FII Derivative Analysis for Nifty Future trade on 1 Jan 2013

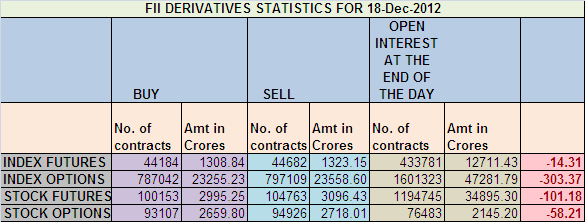

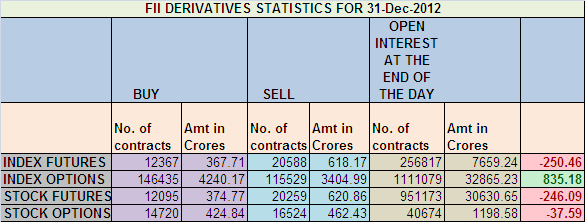

1. FIIs sold 8221 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 250.46 cores with net Open Interest decreasing by 6665 contracts.

2. As CNX Nifty Future was down by 3 points with Open Interest in Index Futures decreasing by 6665, so FIIs have booked profit in longs in Nifty and Bank Nifty Futures.Nifty Futures has been trading in tight range with lowest volume of 2012 as most of FII have gone for holidays.

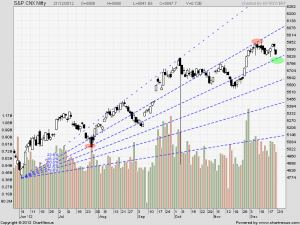

3. NS closed at 5905 after making high ...

Continue Reading