Monday, November 30

Sunday, November 29

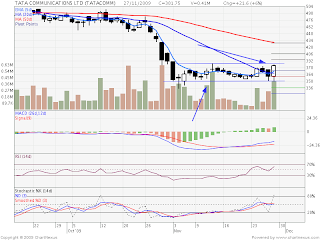

Nifty Technical View

Nifty has closed below 5 EMA after phenomenal after the European opening and saw a good recovery.

Now as per my TA you we have closed below 5 EMA which is at 5012 and 71.6% retracement also as show in charts attached above.

We can see rally tommorow as asian markets should open higher but if 5012 above are not sustained than we can again down to a levels of 4700

4920 which is 20 SMA hold the key below that we will again enter in a downtrend.

Weekly Levels to be watched.

Weekly Pivot:4962

Weekly Resistance:5028 5116 5227

Weekly Support:4830 4719 4632

UAE: Dubai Government calls for debt restructuring by state companies

Got this report on Dubai Crises from JM Read this for Clarity on Dubai Crises.

The Dubai Government announced yesterday that it has asked investors to extend the maturity of upcoming debt amortisations of two of its state-owned companies, Dubai World and its real estate development arm Nakheel, until 30 May 2010. Subsequently, theDubai

The Dubai Government announced yesterday that it has asked investors to extend the maturity of upcoming debt amortisations of two of its state-owned companies, Dubai World and its real estate development arm Nakheel, until 30 May 2010. Subsequently, the

Dubai World is a 100% state-owned holding company that owns Nakheel (100%), a real estate developer; DP World (77%), one of the world’s largest port operators and a listed company; Drydocks World (100%), a shipbuilding and maintenance company; and Limitless LLC (100%), a real estate developer which owns various assets in Europe, Africa, Asia and the Middle East. The government of Dubai

The upcoming bond amortisations of Dubai World are in the attached table. We calculate that in 2010, Dubai World and its subsidiaries will be redeeming about $7.8bn in the reminder of 2009 and 2010 and another $6.8bn in 2011. The most pressing redemption is the $3.52bn sukuk bond of Nakheel, which will be due on December 14, 2009 – a bond which is owned widely by overseas and GCC investors. Altogether, Dubai

| Dubai World (incl. subsidiaries) debt maturity schedule | ||

| Name | Date | Amount (USD mn) |

| Nakheel | 14-Dec-09 | 3520 |

| Limitless | 31-Mar-10 | 1200 |

| Nakheel | 13-May-10 | 980 |

| Dubai World | 19-Jun-10 | 2100 |

| Nakheel | 11-Jan-11 | 1200 |

| Dubail World | 19-Jun-11 | 1950 |

| Dubail World | 19-Jun-11 | 450 |

| Palm District Cooling | 20-Jul-11 | 500 |

| Port, Free Zone World | 29-Sep-11 | 150 |

| Port, Free Zone World | 29-Sep-11 | 853 |

| Dubai Drydocks | 11-Oct-11 | 1700 |

| Total | 14603 | |

| Source: Reuters | ||

COMMENT: Technically, this does not constitute a sovereign default, since there are no sovereign guarantees on Dubai World and its subsidiaries; in fact, the government issued a decree earlier this year stating that it will not underwrite liabilities of Dubai World. But it was the government rather than the company that announced the standstill yesterday, and investors can be forgiven for regarding the finances of the emirate and of its wholly-owned subsidiaries as not clearly distinguishable. Dubai CDS has widened sharply to 570bps and the nominal value of Nakheel bonds collapsed to 70 from previous 110.

We have been arguing that Dubai ’s financing problems will have to be resolved within the broader federative structure of UAE, leaning heavily on Abu Dhabi Dubai launched a UAE backed $20bn bond program back in February 2009 and so far tapped about $15bn from the Central Bank of UAE ($10bn) and various Abu Dhabi Dubai Dubai

As for Dubai World and Nakheel, the details of a potential restructuring are not known; it is not even clear which subsidiaries of Dubai World will be restructured, if at all. The latest developments surrounding Dubai World and Nakheel have obviously raised serious questions over the credit quality of both the sovereign and various quasi sovereign entities in Dubai

The way in which the UAE authorities handle the problem will clearly be important for investor confidence, as it will set a precedent for Dubai

The problem is that it may be technically difficult to engineer a voluntary restructuring of short-term liabilities in the coming few days, before December 14, when Nakheel’s $3.5bn sukuk bond will mature. In that case, we may well be looking at a technical default, unless UAE authorities announce a credible alternative (re)financing plan in due course.

Thursday, November 26

Tuesday, November 24

Bharti Airtel Long term Charts

IF we see the long term charts of Bharti Airtel it now has 2 supports at 267 the low which made recently and one more at 238 levels.The Rectangle which i have mentioned should be used to accumulate the stocks of bharti and if 238 breaks buy around 200 levels and forgot about the stock in your portfolio for coming 3-4 years.You will see your at least double. With the emergence of 3G and 4G in India telecom space the volumes will increase and that will increase the profitability of the company.

Monday, November 23

Sunday, November 22

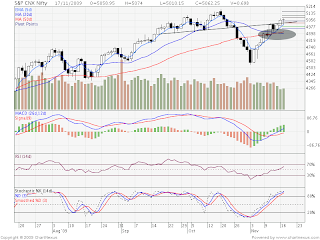

Nifty Technical View

Nifty continued with its winning streak third week in a row with 1% gain on weekly basis.It made a u turn in the afternoon session on friday and closed up with 62 point gain,But was unable to breach the resistance of 5080 as shown in charts attached above.

FII and DII were net sellers on friday after such a good up move.Coming week is an expiry week so accept lots of volatility.My guess is if 5080 does not break on upside than we can go down till 4850.

Nifty Weekly Pivot: 5,021

Nifty Weekly Resistance: 5080 5,109.7 5,167.3

Nifty Weekly Support:4,875.3 4,963.7

Wednesday, November 18

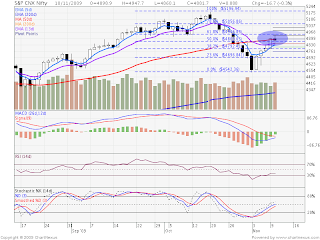

Nifty Technical View

NIfty is unable to cross the 5070 levels.Now point to ponder over is SMA cross over of 20 and 50 which is giving a bearish indication to me.

Also the Trendline near 5010 if breaks can see a serious unwinding of longs.

PUTS OI has deresed indicating shorted puts are geeting covered .IS it a prelude of a fall

Levels to be watched out:

Pivot 5048.8

Resistance 5087.5 5112.7 5151.3

Support 5023.6 4985.0 4959.8

Saturday, November 14

Nifty Weekly Technical View

Nifty Daily Charts shows the trendline got broke in the 12 day fall we have seen but it again got up the trendline within 3 weeks so it can not be considered as violation in trendline and on going correction in the bull market.

Now whats next we are facing resistance at 5030 levels continuously in past 3 trading sessions.So that comes out to be resistance and can be considered stop loss for the shorts.

Momentum is fading in past couple of trading sessions. Now longs should protect there profits with a stop loss around 4940 levels.As nifty has closed above all its averages so it would be advisable not to short nifty now.Wait for some sign of weakness than short.

Levels which needs to be watched out

Weekly Pivot:4936

Weekly Support:4939 4875 4853 4708

Weekly Resistance:5030 5081 5164

Friday, November 13

Thursday, November 12

Tuesday, November 10

M&M with a technical look

M&M Stock is making a new High and institutional are quiet bullish on it.Looking technically at this stock is taking support at its trend line (Shown as green color in the chart)Stock is an ideal candidate to be bought on dips.

But one point of concern is Negative divergence which is observed in RSI and MACD.But to bring to user note that indicator can remain in negative divergence for a long period of time.

On upside the stock can touch 1150 touching the upper band of trend line,

For tomorrows perspective stock is a buy above 1014 for a tgt of 1037 1067 1090 Support is at 983 961

Nifty corrected from 61.8% retracement level

Nifty made low of 4542 and made a high of 5184 if we take fibo levels 61.8% it come around 4940 which is at level where we fall from today and we took support at 50% retracement level 4866.Next support comes around 4789.

Levels to be watched out tomorrow Buy Nifty above 4896

Resistance at 4932.9 4984.1 5020.5

Support at 4845.3 4808.9 4757.7

Sunday, November 8

Trading Ideas

Maruti Suzuki Unable to cross 50 SMA which is at 1523,If that is crosses can see 1546 1560 and if not can see 1503 1480 1392

RIIL - Buy above 964 Resistance at 993 1042 Suupport at 871

Buy HDFC Bank above 1652 For a tgt of 1670 1686 Support at 1623 1607

Buy Andhra Bank above 116 for a tgt of 120 123 126

Nifty Weekly Technical View

Nifty Weekly 5 EMA is at 4860 Levels which will prove as Resistance as of now. Support at 20 Week SMA at 4700.As mentioned in previous Week 20 Weekly SMA will provide as a support and nifty.Previous Week Post

Now looking at the Daily Charts of Nifty, We have closed above 5 EMA but resitance is now at 4830 which is both Pivot Resistance and 13 D EMA.

So Right now 4834 and 4860 will be immediate resistances and once crossed we can head towards 4930 4970

Wednesday, November 4

Tuesday, November 3

Sunday, November 1

Nifty Weekly Technical View

IF we take the Fibo retracement Level from the high 5181 and low of 3912 we now stand at 38.2% Retracement level.A Bounce can be accepted till 50 SMA of 4858.

Weekly Pivot 4,811

Weekly Resistance: 4,934.5 5,157.0

Weekly Support:4,465.5 4,588.8

20 Week SMA which was Resistance will now become a support lets see?