Nifty sees 4 quarter of correction, EOD Analysis

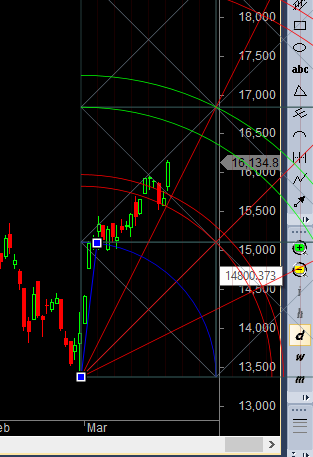

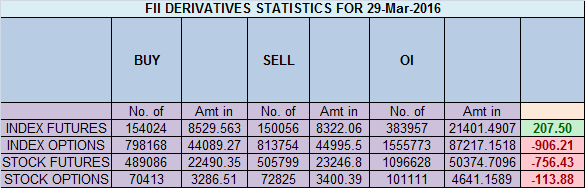

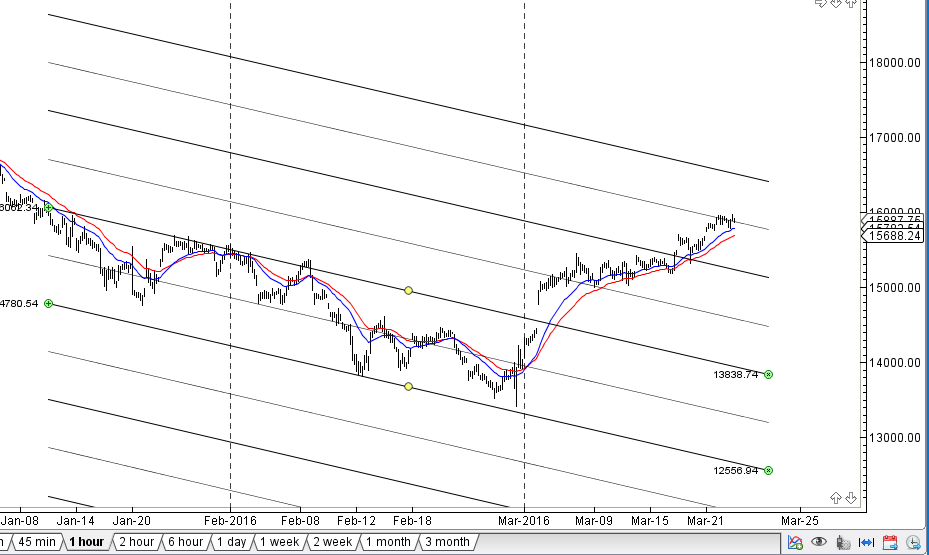

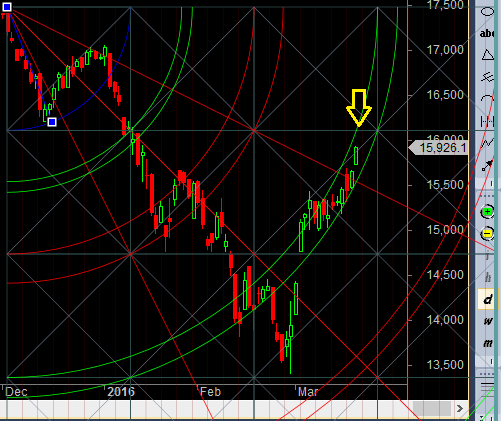

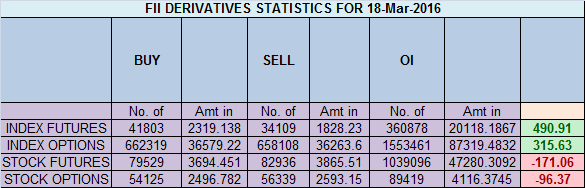

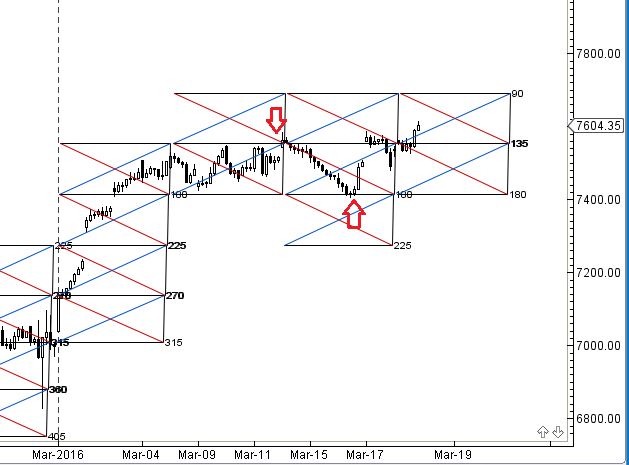

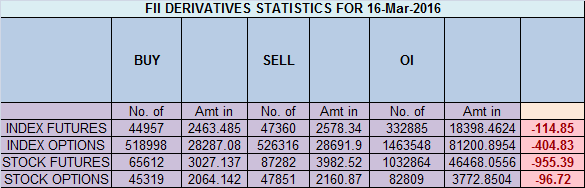

- As discussed in Last Analysis Support is again at 7550 and resistance in range of 7780-7800. High made today was 7777, as nifty reacted from demand zone, Nifty has risen 767 points in March series and formed a hammer pattern on Quarterly chart, As seen in below chart nifty has corrected for 4 quarters in a row and it has happened 3 time before, and every time market has rallied, Will History repeat itself needs to be seen. Bank Nifty forms doji near supply zone, EOD Analysis

Continue Reading