FII Derivative Data Analysis for 1 August Trade in Nifty Future

The trouble with most people is that they think with their hopes or fears or wishes rather than with their minds... Will Durant

Hope is the buzzword on financial markets around the world ? Hope of more QE,Hope of action from ECB ,Hope of RBI cutting rates but as a traders

HOPE is your worst enemy.Think about how many trades you did on Hope and ended up being the biggest loosing trade.July series ended on a firm note with a closing above the scared level of 5217 which will keep the momentum going on for bulls. FED and ECB meeting are lined up tomorrow and there course of action will decide the further trend of global market.

India is facing the worst power crisis of decade with almost 600 million people in dark because of failure of Norther,Easter and Western grids and our Power Minster SUSHIL KUMAR SHIND got promoted to Home Minster today,Such is the irony of Indian Politics.

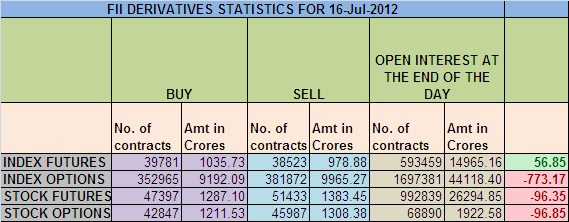

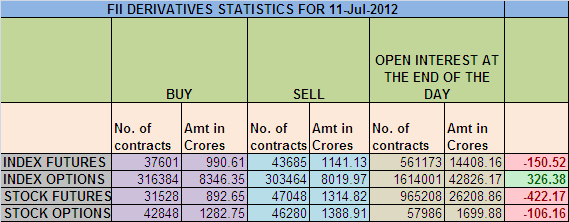

P CHIDAMBARAM will be the new FM, lets see how market reacts to this development.1. FII bought 8246 Contracts of NF ,worth 187 cores with net OI increasing by 10292 contracts.

2. As Nifty Future was up by 23 points and OI...

Read the Full Story