Sunday, January 31

Friday, January 29

Tuesday, January 26

Sunday, January 24

Help Required

Hi All,

Today my Maternal Grandma expired in morning at 6:30AM.Request you all to pray for her soul to be rested in peace.

Thanaks All

Today my Maternal Grandma expired in morning at 6:30AM.Request you all to pray for her soul to be rested in peace.

Thanaks All

Monday, January 18

Thursday, January 14

Tuesday, January 12

Trading Ideas

Infosys after giving results above market expectation did just hold its long trendline as shown in the chart,Now we can see a good upmove in Infosys

Levels which needs to be watched are 2620 above that accept an upmove till 2684 and 2714 Supports comes at 2525.

Rgds,

Bramesh

Sunday, January 10

Trading Ideas for Week Starting 11-01-2010

DLF Limited Multiple resistances at 394-95 range and after that 397 levels.Once thats crossed except a run till 405 and 416 Levels.

Support exists at 378 levels.

Multiple resistance at 1053 Levels once crossed targets are 1061 1078 1104 Support exists at 1019 and 993 levels.

Resistance at 48 50 53 Support at 44 41 39

Regards,

Bramesh

9985711341

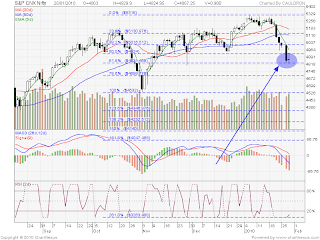

Nifty Weekly Technicals

Nifty Daily Chart is attached.As seen from the chart following conclusion can be deduced for the coming week.Market after hitting a new high is consolidating in a narrow range,Now from past 4 days it has litreally has not given any move,Most of the action is happening in small and mid caps space where stocks from no where are seeing a move of 5-15% on good vols.I would say it time to be caution instead of being elated.Keep booking profits and trail your Stop loss

Levels needs to be watched is 5169 on downside (61.8% Retracemet from 4951 to 5311),If that gets broken we may see 5121 5075 5018.

Pivot Levels for Monday

Pivot:5252

Support:5227 5210 5194

Resistance:5269 5294 5311

On Weekly Charts Momentum is declining and RSI and MACD are showing negative divergences,but prices are not coming down of 5 W EMA so still we are in an uptrennd.5 Week EMA is at 5146 level should be watched on closing basis on weekly charts

Pivot Levels for Week

Pivot:5242

Support:5170 5097

Resistance:5314 5384

The Four Stages of Trading

Like so many other things in life -- trading involves progressing through various necessary stages of learning. This happens regardless of whether we are conscious of the process or not. Additionally, the amount of time we spend in these stages will vary depending on a number of factors, including our age, education, emotional makeup, finances, and perhaps most importantly, our willingness to learn.

The information presented here is not new, but it bears repeating because fully grasping these concepts will not only help you identify where you are in the learning process but aid you in planning for future growth.

Stage One -- Unconscious Incompetent

The first stage a trader experiences is that of the unconscious incompetent. This is the stage where traders don't even know that they don’t know what they’re doing -- because it requires no particular skill to put on a winning trade (you have a 50 / 50 chance of being right). It is statistically quite normal for a new trader to put together a string of winning trades.

This generally results in the trader feeling elation and euphoria and is quite dangerous because the inexperienced trader lacks the necessary skills to put together consistent successful results. Inevitably, the new trader is shoved along to the next stage in much the same way an infant suddenly becomes a toddler.

Stage Two – Conscious Incompetent

The second stage is the most frightening stage of trading. New traders at this stage are now painfully aware that they do not know what they are doing. It is akin to the toddler who has taken first steps, only to fall and hit his or her head on the floor or coffee table. Fortunately, few, if any, of us consciously remember those experiences.

Such is not the case when it comes to trading. We remember the painful losses that damaged or perhaps devastated our trading accounts. These are lessons that we will not forget any time soon! We must learn how to put these painful experiences into perspective and learn from them or we quit trading -- either to stop the pain or because our trading account is wiped out.

For most traders who survive into stage two, education is front and center in their life. Many will conclude that the key lies in better trade analysis. This is only partially correct. A frenzied study of various trading methodologies usually ensues.

Those who possess a strong desire to learn will eventually find a trading style and “edge” suited to them. If they are fortunate enough not to have squandered all of their trading account during stage one and two, and if they have learned something about trade management, probability theory, risk control and trading psychology, they will move on to stage three.

Stage Three -- Conscious Competent

Stage three traders possess most of the necessary tools to be successful. They only lack experience. This too is a stressful stage for, although traders at this stage are capable of producing consistent results, they must think about every step along the way. This eats up a great deal of energy and makes it difficult, perhaps impossible, to relax and simply enjoy what they are doing.

Building on our previous analogy, this would be similar to a child crossing a busy street or navigating a narrow trail. While the child possesses the necessary skills -- he or she must be focused and constantly evaluating every step of the process. On the plus side, traders at this stage are now producing consistent results that can easily be seen in their equity curve. With each passing day, the trader becomes more capable, experienced and relaxed.

Stage Four – Unconscious Competent

Stage four traders have arrived in every sense of the word. For them, trading has become an automatic reflex and requires no more mental effort than the average person expends on walking. There is little or no struggle with trading decisions but, rather, a conditioned response to trading opportunities. There is no hesitation about entering a position or booking a loss. It’s not personal -- it’s just business.

Additionally, most traders in this zone continue to educate themselves. They have learned that small refinements in technique pay large dividends to their trading accounts over the long haul.

This does not mean that the “unconscious competent” trader will not have challenges. Health problems, family issues, financial difficulties will arise eventually for everyone. Advanced traders have learned to constantly monitor his or her susceptibility to trading errors related to these types of outside forces.

It bears mentioning that no one has managed to become a successful trader without going through all of these stages. All of them are necessary and fundamentally important for continued growth. Knowing where you are in this process helps you know what to expect and what you need to do to progress to the next stage in your trading.

The information presented here is not new, but it bears repeating because fully grasping these concepts will not only help you identify where you are in the learning process but aid you in planning for future growth.

Stage One -- Unconscious Incompetent

The first stage a trader experiences is that of the unconscious incompetent. This is the stage where traders don't even know that they don’t know what they’re doing -- because it requires no particular skill to put on a winning trade (you have a 50 / 50 chance of being right). It is statistically quite normal for a new trader to put together a string of winning trades.

This generally results in the trader feeling elation and euphoria and is quite dangerous because the inexperienced trader lacks the necessary skills to put together consistent successful results. Inevitably, the new trader is shoved along to the next stage in much the same way an infant suddenly becomes a toddler.

Stage Two – Conscious Incompetent

The second stage is the most frightening stage of trading. New traders at this stage are now painfully aware that they do not know what they are doing. It is akin to the toddler who has taken first steps, only to fall and hit his or her head on the floor or coffee table. Fortunately, few, if any, of us consciously remember those experiences.

Such is not the case when it comes to trading. We remember the painful losses that damaged or perhaps devastated our trading accounts. These are lessons that we will not forget any time soon! We must learn how to put these painful experiences into perspective and learn from them or we quit trading -- either to stop the pain or because our trading account is wiped out.

For most traders who survive into stage two, education is front and center in their life. Many will conclude that the key lies in better trade analysis. This is only partially correct. A frenzied study of various trading methodologies usually ensues.

Those who possess a strong desire to learn will eventually find a trading style and “edge” suited to them. If they are fortunate enough not to have squandered all of their trading account during stage one and two, and if they have learned something about trade management, probability theory, risk control and trading psychology, they will move on to stage three.

Stage Three -- Conscious Competent

Stage three traders possess most of the necessary tools to be successful. They only lack experience. This too is a stressful stage for, although traders at this stage are capable of producing consistent results, they must think about every step along the way. This eats up a great deal of energy and makes it difficult, perhaps impossible, to relax and simply enjoy what they are doing.

Building on our previous analogy, this would be similar to a child crossing a busy street or navigating a narrow trail. While the child possesses the necessary skills -- he or she must be focused and constantly evaluating every step of the process. On the plus side, traders at this stage are now producing consistent results that can easily be seen in their equity curve. With each passing day, the trader becomes more capable, experienced and relaxed.

Stage Four – Unconscious Competent

Stage four traders have arrived in every sense of the word. For them, trading has become an automatic reflex and requires no more mental effort than the average person expends on walking. There is little or no struggle with trading decisions but, rather, a conditioned response to trading opportunities. There is no hesitation about entering a position or booking a loss. It’s not personal -- it’s just business.

Additionally, most traders in this zone continue to educate themselves. They have learned that small refinements in technique pay large dividends to their trading accounts over the long haul.

This does not mean that the “unconscious competent” trader will not have challenges. Health problems, family issues, financial difficulties will arise eventually for everyone. Advanced traders have learned to constantly monitor his or her susceptibility to trading errors related to these types of outside forces.

It bears mentioning that no one has managed to become a successful trader without going through all of these stages. All of them are necessary and fundamentally important for continued growth. Knowing where you are in this process helps you know what to expect and what you need to do to progress to the next stage in your trading.