic indicators have turned sharply positive, showing gains for each of the last four months. Manufacturing is on the rebound. And banks are promising to pay record bonuses, as their earnings have rebounded.

With this recent rush of upbeat economic news, it’s no wonder commentators are trumpeting the rebound of the U.S. economy.

But I think it’s time to short U.S. stocks.

Shocked?

Don’t be.

What most experts see as a strengthening U.S. rebound, I see as an increasingly dangerous “false dawn” – for these two key reasons:

* An overly expansive monetary policy that’s almost certain to spawn inflation.

* And a record-level budget deficit that will cause interest rates to spike, crimping economic growth.

A Foundation for Trouble

U.S. policies that were intended to combat the financial crisis that broke last year – as well as the recession that’s been plaguing us since December 2007 – have actually inflicted a lot of weakness upon our economic system.

For instance, the federal government has made $11.6 trillion in financing commitments, many of which will saddle us with debt for generations – some of it forever. Outlays of that magnitude in a $14 trillion economy are bound to have lasting implications: Think of the consumer who has a series of maxxed-out credit cards – he’ll make the minimum payments, but the actual balance will never get paid down.

And the foundation for this financial fiasco was actually constructed several years ago.

After the bursting of the 1996-2000 “dot-com” bubble, the U.S. Federal Reserve re-inflated the money supply. That caused stocks to resume their upward march, and as we now know, also inflated a housing bubble of such enormous size that it caused a general financial-system crash when that real estate bubble burst in 2007-08.

This time around, the Fed has been even more expansive. The benchmark Federal Funds Rate was 1.0% in 2002-04. This time it is 0.25%. What’s more, this time around we’ve had a $2 trillion expansion of the Fed balance sheet, a doubling of the monetary base and $300 billion worth of direct central bank purchases of government debt. Given this orgy of Fed expansionism, it’s likely that the onset of inflation – whether it’s in consumer prices or asset prices – will be correspondingly worse. In fact, we’re already seeing that gold prices are once again making a run at their all-time high. And crude oil hovers at about $70 per barrel, a level that would have been unimaginable before 2004.

Now that he’s been nominated for reappointment, U.S. Federal Reserve Chairman Ben S. Bernanke says he will tighten monetary policy in good time. But why should we believe him? If he tries to tighten significantly, he will incur the wrath of the Obama administration and the Democrats in Congress.

Even back during the 2001-04 time frame – when there was an administration in place that claimed to believe in monetary stringency – the Fed didn’t tighten. Bernanke himself was among the most aggressive opponents of tightening. Back in 2002, in fact, when inflation was running at a perfectly respectable 2%, Bernanke actually spun myths about the imminent onset of “deflation.”

Given what we know, it seems that if the current economic bounce shows even the slightest signs of faltering, Bernanke won’t tighten – he’ll pump even more money into the U.S. financial system. Rest assured that the administration, Congress, and much of the media will be cheering his move.

Borrow Now, Hurt Later

If an overly expansive monetary policy was the only problem we faced, it might not be so bad. Unfortunately, there’s more.

Lots more.

Unlike in 2002 – in fact, unlike any other time in U.S. history – this country now has a budget deficit in excess of 10% of gross domestic product (GDP). For fiscal 2009, that was forgivable: We’ve had a major recession, and a shattering financial crisis, which the federal government has tried to battle with aggressive bailout programs.

Here’s the problem, however: The projected deficit remains above 10% of GDP for fiscal 2010, even though no additional bailouts are contemplated and the Obama administration is projecting a modest-but-steady economic recovery.

The result is harder to predict – this country hasn’t travelled down this particular path before. This strategy bears some resemblance to the position Japan found itself in during its so-called “Lost Decade” of the 1990s. But even Japan’s deficit never reached this 10% threshold.

In Japan, the effect seems to have been the gradual abandonment of small business finance, and the resulting starvation of the most critical factor in economic growth – entrepreneurship.

The small-business sector creates most of the new jobs in the U.S. economy. But in a challenging environment, it’s easy to see why this sector gets overlooked. Without political connections or large contracts to hand out, the small-business sector ends up being last in line in the financing queue when the economy faces strong headwinds. Why should banks or other people lend to small businesses when the U.S. government bond market stands as such as huge, safe parking place for their cash?

Interest rates will also become an issue. With the inflationary pressures we expect to see from the overly expansive monetary policy we’ve described, long-term interest rates are likely going to rise anyway. As was the case in Japan’s decade-long malaise, these forces will combine to spark high default rates in the banking system, low or zero economic growth, and a general downward trend in the stock market.

All of this will make it tough for small businesses to obtain the cash they need to grow, meaning this key job-creation engine will have to sputter along.

It’s still early in the game, and there are many factors to consider, so the future economic picture remains a bit murky right now. But my guess is that the bubble in asset prices will be largely confined to commodities, that economic growth after this current initial burst will relapse, and that U.S. stocks will prove to be the same generally unattractive investment that they were in 1970s – the era of the so-called “Nifty Fifty.” If the stock market bubble gets even more exuberant from here, the relapse will be correspondingly more painful.

Has Nifty seen a breakout???

To understand this first let us first learn about break out. A

breakout is the point at which stock breaks away the price or moves

out of a trading range or pattern with significant volume. Technical

analyst will often look for breaks of support and resistance to enter

positions. From the definition you know that there are two key

components to confirm a breakout: (1) price and (2) volume. When

stocks break critical levels with volume then it is called a breakout

but when it the same thing occurs without volume, you should consider

the breakout to be false break out in our term it is Chakravyuha.

Please understand that we gave a sell call when the indices entered

the danger zone of 21000 way back in 2008 analyzing in the same way.

Let us check the volumes now and find out if it is real break out or

it is a chakravyuha. The BSE clocked a turnover of Rs 6,055 crore,

higher than Rs 5,722.02 crore on Friday, 4 September 2009. Yes the

volume is good. But here is the googly...

Turnover in NSE's futures & options (F&O) segment declined to Rs

57,490.85 crore from Rs 70,260.73 crore on Friday, 4 September 2009.

BSE volume is higher indicating some stock specific activities and

speculative activities happening in the market and the Futures and

options volume (which cannot be manipulated so easily) clearly

illustrates that the volume is less and we need to be careful with the

movement of the indices.

For tomorrow’s trading - the key level to watch - 4842 which was the high formed on Tuesday and 4782 which was the low of yesterday’s trading.

breakout is the point at which stock breaks away the price or moves

out of a trading range or pattern with significant volume. Technical

analyst will often look for breaks of support and resistance to enter

positions. From the definition you know that there are two key

components to confirm a breakout: (1) price and (2) volume. When

stocks break critical levels with volume then it is called a breakout

but when it the same thing occurs without volume, you should consider

the breakout to be false break out in our term it is Chakravyuha.

Please understand that we gave a sell call when the indices entered

the danger zone of 21000 way back in 2008 analyzing in the same way.

Let us check the volumes now and find out if it is real break out or

it is a chakravyuha. The BSE clocked a turnover of Rs 6,055 crore,

higher than Rs 5,722.02 crore on Friday, 4 September 2009. Yes the

volume is good. But here is the googly...

Turnover in NSE's futures & options (F&O) segment declined to Rs

57,490.85 crore from Rs 70,260.73 crore on Friday, 4 September 2009.

BSE volume is higher indicating some stock specific activities and

speculative activities happening in the market and the Futures and

options volume (which cannot be manipulated so easily) clearly

illustrates that the volume is less and we need to be careful with the

movement of the indices.

For tomorrow’s trading - the key level to watch - 4842 which was the high formed on Tuesday and 4782 which was the low of yesterday’s trading.

Tuesday, September 8

Sunday, September 6

Nifty Weekly Technical View

Nifty Daily charts are Attached. Following Conclusions can be drawn for the week gone by and predictions can be made for the coming week.

1. The Blue line which is trendline held the support and we did not broke the 4575-80 Band We touched it thrice and than gave a good bounce on Friday

2.Nifty is above 5 EMA and 5 WMA which gives good possibility to make a new high and probably move towards 4800-900 levels.