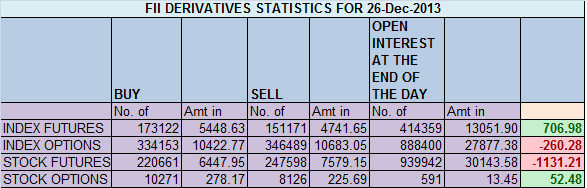

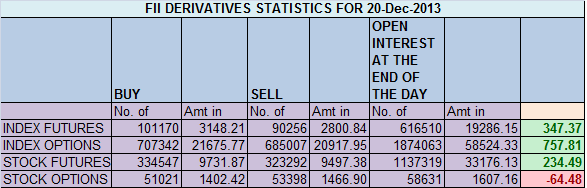

FII FnO Analysis for last trading day of 2013

- FIIs

sold 1225 contracts of Index Future worth 42 cores with net Open

Interest decreasing by 2603 contracts, so FII's added shorts in today's

session.

Continue Reading

Positional

traders should keep an eye on close above 102, for short term target of

110. Any close below 97 stock is heading back to 94 in short term.

Positional

traders should keep an eye on close above 102, for short term target of

110. Any close below 97 stock is heading back to 94 in short term.

Bank

Nifty hourly charts are showing positive divergence in leading

indicators holding

Bank

Nifty hourly charts are showing positive divergence in leading

indicators holding