IT - IS 'IT' SHOWING SIGNS OF REVIVAL?

Most of the bigwig IT companies have declared their performance for Q1FY10 and call it muted analysts expectations or improved performance, most of the bigwigs have done well despite the trying circumstances.

It started with Infosys which for first quarter of current fiscal posted a 17.2% YoY rise in net profit at Rs.1,527 crore but QoQ, it was down 5.3%. But what really worried the marketmen was its guidance for FY10, where it has forecast consolidated revenue to fall 3.1-4.6% to $4.45-$4.52 billion and expects earnings to decline 11.1-12.3% in dollar terms. For Q2FY10, its guidance states that it expects revenues to decline by 1.9% to 0.1%.

TCS showed a YoY 23% and QoQ 15% growth in net profit at Rs.1520 crore. TCS does not give guidance. But the news on the street is that the company is expected to show a higher forex loss of around Rs.90 crore in Q2FY10, up from Rs.84 crore in Q1FY10. This is because the company expects over $112 million of its forex hedges expected to mature during the period.

Wipro showed a 5% (YoY) rise in revenues during the first quarter at Rs.6,274 crore but QoQ it fell marginally by 3%. Net profit was up 11.78% (YoY) at Rs 1015.5 crore and almost flat when compared on a QoQ. The company however provided a cautious and flat forecast for the quarter ending September reflecting lower demand for

The common thread running between all three bigwigs is that their Q1FY10 numbers beat expectations – both of the market as well of analysts, who had expected a much dismal performance. Another commonality is that they all have given a much subdued guidance for Q2FY10 and for FY10.

So what is the inference we draw from these readings? There is no doubt that the Indian IT companies have managed to keep their heads up even in these turbulent times. Despite having a wide exposure to

Things have also started stabilizing in the developed countries as volume shrinkages have stopped and business ramp downs have also tapered off. Hence in that context, we can say that the worst does seem to be over. And the companies have given a lower guidance to be more on the safer side. As per a survey conducted by Bloomberg of economists, the consensus is that the

Also most of these companies have re-negotiated prices at lower rates for the current year and they do not expect the prices to go up any time soon though at the same time, they do not expect the prices to fall also. It is a happy situation for them even if prices are maintained at current levels.

Another positive for the Indian frontline IT companies is that they have also started looking at home itself for big time business. Wipro and TCS have always had a presence in the domestic market, especially when it came to execution of Govt projects. But Infosys is looking anew at the Indian shores and the business potential it sees is immense. Infosys is looking at a business worth $2 billion in

Apart from the Unique Identity Card project, there is the $2 billion e-biz program initiated under the National e-governance Plan which has 27 mission mode projects. Government organisations such as India Post, Indian Railways are also earmarked for major computerization exercise. There are also smaller outsourcing contracts from ONGC, LIC and the State Bank of

Outlook for IT stocks? It remains cautious and to take a call on the sector, best to wait for the Q2 results which will give a clearer picture.

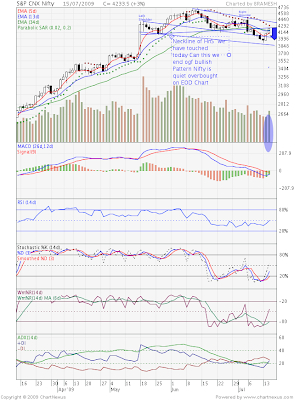

ITC is an ideal stock to test traders patiece.

ITC is an ideal stock to test traders patiece.