Nifty Trading Stratergy for 27 Nov

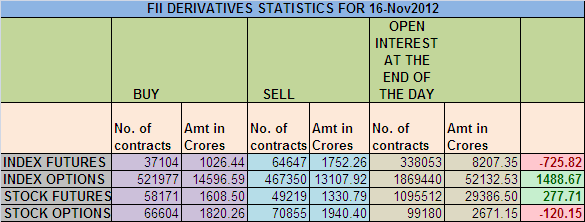

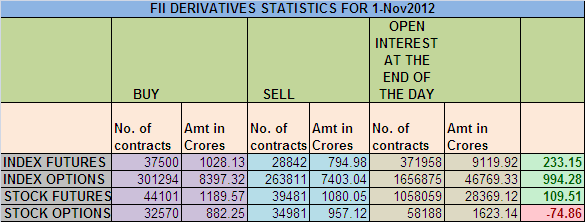

1. FIIs bought 5906 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 161.85 cores with net Open Interest increasing by 16920 contracts.

2. As Nse Nifty Future was up by 9 points with Open Interest in Index Futures increasing by 16920, so FIIs created fresh longs again in longs of Nifty and Bank Nifty Futures.Do note FII has limited there activity to day trading as there total average comes at 5481 suggesting they are mostly doing day trading.

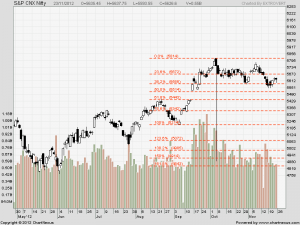

3. NS closed at 5636 after making a high...

Continue Reading