Is It possible to make money day trading part time ?

First and Foremost let me clear the air which most of aspiring traders have ..

Continue Reading

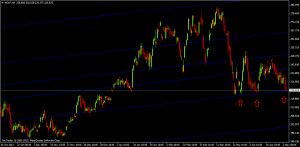

Bank Nifty is trading in perfect channel, took resistance at the higher

end of channel and is now trading at the lower end of channel and near

to its 200 HSMA@ 12700. Break below...

Bank Nifty is trading in perfect channel, took resistance at the higher

end of channel and is now trading at the lower end of channel and near

to its 200 HSMA@ 12700. Break below...

LT

will be coming out with its results today around 1 PM in afternoon.

Stock has been consolidating in past 2 trading sessions and

breakout/breakdown will follow today.Stock will be highly volatile today

and traders are advised to use extreme caution when trading LT, trade

as per levels and stick with SL

LT

will be coming out with its results today around 1 PM in afternoon.

Stock has been consolidating in past 2 trading sessions and

breakout/breakdown will follow today.Stock will be highly volatile today

and traders are advised to use extreme caution when trading LT, trade

as per levels and stick with SL

RIL closed above its 200 DMA with bullish engulfing pattern, Stock once its crosses above 845 can see a breakout move till 870 in short term.

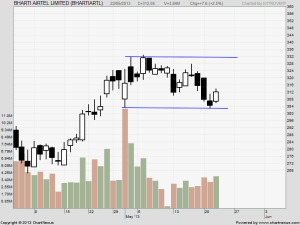

Tata

Global has formed a swing high at 153.4, stock has been falling from

that level. Today's fall it took support at falling trendline at 139.

Holding the same bounceback can be expected else 130 odd levels are on

cards.

Tata

Global has formed a swing high at 153.4, stock has been falling from

that level. Today's fall it took support at falling trendline at 139.

Holding the same bounceback can be expected else 130 odd levels are on

cards.