Not able to pull the trigger in Trading

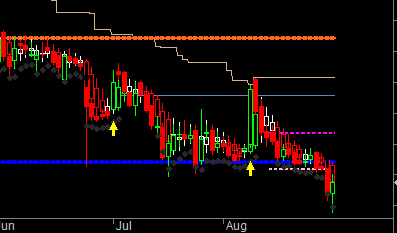

Nifty closed below 8577 on Friday, You went short hoping to make a 100 points. Monday market continue to trade below 8577 but suddenly reversal come and it start trading above 8577. You have decided if it close above 8577 for 1 hour i will close the trade. It sustains above that than you think market is bearish and lets wait for the close above 8577 for exit. At 3:20 price is comfortably closing above 8577 , You think its just one of scenario as market is doing time correction and it will come down, So Hold on to losing trade. And Yesterday it was a Big Zoom and now we are up more than 200 points from 8577. But you are holding to losing trade hoping it will come down.

Another possible scenario is you exit at 8577 but do not go long and watching this rally from sidelines as last time you went long it did not move aggressively.

Does the above 2 trading scenario happens with you quiet often.

Continue Reading

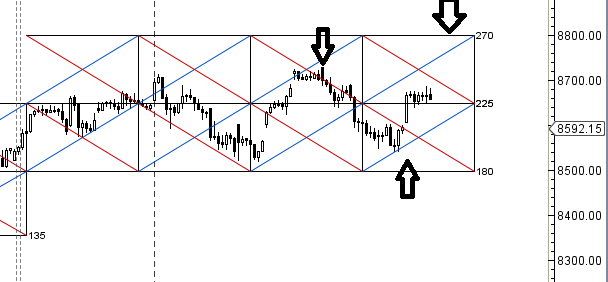

Nifty is heading towards 8760-8790 zone where next level

Nifty is heading towards 8760-8790 zone where next level