Bank Nifty Weekly Analysis before Crucial RBI Policy on 2 June

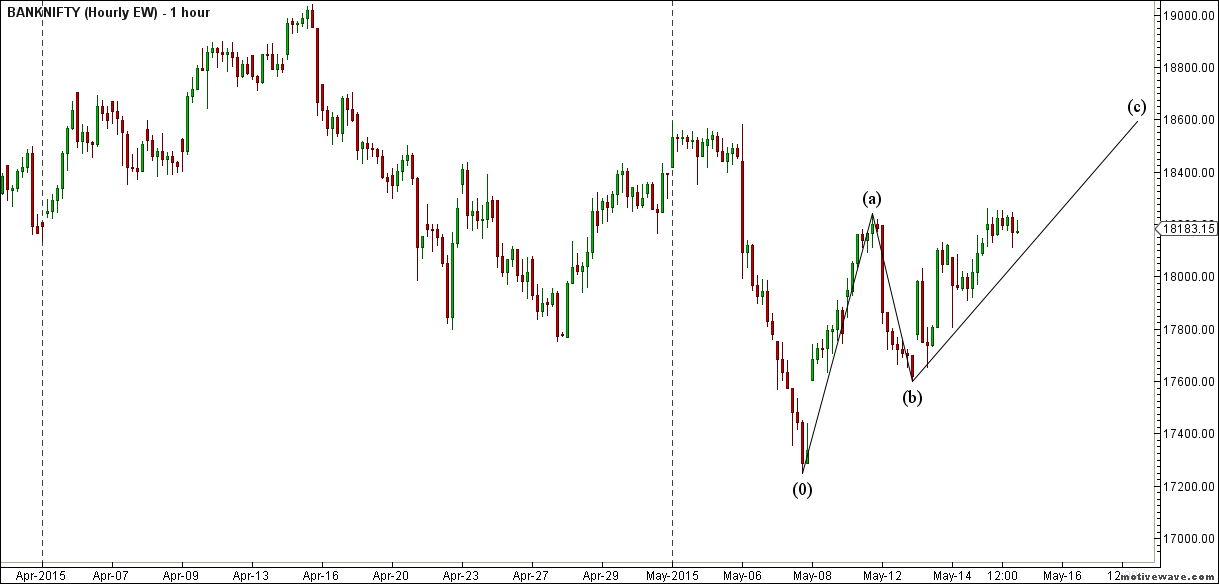

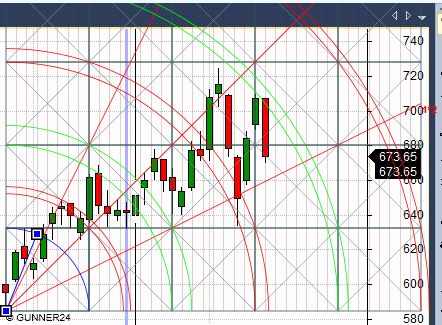

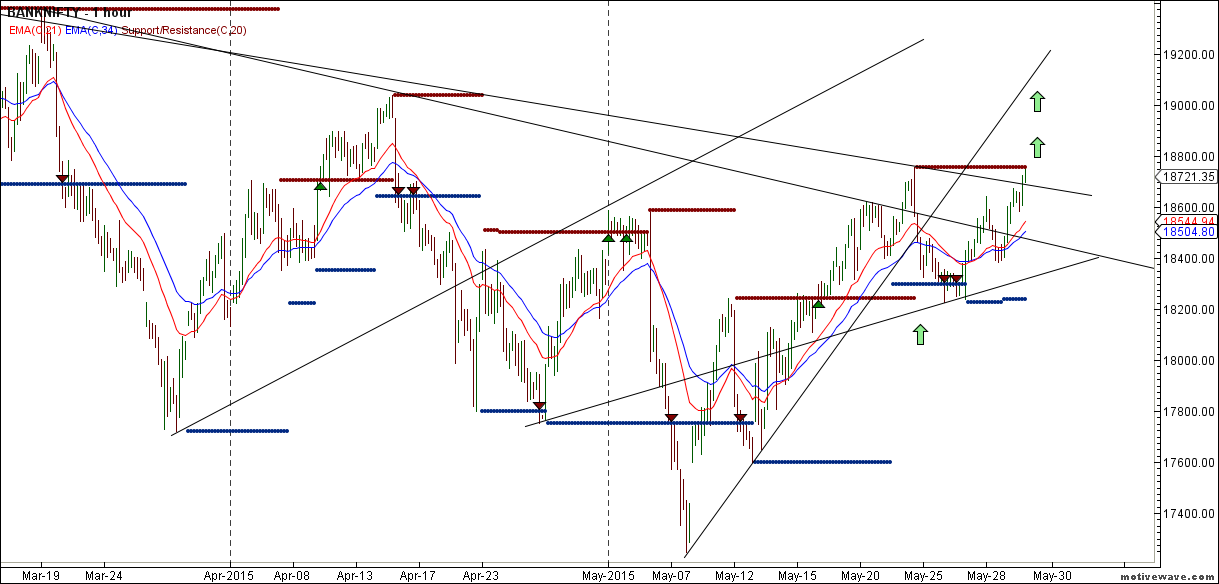

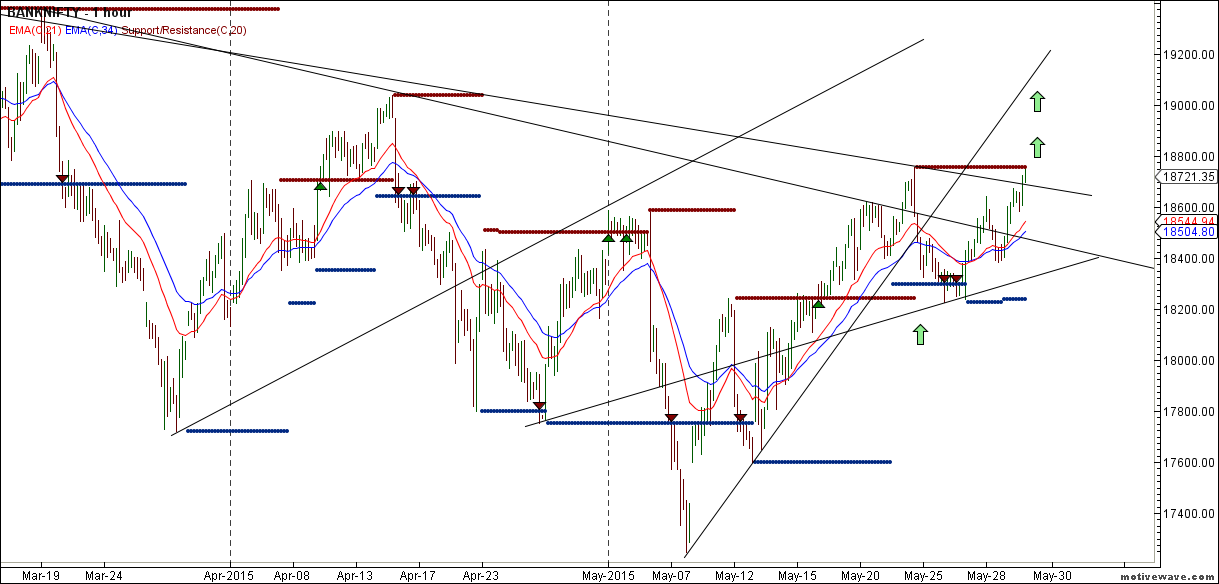

Bank Nifty Hourly

Bank Nifty broke its trendline and also closed above its 21/34 EMA, suggesting break of 18750 can see move towards 18900/19038 is on cards. Bearish below..

I have a problem with hesitation. Even though I have a strategy that fits my personality and is consistently profitable, I still hesitate on 2 out of 5 trades. And for some strange reason I always hesitate when the profit would have been the best. My whole body senses that I need to take the trade, but it’s almost like I have another person in my mind who controls me and holds me off from following my intuition.I’m sure we can all relate to this. I know I can. Sometimes it feels like our emotions literally take over and we are hostage to them. Almost like it’s another person in our mind, as Srinivasa notes. So the natural question becomes: how do you control your emotions while trading?