Reliance Industries has been barred by Sebi (Securities and Exchange

Board of India) on Friday from equity derivatives trading for one year.

SEBI has imposed BAN following alleged fraudulent trading in the

futures and options (F&O), or derivatives, of RIL's former listed

subsidiary Reliance Petroleum, which has since been merged with the

parent firm. Sebi has allowed RIL and other entities to square off or

close existing open positions.

The regulator has asked RIL to pay

Rs 447 crore along with an annual interest of 12 per cent since November

29, 2007, taking the total disgorgement liability of the company to

nearly Rs 1,000 crore. It has been asked to pay the amount within 45

days.SEBI said Reliance has made gain of 551 cores so technically

reliance has to pay fine of just 450 cores which is minuscule for

company having market cap of 44 Billion USD. This News will be

sentimentally negative to stock but long term prospect will not get

affected. Lets study the technical parameter of stock how it can react

on Monday.

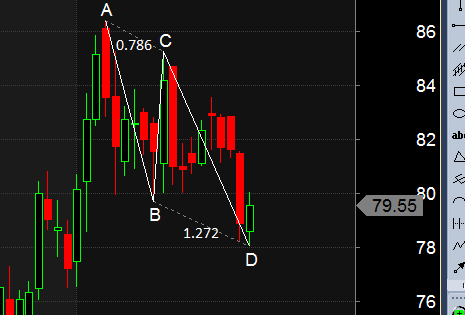

Reliance Gann Chart

Continue Reading