FII FnO Data Analysis for 1 Feb Trade for Nifty Futures

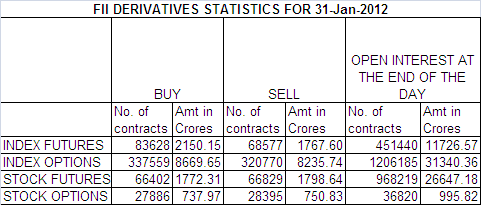

1. FII bought 15051 Contracts of NF worth 382 cores OI also increased by 4919 contracts.

2. Nifty Futures was able to cover up all the looses made yesterday ended up by 117 points,As OI also increased by 4919 contracts longs were added into the system.

3. We have clearly mentioned yesterday there were no indication of shorting from BIg Boys and today we saw the effect. Hope the timely warning helped trader and avoided shorting the INDEX

4. Today Nifty made one more attempt to cross over 200 DMA@5199 and closely near that level only.

5. Today's Price action has few important Observation

- Nifty filled the.....