FII Derivative Data Analysis for Nifty Future June 2012

We had an disastrous GDP data out today,Q4 growing at just 5.3% slowest GDP number in past 10 years but still Nifty made a move of just 15 points made a quick low of 4882 and bounced back,So have market participants already factored in these number or was it due to expiry pressure?

My take it was due to expiry pressure as Cash FII and DII both were sellers and Nifty rise is last 30 min was just due to Futures Rollover as RIL moved to 729 in cash market and Futures made a high of 706, Huge short covering was seen in Small Bank Stock CBI,Dena ,UCO in last 30 mins. So its an expiry game which took place and market will return to their natural form by tomorrow. The worst part of the day was Mr. Pranab Da is still not accepting the mistake of GOI in slowing down Indian growth story but putting the blame on European Crisis and Greece. If you cannot get your house in order how come you blame others for the problem ?

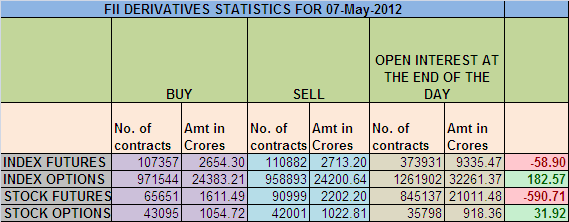

1. FII sold 49447 Contracts of NF worth 1252 cores,OI decreased by 359636.

2. Bank Nifty OI for all 3 month ie. May,June ...

Read the Full Story