Nifty July Expiry Analysis

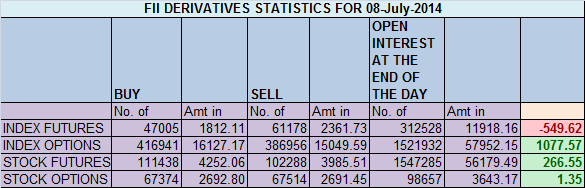

- FII's bought 16225 contract of Index Future worth 638 cores, 33.3 K Long contract were added and 16.9 K short contracts were added by FII's. Net Open Interest increased by 50.2 K contract.FII's have net 89 K contract of Shorts open and 85.8 K Contract of Long open in current series. If we removed last 3 days of shorts added by FII, we are left with 48K contract which were majorly added 01 July to 10 July when Nifty traded in range of 7677-7809, so 7677 below these shorts will become profitable so FII's will try to push index below 7677 to exit the trades in profit, unable to do so we can expire above 7800 so next 2 days we can see a 150+ move in market.

Continue Reading