Nifty 2015 Overview-- A Lost Year

Regular Post will start publishing from Saturday. Traders’ Resolutions for New Year-2016

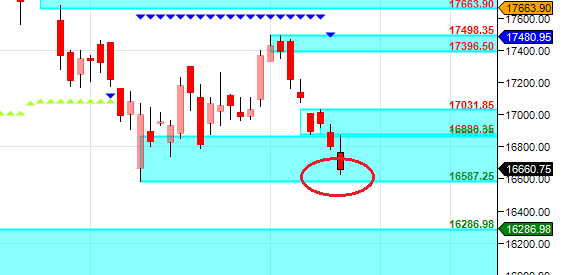

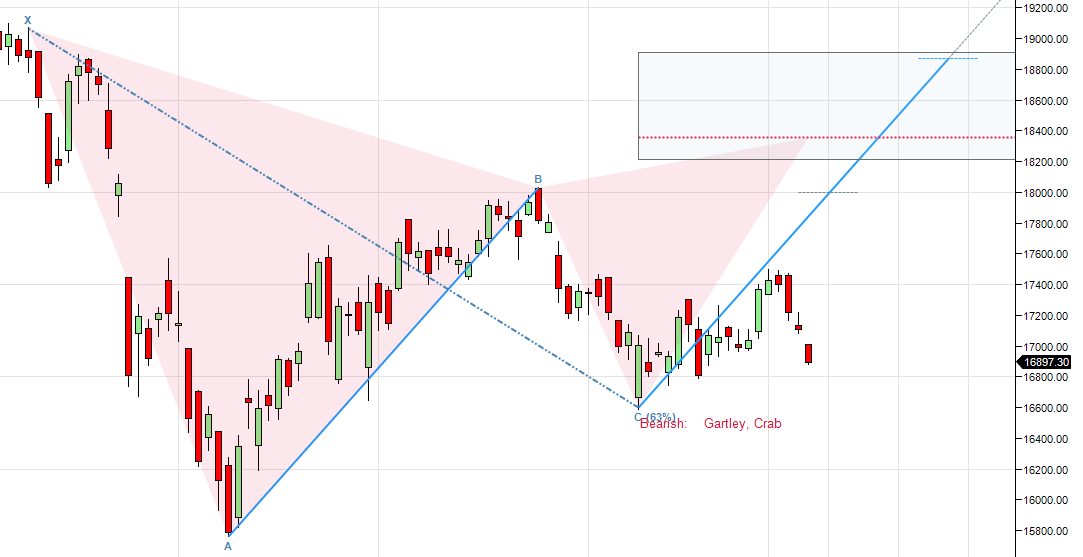

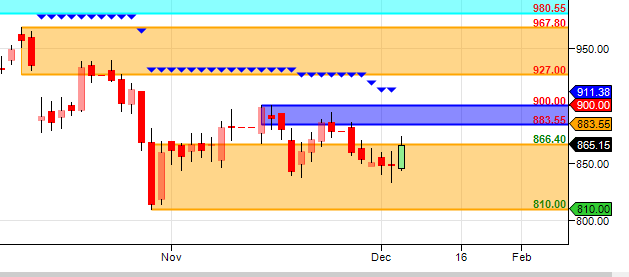

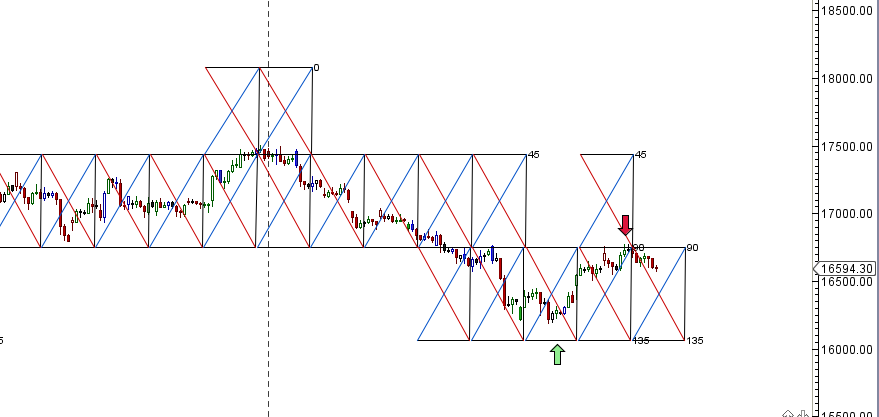

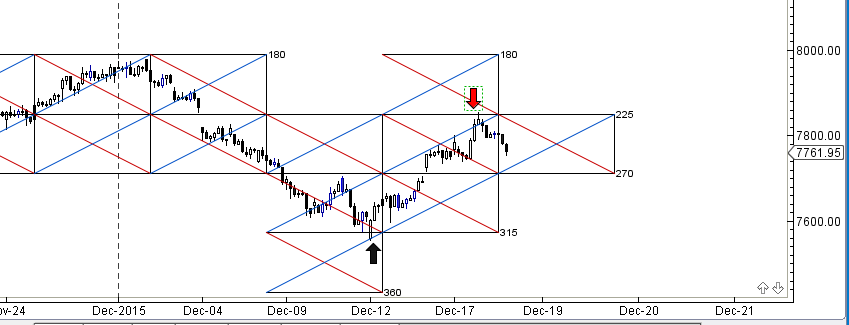

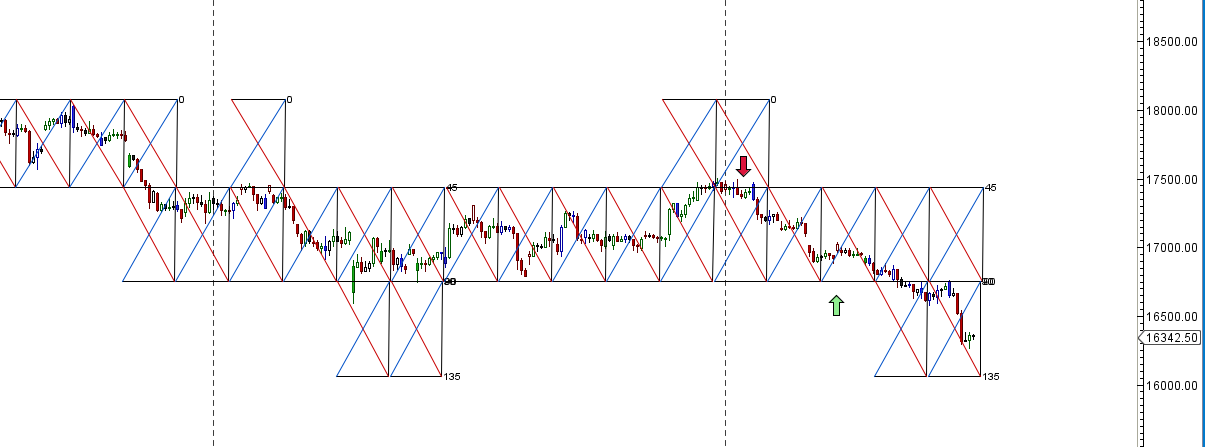

2015 year started with a Bang with Nifty clocking a gain of 6.35% in Jan Month but as per Gann Yearly cycle we made a High of 9119 04-March-2015 which was the Top of market when RBI gave the surprise rate cut and came down till 7539 08-Sep-2015 and closing the year with a loss of 3%. We can consider 2015 as year of consolidation after Nifty made heft gains off 28%i 2014 riding the MODI wave. Quarterly and Yearly chart of Nifty are shown below.

7

7