The 15th general election has returned UPA to power. Clearly in a show of

positive selection, much beyond the most optimistic media projection, the

Congress led incumbent UPA got an overwhelming majority and are all set to

form the next government without any support from the Left parties. Also the

UPA has the option not to rely on support from any of the regional parties and

reach the mid-mark in a house of 543 MPs by getting support from the like

minded “independents and others”. More than anything else, these

developments are likely to buoy sentiments in the stock markets. Not only to

say that the stock markets would rally in the short term, but the election

results could just lay the foundation for a long term rally in stock prices, in our

view.

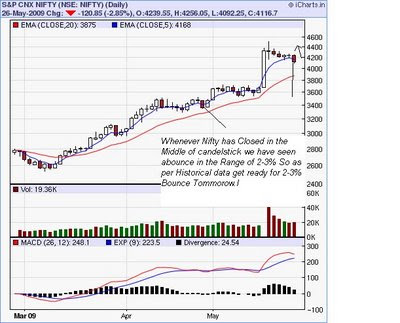

Market Outlook: Results are beyond the market expectation hence positive.

Since March market went up by 60% with FIIs pumping in USD2.5bn.

Domestic institutions did not participate and have been waiting for the market

to correct, anticipating a fractured election mandate to be the catalyst. With

market opening gap up – it could be 200-250 points Nifty up on Monday, with

a positive bias, DIIs have no option but to start investing as the event risk is

now over. Long only FIIs, who have been waiting on the sideline for the event

risk to pass, would also come in. GEM (emerging market) funds are 2.5% in

cash and Asia dedicated funds are 3.5% in cash which needs to be deployed.

There would be short covering – markets have puts built up around 3300-

3200 level. Next big event is allocation of ministry but the real big event would

be the budget in 3-months time.

Sector outlook:From the UPA manifesto one could predict the coalition’s commitment to the

social and rural sectors, with emphasis on agriculture and inclusive growth.

Also the nuclear deal and Indo-US relationship would play an important role.

We conclude the following likely effect.

Agriculture/Rural/Social Sector: New allocation in these sectors benefits

companies exposed to these sectors. Stocks to watch out for are Maruti,

Bajaj Auto, Hero Honda, M&M & Jain Irrigation. HLL, Dabur, Asian

Paints, Titan would also benefit from rural sales. Bharti Tele would benefit

from rural mobility.

Commodity trading: Financial Technology

Nuclear Deal: L&T, Areva T&D, Gammon India, HCC, Tata Power would

benefit

Infrastructure: Major investments in power sector infrastructure, airports,

roads and rural infrastructures, as employment generation multiplier is high.

GVK, GMR, BHEL, Mundra Ports, IRB

Cement & Steel: Infrastructure push will generate demand for both cement

and steel. Grasim, Century, SAIL, JSW, Sterlite.

Power: PFC, PTC.

Real estate: Government would be keen to give more stimulus to the sector

employs one sixth of marginal employment. Will push for small housing,

hence SBI (reach of town B, C), PNB, LIC HF, DHFL (mortgage ticket size is

small). Real estate (DLF, Unitech, Indiabull Real Estate, HDIL).

Disinvestments : Fiscal prudence demands IPO/FPO of PSUs where

government holding is high. Entire PSU space could be re-rated.

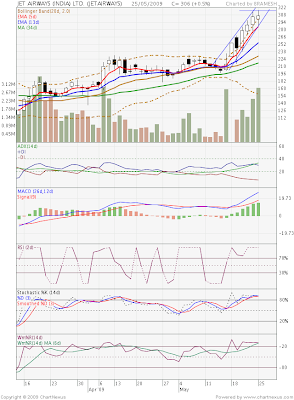

FDI: Retail (Pantaloon), Aviation sector could be re-rated.

NELP 8, 3G Auction: Will go through. Benefit to RIL, Cairns, Bharti, Idea

Pension & insurance sector reforms: Likely hence benefits Aditya Birla

Nuvo, Max Life directly.

What can be shorted?: Time to increase beta and overweight cyclicals and

underweight defensives. Sell pure FMCG like Nestle, IT (low beta) : Infosys,

TCS, Wipro, Tech Mahindra, Pharma: Divi’s lab, Sun Pharma