Nifty Weekly Forecast for 01-05 Feb

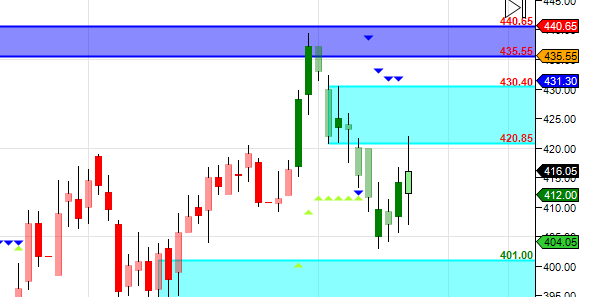

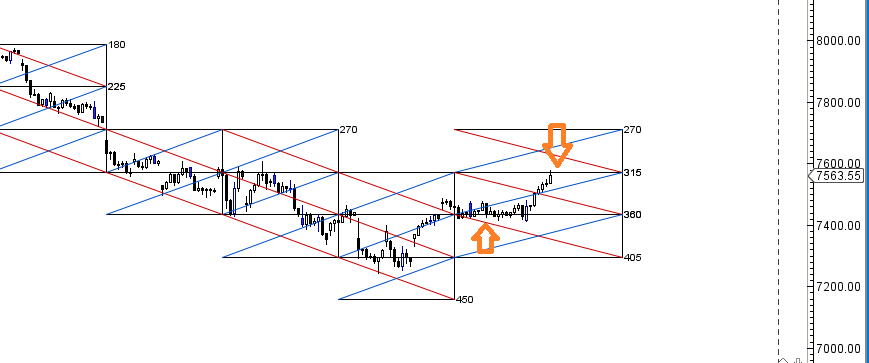

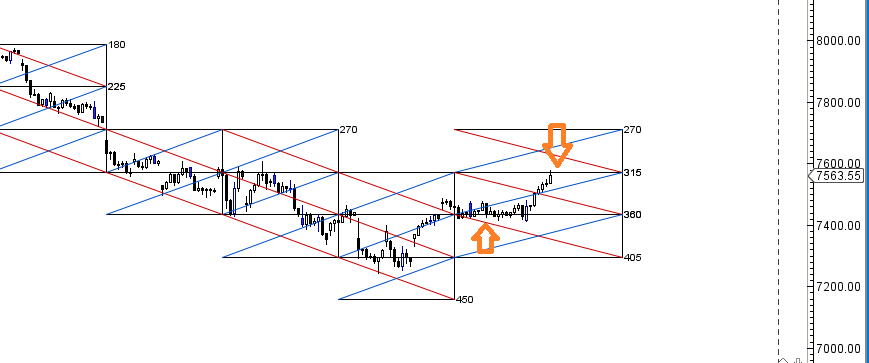

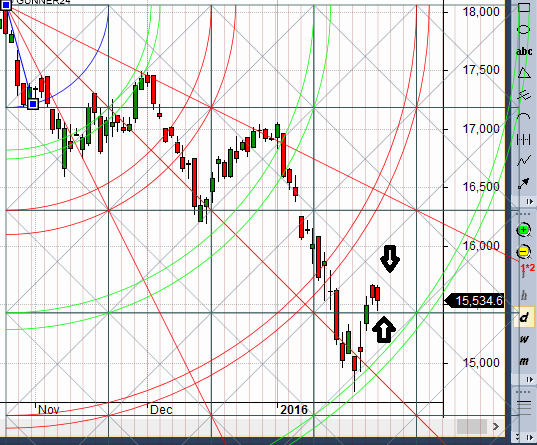

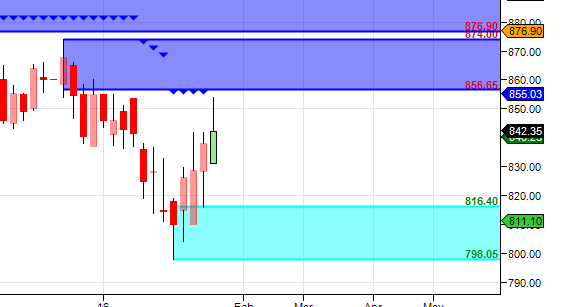

Nifty Hourly Chart

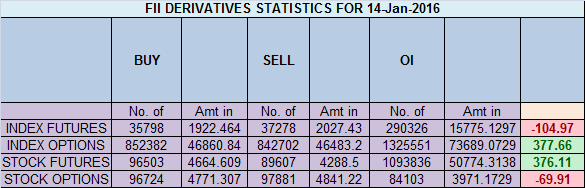

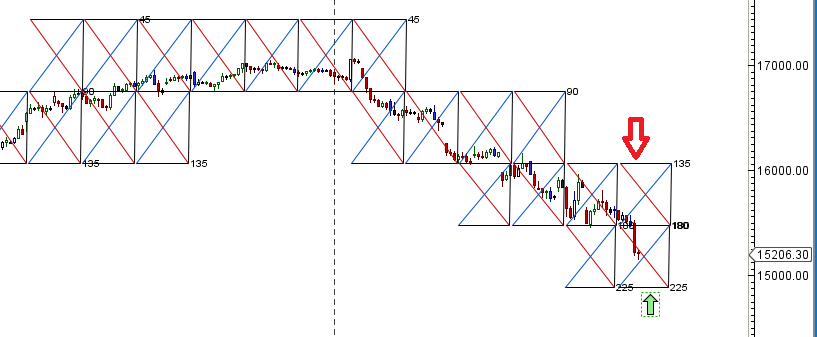

As discussed in last analysis Coming week

If you study history, you will find that all stories of success are also stories of great failures. But people don't see the failures. They only see one side of the picture and they say that person got lucky: "He must have been at the right place at the right time."Tom Watson Sr. said, "If you want to succeed, double your failure rate."

Most of traders are aware of this age old adage " A trader you should cut your losses short and let your winners run."Still most of traders work against this and keep blowing off their account.

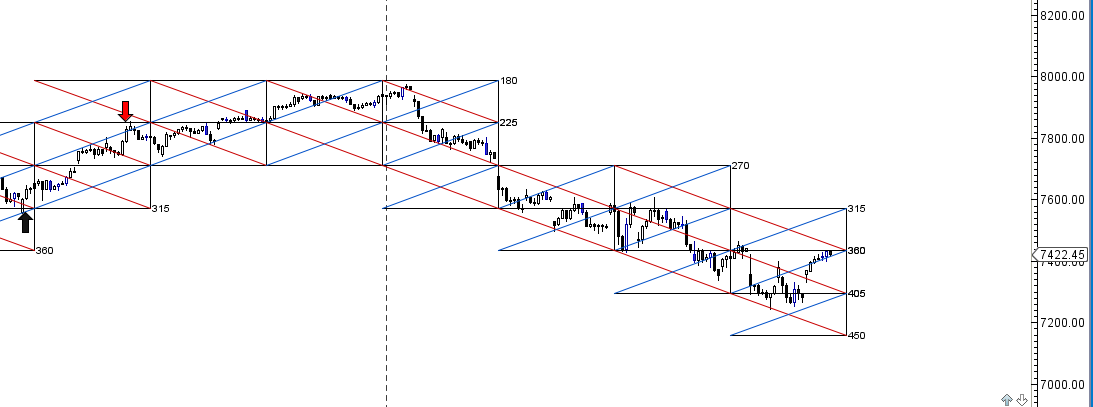

As discussed in last analysis Break of 315 @7551 can see fast move till 7430.

As discussed in last analysis Break of 315 @7551 can see fast move till 7430.