Sunday, November 30

Tuesday, November 25

Monday, November 24

CITIGROUP – GETS THE UMBRELLA OF BAILOUT

The one big question on everyone’s mind was the fate of Citigroup. After the crashes of Lehman and then Merrill, people have now become wary and the feeling today is that no company, how so ever big it might be, is immune - any company can go down like the Titanic, sink into the oblivion.

The news that Citgroup might sell part of its assets or even all of it came as a shocker. The plunge in its share price was also worrying, threatening to engulf other big banks. But finally, this dark looming cloud seems to be dissipating. After a tense, round-the-clock bout of negotiations that stretched until almost midnight on Sunday, a bold plan seems to now have emerged.

The US Govt knew that this is one collapse, which its economy could no longer afford to have. And rescue Citigroup, it had to do! Hence a plan, mooted jointly by the Treasury Department, the Federal Reserve and the Federal Deposit Insurance Corp (FDIC) will now provide the required crutches to the maimed group.

As part of the plan, apart from taking a $20 billion stake, the Treasury and the FDIC will guarantee against the "possibility of unusually large losses" on up to $306 billion of risky loans and securities backed by commercial and residential mortgages. Under the loss-sharing arrangement, Citigroup Inc. will assume the first $29 billion in losses on the risky pool of assets. Beyond that amount, the government would absorb 90% of the remaining losses and Citigroup 10%. Money from the $700 billion bailout and funds from the FDIC would cover the government's portion of potential losses. The Treasury Department will use its bailout fund to assume up to $5 billion of losses. If necessary, the FDIC will bear the next $10 billion of losses and losses beyond that would be borne by the Federal Reserve.

In exchange, Citigroup will issue $7 billion of preferred stock to government regulators. In addition, the government is buying $20 billion of preferred stock in Citigroup, which will pay a 8% dividend and will marginally erode the value of shares held by investors.

Apart from this complex plan, as a condition of the rescue, Citigroup is barred from paying quarterly dividends to shareholders of more than 1 cent a share for three years unless the company obtains consent from the three federal agencies. The agreement also places restrictions on executive compensation, including bonuses.

Investors are happy that this bank too has been rescued but the dissent amongst the smaller banks, which could also have been rescued if the Govt had taken timely action seems to now be growing. Why was Lehman allowed to go down? Couldn’t it too have been rescued with a timely action plan? Another growing worry is that these actions could put billions of taxpayers' dollars in further jeopardy. Moreover, it would encourage financial companies to take excessive risk on the belief that the government will bail them out.

Collapse of Citigroup was one more crisis which could have toppled the US economy and to some extent, sent the global economy into a longer drawn out recession. Citigroup, America’s largest and mightiest financial institution today is sitting on a loss of $65 billion and more than half that amount comes from mortgage related securities created by one man - Thomas G. Maheras, who repeatedly assured the bank that everything was alright and stated that there were no losses. The bank, which is actually a worldwide conglomerate, relied on the words of this one man and allowed the bank to collapse. And by the time the risk management team took over, it was too late. The question that comes to mind once again – how can such a large bank rely on the words of just one man? The near collapse of Citigroup is symbolic of the madness, which had taken over the entire Wall Street – to get rich fast, two hoots to management and risks! And today, the whole world is paying a price. This is the price we all have to pay for depending so largely on one super power.

For now, one more crisis has been averted. But are there any more lurking in the background? How many more bailouts to go?

The news that Citgroup might sell part of its assets or even all of it came as a shocker. The plunge in its share price was also worrying, threatening to engulf other big banks. But finally, this dark looming cloud seems to be dissipating. After a tense, round-the-clock bout of negotiations that stretched until almost midnight on Sunday, a bold plan seems to now have emerged.

The US Govt knew that this is one collapse, which its economy could no longer afford to have. And rescue Citigroup, it had to do! Hence a plan, mooted jointly by the Treasury Department, the Federal Reserve and the Federal Deposit Insurance Corp (FDIC) will now provide the required crutches to the maimed group.

As part of the plan, apart from taking a $20 billion stake, the Treasury and the FDIC will guarantee against the "possibility of unusually large losses" on up to $306 billion of risky loans and securities backed by commercial and residential mortgages. Under the loss-sharing arrangement, Citigroup Inc. will assume the first $29 billion in losses on the risky pool of assets. Beyond that amount, the government would absorb 90% of the remaining losses and Citigroup 10%. Money from the $700 billion bailout and funds from the FDIC would cover the government's portion of potential losses. The Treasury Department will use its bailout fund to assume up to $5 billion of losses. If necessary, the FDIC will bear the next $10 billion of losses and losses beyond that would be borne by the Federal Reserve.

In exchange, Citigroup will issue $7 billion of preferred stock to government regulators. In addition, the government is buying $20 billion of preferred stock in Citigroup, which will pay a 8% dividend and will marginally erode the value of shares held by investors.

Apart from this complex plan, as a condition of the rescue, Citigroup is barred from paying quarterly dividends to shareholders of more than 1 cent a share for three years unless the company obtains consent from the three federal agencies. The agreement also places restrictions on executive compensation, including bonuses.

Investors are happy that this bank too has been rescued but the dissent amongst the smaller banks, which could also have been rescued if the Govt had taken timely action seems to now be growing. Why was Lehman allowed to go down? Couldn’t it too have been rescued with a timely action plan? Another growing worry is that these actions could put billions of taxpayers' dollars in further jeopardy. Moreover, it would encourage financial companies to take excessive risk on the belief that the government will bail them out.

Collapse of Citigroup was one more crisis which could have toppled the US economy and to some extent, sent the global economy into a longer drawn out recession. Citigroup, America’s largest and mightiest financial institution today is sitting on a loss of $65 billion and more than half that amount comes from mortgage related securities created by one man - Thomas G. Maheras, who repeatedly assured the bank that everything was alright and stated that there were no losses. The bank, which is actually a worldwide conglomerate, relied on the words of this one man and allowed the bank to collapse. And by the time the risk management team took over, it was too late. The question that comes to mind once again – how can such a large bank rely on the words of just one man? The near collapse of Citigroup is symbolic of the madness, which had taken over the entire Wall Street – to get rich fast, two hoots to management and risks! And today, the whole world is paying a price. This is the price we all have to pay for depending so largely on one super power.

For now, one more crisis has been averted. But are there any more lurking in the background? How many more bailouts to go?

Saturday, November 22

Wednesday, November 19

G-20 or 420?

The "Group of 20" nations met in Washington over the weekend. The weather was cloudy and cool. The winds were blowing west-by-north-west at 14 miles per hour. But what came out was mostly hot air. Stale, hot air.

President Bush who is destined - unless saved by some miracle - to go on record as the worst President in the history of modern day USA laid the foundation for this nothingness.

Before the meeting began President Bush reminded us all that this financial crisis was not a failure of capitalism - there was no need to discourage financial innovation with excessive regulation.

Sure, the world needs a lot more financial innovation to be wrapped around the greed and slimy business practices of the financial geniuses.

The Europeans wanted more global oversight, more regulation. Eventually, the G-20 came out with a list of 20 points: a promise to do more and put in action with a notice that "we will meet again by April 30, 2009, to review the implementation of the principles and decisions agreed today".

Doctor, what's the problem?

But before any doctor sets forth a prescription, there must be a clear understanding of the disease. A treatment can only be effective when one understands the illness and identifies the cure.

So, what are the events that led us to where we are? What are the crises that led to a dinner and weekend meeting of the leaders of 20 countries that represent about 90% of the global GDP and 75% of the world's population?

This is what the statement of the G-20 had to say (points 3 and 4):

"Root Causes of the Current Crisis

3. During a period of strong global growth, growing capital flows, and prolonged stability earlier this decade, market participants sought higher yields without an adequate appreciation of the risks and failed to exercise proper due diligence.

At the same time, weak underwriting standards, unsound risk management practices, increasingly complex and opaque financial products, and consequent excessive leverage combined to create vulnerabilities in the system.

Policymakers, regulators and supervisors, in some advanced countries, did not adequately appreciate and address the risks building up in financial markets, keep pace with financial innovation, or take into account the systemic ramifications of domestic regulatory actions.

4. Major underlying factors to the current situation were, among others, inconsistent and insufficiently coordinated macroeconomic policies, inadequate structural reforms, which led to unsustainable global macroeconomic outcomes. These developments, together, contributed to excesses and ultimately resulted in severe market disruption."

Now let's put that in English.

G-20: During a period of strong global growth, growing capital flows, and prolonged stability earlier this decade, market participants sought higher yields without an adequate appreciation of the risks and failed to exercise proper due diligence

The English version: After the technology bust in 2000 and the 9/11 terrorist attacks on the US, the global economies were on the edge of a long recession and - to prevent that from happening - the central bankers of the world kept on cutting interest rates with a view to encouraging economic activity. Whenever there is pain around the corner, the doctor prescribes the pain killer to remove the pain. The central bankers prescribed the drug ecstasy to turn that pain into the most orgasmic experience. The central bankers printed so much money that the financial geniuses figured out what to do with it: they gave it to people who could not really afford to ever repay it. And each time they lent money, the financial geniuses made a profit. And each time they made a profit, the financial firms rewarded themselves with salaries and USD 65 million bonuses.

G-20: At the same time, weak underwriting standards, unsound risk management practices, increasingly complex and opaque financial products, and consequent excessive leverage combined to create vulnerabilities in the system.

The English version: Hey, if you were cleaning out USD 1 million in salary every year (and there must have been 100,000 people in the field of finance, law, accounting, and consultancy who made that much money) and then getting a bonus and stock options over and above that - would you care about the vulnerability in the "system". Man, you were the "system"! People relied on you for ethical practices and you didn't give a damn about that - your annual salary and the sound of the bonus money getting to your bank account sounded sweeter than God's church bells.

G-20: Policymakers, regulators and supervisors, in some advanced countries, did not adequately appreciate and address the risks building up in financial markets, keep pace with financial innovation, or take into account the systemic ramifications of domestic regulatory actions.

The English version: Mr. Alan Greenspan was the head of the US Federal Reserve. He knew what he was doing: giving money away for free to encourage businesses to take risks - and spur economic activity. The European central bankers were appalled at the "cheap money" policy of the US. They knew what Mr. Greenspan was doing - building a bubble economy. An economy fuelled by higher debt at the consumer level. An economy oiled by financial products that needed more global supervision. Mr. Brown, the then equivalent of the Finance Minister of the UK (and now the Prime Minister) did not want more regulation and oversight in Europe. His reason: because the US was grappling with the post-Enron and post-WorldCom frauds by putting in place more reporting standards for corporate governance, financial businesses were moving more of their innovation to London and Europe. If Europe placed more regulation, then it would lose its "competitive" advantage. London could no longe r challenge New York as a financial centre. Mr. Brown's arguments prevailed. Back in the US, the current "Finance Minister" Hank Paulson - who was then head of Goldman, Sachs pleaded with the SEC to allow Wall Street firms to borrow more. And the SEC approved that: more of Mr. Greenspan's free money found its way into hands of the financial geniuses. The bonuses got higher and higher.

G-20: 4. Major underlying factors to the current situation were, among others, inconsistent and insufficiently coordinated macroeconomic policies, inadequate structural reforms, which led to unsustainable global macroeconomic outcomes. These developments, together, contributed to excesses and ultimately resulted in severe market disruption

The English version: Maybe the Chinese have not picked this one - but they are being blamed for the "current situation". Follow me on this line of thought. The US central bank wants to give money free in the hope that businesses borrow this money and businesses invest. This investment creates jobs. Job creation leads to higher income. Higher income leads to more consumption. Higher consumption leads to higher economic activity. This leads to businesses investing more. More jobs, more incomes, more consumption...a virtuous cycle is established. But that is in the text books.

This is what happened in real life: The US central bank gave free money. The Wall Street firms lent this money to individuals in USA to consume more. The individuals consumed goods that were "Made in China". Investments did increase: in factories in China. Salaries did increase: of the labour class in China. Businesses did flourish: that is how the Wall Street firms could afford to paid out the big bonuses. The "structural" imbalance was caused by the fact that the Chinese - and other exporting countries that benefited from the surge in US household consumption - did not allow their own currencies to strengthen. If the Chinese currency had strengthened, exports from China would have been more expensive - and China would have lost out to other exporting nations like Vietnam, Indonesia, Thailand, Malaysia, and Mexico. Exports to USA allowed China to create jobs and increase employment and brought stability within China. All this because China kept its currency low and allowed exports to flourish.

At the US end, the packaging and re-packaging of financial loans - as one commentator noted - was the only export. The US exported USD 300 billion worth of these loans mostly to the European banks (remember London wanted to be the centre of the financial universe) and some to the Japanese and Asian banks.

The "problem" was not that Wall Street was giving loans to US consumers. That is the job of any finance company: to arrange finance.

The "problem" was that Wall Street and the credit rating companies like S&P and Moody's were rewarded to help sustain a lie: the lie that the loans being given to people who could not really afford them were able to pay these loans back.

Along the way, everyone got their pound of flesh: the Wall Street firms got the salaries and bonuses; the rating agencies got their fees; and the Chinese and the exporters got their jobs and built foreign exchange reserves.

And, yes, the US consumer - financially illiterate and unaware of www.personalfn.com - was able to buy new homes, new cars, new everything. All for some debt obligation and interest payments that seemed really cheap - and (due to financial innovation) began sometime in the distant future.

So, if this is indeed the problem - in simple English - what is the cure?

Complexities of drugs

The last time there was a problem - and, sigh, it involved the same Wall Street firms - the US Fed prescribed "cheap money" as the cure.

But drugs have side-effects. Any doctor knows that.

And in certain combinations - they can be lethal.

Mr Greenspan knows that by now - you mix free money, with the ability of Wall Street firms to borrow infinitely, and sprinkle that with self-regulation - you end up where the world is today.

So the action plan that the G-20 has recommended is one of more oversight, more regulation. And more transparency of the accounting standards used to evaluate the risks of the financial instruments created by the financial geniuses.

Good stuff, I am sure and the G-20 will figure what the new system will look like.

But they have not addressed two issues:

1) The G-20 statement was silent on whether they will punish the crooks who mis-sold financial products to borrowers and to the lenders, and

2) The G-20 statement did not spell out how "unsustainable global macroeconomic outcomes" will be addressed. Will China - and other exporters - allow their currencies to strengthen so that they stop exporting - and will China risk a social upheaval at home due to job losses from shutting down export factories? China had already announced a USD 560 billion stimulus package - to offset the decline in exports to countries like the US.

So the G-20 was what it was: a lot of good photo ops for the leaders and some long-worded statements.

But, "hot air" is sometimes a good thing.

It tells the doctor that the patient is still alive.

Still pretty sick - but alive.

The world will take some time to get back on its feet and run again.

And India? I hope that the policy makers get their act together and start chalking out some serious investments in infrastructure (and not just the electronic voting machines) to build the base that India needs to take it to an 8% rate of annual growth in the economy - on a sustainable basis.

And the Indian stock markets? Let me know when SEBI shuts down P-Notes then we can have a rational discussion.

Until then, it remains a casino.

A wonderful, no-failure-in-settlement-systems, highly efficient casino.

But a casino - not a vehicle to allow Indian companies to attract long-term capital to build out India's economy.

President Bush who is destined - unless saved by some miracle - to go on record as the worst President in the history of modern day USA laid the foundation for this nothingness.

Before the meeting began President Bush reminded us all that this financial crisis was not a failure of capitalism - there was no need to discourage financial innovation with excessive regulation.

Sure, the world needs a lot more financial innovation to be wrapped around the greed and slimy business practices of the financial geniuses.

The Europeans wanted more global oversight, more regulation. Eventually, the G-20 came out with a list of 20 points: a promise to do more and put in action with a notice that "we will meet again by April 30, 2009, to review the implementation of the principles and decisions agreed today".

Doctor, what's the problem?

But before any doctor sets forth a prescription, there must be a clear understanding of the disease. A treatment can only be effective when one understands the illness and identifies the cure.

So, what are the events that led us to where we are? What are the crises that led to a dinner and weekend meeting of the leaders of 20 countries that represent about 90% of the global GDP and 75% of the world's population?

This is what the statement of the G-20 had to say (points 3 and 4):

"Root Causes of the Current Crisis

3. During a period of strong global growth, growing capital flows, and prolonged stability earlier this decade, market participants sought higher yields without an adequate appreciation of the risks and failed to exercise proper due diligence.

At the same time, weak underwriting standards, unsound risk management practices, increasingly complex and opaque financial products, and consequent excessive leverage combined to create vulnerabilities in the system.

Policymakers, regulators and supervisors, in some advanced countries, did not adequately appreciate and address the risks building up in financial markets, keep pace with financial innovation, or take into account the systemic ramifications of domestic regulatory actions.

4. Major underlying factors to the current situation were, among others, inconsistent and insufficiently coordinated macroeconomic policies, inadequate structural reforms, which led to unsustainable global macroeconomic outcomes. These developments, together, contributed to excesses and ultimately resulted in severe market disruption."

Now let's put that in English.

G-20: During a period of strong global growth, growing capital flows, and prolonged stability earlier this decade, market participants sought higher yields without an adequate appreciation of the risks and failed to exercise proper due diligence

The English version: After the technology bust in 2000 and the 9/11 terrorist attacks on the US, the global economies were on the edge of a long recession and - to prevent that from happening - the central bankers of the world kept on cutting interest rates with a view to encouraging economic activity. Whenever there is pain around the corner, the doctor prescribes the pain killer to remove the pain. The central bankers prescribed the drug ecstasy to turn that pain into the most orgasmic experience. The central bankers printed so much money that the financial geniuses figured out what to do with it: they gave it to people who could not really afford to ever repay it. And each time they lent money, the financial geniuses made a profit. And each time they made a profit, the financial firms rewarded themselves with salaries and USD 65 million bonuses.

G-20: At the same time, weak underwriting standards, unsound risk management practices, increasingly complex and opaque financial products, and consequent excessive leverage combined to create vulnerabilities in the system.

The English version: Hey, if you were cleaning out USD 1 million in salary every year (and there must have been 100,000 people in the field of finance, law, accounting, and consultancy who made that much money) and then getting a bonus and stock options over and above that - would you care about the vulnerability in the "system". Man, you were the "system"! People relied on you for ethical practices and you didn't give a damn about that - your annual salary and the sound of the bonus money getting to your bank account sounded sweeter than God's church bells.

G-20: Policymakers, regulators and supervisors, in some advanced countries, did not adequately appreciate and address the risks building up in financial markets, keep pace with financial innovation, or take into account the systemic ramifications of domestic regulatory actions.

The English version: Mr. Alan Greenspan was the head of the US Federal Reserve. He knew what he was doing: giving money away for free to encourage businesses to take risks - and spur economic activity. The European central bankers were appalled at the "cheap money" policy of the US. They knew what Mr. Greenspan was doing - building a bubble economy. An economy fuelled by higher debt at the consumer level. An economy oiled by financial products that needed more global supervision. Mr. Brown, the then equivalent of the Finance Minister of the UK (and now the Prime Minister) did not want more regulation and oversight in Europe. His reason: because the US was grappling with the post-Enron and post-WorldCom frauds by putting in place more reporting standards for corporate governance, financial businesses were moving more of their innovation to London and Europe. If Europe placed more regulation, then it would lose its "competitive" advantage. London could no longe r challenge New York as a financial centre. Mr. Brown's arguments prevailed. Back in the US, the current "Finance Minister" Hank Paulson - who was then head of Goldman, Sachs pleaded with the SEC to allow Wall Street firms to borrow more. And the SEC approved that: more of Mr. Greenspan's free money found its way into hands of the financial geniuses. The bonuses got higher and higher.

G-20: 4. Major underlying factors to the current situation were, among others, inconsistent and insufficiently coordinated macroeconomic policies, inadequate structural reforms, which led to unsustainable global macroeconomic outcomes. These developments, together, contributed to excesses and ultimately resulted in severe market disruption

The English version: Maybe the Chinese have not picked this one - but they are being blamed for the "current situation". Follow me on this line of thought. The US central bank wants to give money free in the hope that businesses borrow this money and businesses invest. This investment creates jobs. Job creation leads to higher income. Higher income leads to more consumption. Higher consumption leads to higher economic activity. This leads to businesses investing more. More jobs, more incomes, more consumption...a virtuous cycle is established. But that is in the text books.

This is what happened in real life: The US central bank gave free money. The Wall Street firms lent this money to individuals in USA to consume more. The individuals consumed goods that were "Made in China". Investments did increase: in factories in China. Salaries did increase: of the labour class in China. Businesses did flourish: that is how the Wall Street firms could afford to paid out the big bonuses. The "structural" imbalance was caused by the fact that the Chinese - and other exporting countries that benefited from the surge in US household consumption - did not allow their own currencies to strengthen. If the Chinese currency had strengthened, exports from China would have been more expensive - and China would have lost out to other exporting nations like Vietnam, Indonesia, Thailand, Malaysia, and Mexico. Exports to USA allowed China to create jobs and increase employment and brought stability within China. All this because China kept its currency low and allowed exports to flourish.

At the US end, the packaging and re-packaging of financial loans - as one commentator noted - was the only export. The US exported USD 300 billion worth of these loans mostly to the European banks (remember London wanted to be the centre of the financial universe) and some to the Japanese and Asian banks.

The "problem" was not that Wall Street was giving loans to US consumers. That is the job of any finance company: to arrange finance.

The "problem" was that Wall Street and the credit rating companies like S&P and Moody's were rewarded to help sustain a lie: the lie that the loans being given to people who could not really afford them were able to pay these loans back.

Along the way, everyone got their pound of flesh: the Wall Street firms got the salaries and bonuses; the rating agencies got their fees; and the Chinese and the exporters got their jobs and built foreign exchange reserves.

And, yes, the US consumer - financially illiterate and unaware of www.personalfn.com - was able to buy new homes, new cars, new everything. All for some debt obligation and interest payments that seemed really cheap - and (due to financial innovation) began sometime in the distant future.

So, if this is indeed the problem - in simple English - what is the cure?

Complexities of drugs

The last time there was a problem - and, sigh, it involved the same Wall Street firms - the US Fed prescribed "cheap money" as the cure.

But drugs have side-effects. Any doctor knows that.

And in certain combinations - they can be lethal.

Mr Greenspan knows that by now - you mix free money, with the ability of Wall Street firms to borrow infinitely, and sprinkle that with self-regulation - you end up where the world is today.

So the action plan that the G-20 has recommended is one of more oversight, more regulation. And more transparency of the accounting standards used to evaluate the risks of the financial instruments created by the financial geniuses.

Good stuff, I am sure and the G-20 will figure what the new system will look like.

But they have not addressed two issues:

1) The G-20 statement was silent on whether they will punish the crooks who mis-sold financial products to borrowers and to the lenders, and

2) The G-20 statement did not spell out how "unsustainable global macroeconomic outcomes" will be addressed. Will China - and other exporters - allow their currencies to strengthen so that they stop exporting - and will China risk a social upheaval at home due to job losses from shutting down export factories? China had already announced a USD 560 billion stimulus package - to offset the decline in exports to countries like the US.

So the G-20 was what it was: a lot of good photo ops for the leaders and some long-worded statements.

But, "hot air" is sometimes a good thing.

It tells the doctor that the patient is still alive.

Still pretty sick - but alive.

The world will take some time to get back on its feet and run again.

And India? I hope that the policy makers get their act together and start chalking out some serious investments in infrastructure (and not just the electronic voting machines) to build the base that India needs to take it to an 8% rate of annual growth in the economy - on a sustainable basis.

And the Indian stock markets? Let me know when SEBI shuts down P-Notes then we can have a rational discussion.

Until then, it remains a casino.

A wonderful, no-failure-in-settlement-systems, highly efficient casino.

But a casino - not a vehicle to allow Indian companies to attract long-term capital to build out India's economy.

Tuesday, November 18

Sunday, November 16

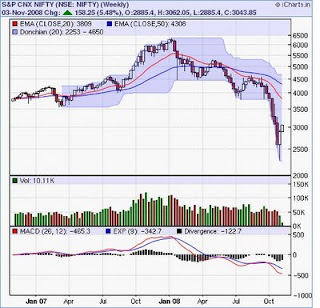

Weekly Outlook

HI All

Nifty is at very precarious situation at present moment.

Support exists at 2746 and than at 2600 Below that October LOws are only Support visible.

nifty IS POSITIVE ONLY ABOVE 2900 and a Dead Cat bounce can not be ruled out.

Stock Specific

Lanco Infrastructure Stock Plummeted 12% in Fridays Session RSI is in Sell mode.

Sell with a S/L of 152 TGt 133 and 120

Axis Bank is also looking Week Sell with a Stop loss of 515 TGt 450 and 405

Reliance is Looking week on charts support at 1002 and resitance is at 1098 Below 1002 it can test previous Lows.

Relinfra support is at 500 and resitance at 546 can go to 565 and 618 above 546

HDFC: A break below Rs1,350 levels will see the stock entering a fresh

intermediate downtrend for target of Rs1,100-1,000 levels. The

Rs2,000 levels looks like a strong resistance for the stock for the

next few months. Any pullback to the same should be used to exit

any pending long holdings.

Aggressive traders can sell at current levels and on rallies to Rs1,600-

1,620 levels with a stop loss of Rs1,675 for target of Rs1,400-1,425

levels.

Nifty is at very precarious situation at present moment.

Support exists at 2746 and than at 2600 Below that October LOws are only Support visible.

nifty IS POSITIVE ONLY ABOVE 2900 and a Dead Cat bounce can not be ruled out.

Stock Specific

Lanco Infrastructure Stock Plummeted 12% in Fridays Session RSI is in Sell mode.

Sell with a S/L of 152 TGt 133 and 120

Axis Bank is also looking Week Sell with a Stop loss of 515 TGt 450 and 405

Reliance is Looking week on charts support at 1002 and resitance is at 1098 Below 1002 it can test previous Lows.

Relinfra support is at 500 and resitance at 546 can go to 565 and 618 above 546

HDFC: A break below Rs1,350 levels will see the stock entering a fresh

intermediate downtrend for target of Rs1,100-1,000 levels. The

Rs2,000 levels looks like a strong resistance for the stock for the

next few months. Any pullback to the same should be used to exit

any pending long holdings.

Aggressive traders can sell at current levels and on rallies to Rs1,600-

1,620 levels with a stop loss of Rs1,675 for target of Rs1,400-1,425

levels.

Saturday, November 15

Thursday, November 13

IIP – brings some cheer on Dalal Street

The listless markets of the morning finally got some reason for cheer, some sense of direction, some reason to move. The much awaited IIP figures were released and as was expected, it was good. Good when compared with the figures of August 08’ but indicating that recovery is a long way off when compared to the earlier year’s growth.

Index of Industrial Production for September grew by 4.8% compared to 1.3% in the previous month but lower than 6.98% on a YoY. Manufacturing which accounts for two-thirds of the IIP rose 4.8% against 7.45% on a YoY. Capital goods were up 18.8% as against 20.9% growth last year. Mining was up at 5.7% as against 4.9% on a YoY. Consumer durables production reported a robust growth at 13.1% as against a fall of 7.3% last year.

The August Industrial Production figure has been revised marginally upwards at 1.4% from 1.3% in August. Albeit marginal, it’s at least upwards. Hanging on any small straw in this bad time is welcome.

After all this number crunching, what is the emerging writing on the wall? Undoubtedly, the growth rates still show signs of pain and it would take a while to get out of the woods. Due to the oncoming festival season, industries usually stock up inventories and hence the figures in September were more or less on the expected lines. In October too, nothing untoward or a negative growth is expected, it would be more or less flat. But November would be a different story and that too a painful story. With many companies cutting down on production and shutting down factories to cut down on the piled up inventory to lack of demand, November IIP figures would be tough. In the entire second half of the current fiscal, IIP is expected to show an average growth at 2.5-3%.

Right now, there is an overall slowdown, The auto sector, realty, steel, cement, all are now showing signs of a slowdown. Though the RBI has taken to infuse some liquidity back in to the system, more rates cuts are expected to help revive the economy. Tight money situation is pinching the common man on the street and demand has taken a beating - be it automobiles, homes or even consumer durables. The season of Diwali has not been as exuberant for the industry as it had been expected. The news of India’s exports plunging to a five year low in October, merchandise exports dipped 15% and slipped into negative territory during October 2008 compared to the same month in 2007. The government expects the situation to continue or even deteriorate in the coming months. Labour-intensive sectors like textiles, garments, handicrafts, certain segments of leather and gems & jewellery are the ones, which have been hit the most by the slowdown in the West. Resultant job-cuts are only further expected to impact the IIP figures.

The only way to kickstart the economy, apart from reducing interest rates is by accelerating spending on building roads, ports, utilities and other infrastructure facilities. As our Prime Minister states, ``expanding investment in infrastructure can play an important counter-cyclical role”. But till that happens, the coming months, especially Q3, will remain tough.

Index of Industrial Production for September grew by 4.8% compared to 1.3% in the previous month but lower than 6.98% on a YoY. Manufacturing which accounts for two-thirds of the IIP rose 4.8% against 7.45% on a YoY. Capital goods were up 18.8% as against 20.9% growth last year. Mining was up at 5.7% as against 4.9% on a YoY. Consumer durables production reported a robust growth at 13.1% as against a fall of 7.3% last year.

The August Industrial Production figure has been revised marginally upwards at 1.4% from 1.3% in August. Albeit marginal, it’s at least upwards. Hanging on any small straw in this bad time is welcome.

After all this number crunching, what is the emerging writing on the wall? Undoubtedly, the growth rates still show signs of pain and it would take a while to get out of the woods. Due to the oncoming festival season, industries usually stock up inventories and hence the figures in September were more or less on the expected lines. In October too, nothing untoward or a negative growth is expected, it would be more or less flat. But November would be a different story and that too a painful story. With many companies cutting down on production and shutting down factories to cut down on the piled up inventory to lack of demand, November IIP figures would be tough. In the entire second half of the current fiscal, IIP is expected to show an average growth at 2.5-3%.

Right now, there is an overall slowdown, The auto sector, realty, steel, cement, all are now showing signs of a slowdown. Though the RBI has taken to infuse some liquidity back in to the system, more rates cuts are expected to help revive the economy. Tight money situation is pinching the common man on the street and demand has taken a beating - be it automobiles, homes or even consumer durables. The season of Diwali has not been as exuberant for the industry as it had been expected. The news of India’s exports plunging to a five year low in October, merchandise exports dipped 15% and slipped into negative territory during October 2008 compared to the same month in 2007. The government expects the situation to continue or even deteriorate in the coming months. Labour-intensive sectors like textiles, garments, handicrafts, certain segments of leather and gems & jewellery are the ones, which have been hit the most by the slowdown in the West. Resultant job-cuts are only further expected to impact the IIP figures.

The only way to kickstart the economy, apart from reducing interest rates is by accelerating spending on building roads, ports, utilities and other infrastructure facilities. As our Prime Minister states, ``expanding investment in infrastructure can play an important counter-cyclical role”. But till that happens, the coming months, especially Q3, will remain tough.

Monday, November 10

Nifty is forming an inverted head-and-shoulders pattern

Nifty is forming an inverted head-and-shoulders pattern, whose neckline is placed at 3,241 and an upside breakout of this

neckline will take Nifty to 3,650 in the near future. Further,the close of Nifty above the 20-day simple moving averages is adding to this bullish scenario until Nifty holds the support of the moving average.

Exit All Longs if nifty is unable to stay above 3260

Hi all

Now nifty has rallied quiet a bit in recent days.

Now we will face major resistance at 3260which is 38.25 retrace of current powerful bear market rally .

Long pepole should get a bit of caution as if unable to cross the 3260 mark we may retrace back to 2860 level.

Technically speaking On daily chart, Nifty is forming an inverted head-and-shoulders pattern, whose neckline is placed at 3,241 and an upside breakout of this

neckline will take Nifty to 3,650 in the near future. Further,the close of Nifty above the 20-day simple moving averages is adding to this bullish scenario until Nifty holds the support of the moving average.

Now nifty has rallied quiet a bit in recent days.

Now we will face major resistance at 3260which is 38.25 retrace of current powerful bear market rally .

Long pepole should get a bit of caution as if unable to cross the 3260 mark we may retrace back to 2860 level.

Technically speaking On daily chart, Nifty is forming an inverted head-and-shoulders pattern, whose neckline is placed at 3,241 and an upside breakout of this

neckline will take Nifty to 3,650 in the near future. Further,the close of Nifty above the 20-day simple moving averages is adding to this bullish scenario until Nifty holds the support of the moving average.

Sunday, November 9

Saturday, November 8

Telecom:A Volume Led Story.

We believe that the Telecommunication sector will outperform the market during the next 6-9 months as at current prices, telecommunication stocks are trading at a discount to the market’s P/E multiple. The average P/E multiple for telecommunication stocks is 10x against the market’s P/E multiple of 13x. Besides, the Indian mobile telecommunication sector continues to be a strong volume-led story with mobile telephone penetration rate still below 30%. We expect the number of mobile subscribers to grow 10% qoq till at least the end of 2010, driven by the availability of cheap handsets, the widening network coverage across the country, and a substantial reduction in tariffs.

In our view, large telecom companies such as Bharti, Reliance Communications, and Idea boast of a significant early-mover advantage in the face of expected competition from the likes of upcoming players such as Swan, Unitech, and Datacom. These companies have captured most of the creamy customers in the country and have substantially scaled up their operations in the last 4-5 years. Besides, they have already established a wide network across the country and own submarine cables across continents, thereby providing competitive tariffs to subscribers and achieving an average EBITDA margin of around 30%.

Furthermore, the upcoming 3G operations should boost their margins by enhancing the

contribution of Value Added Services (VAS) to the total ARPU from around 8% currently to 15% in the next 3-4 years. Other than this, these companies have a net debt/EBITDA ratio around 1, which can support their domestic CAPEX plans and international expansions in the other emerging markets of Africa and South-East Asia.

Top Picks

Bharti

Rcom

IDEA

In our view, large telecom companies such as Bharti, Reliance Communications, and Idea boast of a significant early-mover advantage in the face of expected competition from the likes of upcoming players such as Swan, Unitech, and Datacom. These companies have captured most of the creamy customers in the country and have substantially scaled up their operations in the last 4-5 years. Besides, they have already established a wide network across the country and own submarine cables across continents, thereby providing competitive tariffs to subscribers and achieving an average EBITDA margin of around 30%.

Furthermore, the upcoming 3G operations should boost their margins by enhancing the

contribution of Value Added Services (VAS) to the total ARPU from around 8% currently to 15% in the next 3-4 years. Other than this, these companies have a net debt/EBITDA ratio around 1, which can support their domestic CAPEX plans and international expansions in the other emerging markets of Africa and South-East Asia.

Top Picks

Bharti

Rcom

IDEA

Thursday, November 6

Wednesday, November 5

OBAMA WINS – IGNITES HOPE OF CHANGE

5th November 08’ will be a historic day for America. The 44th President of USA is an African American, with a middle name of "Hussein" and elected by a hugely white population, breaking the racial barrier forver. The winning of Barrack Obama has sent waves of optimism all over the world. The whole world is eager to put Bush and his 8-year regime deep into the closet, and look ahead now with hope.

It was a taken that Obama would be the next President of USA but after the debacle of Florida during Bush’s time, there was still a glimmer of doubt, one never knew for sure till it happened.

Call it the smartest advertising and PR blitzkrieg of the decade or the need for a ‘Change”, its indeed a momentous victory. Obama has shown the world how to win elections and by using the internet as a medium of communication, he has shown how it is today the best mode of communicating with the youth.

The editorial in New York Times states - Mr. Obama won the election because he saw what is wrong with this country: the utter failure of government to protect its citizens. He promised to lead a government that does not try to solve every problem but will do those things beyond the power of individual citizens: to regulate the economy fairly, keep the air clean and the food safe, ensure that the sick have access to health care, and educate children to compete in a globalized world.

Obama is coming into the Office at a time when America and the whole world is going through the worst possible crisis. Call him a good orator or his charisma, after a long time, we saw how a leader can inspire people and how much hope he ignites if the priorities are clear. He now has the huge task of first setting the economics right, take a long and hard look at the various “war” decisions of America and more importantly, bring back the respect to the American passport and its citizens world over.

More than anything else, the winning of Obama brings back optimism and hope onto Wall Street and hence all over. Obama has no magic wand, which he can wave and miraculously set everything right. So what exactly does the winning of Obama mean? It has brought about a wave of hope, his winning has unleashed optimism which had become extinct. Markets are all about sentiments and right now, the sentiments are buoyed and that will help the overall psyche.

What does the winning mean for India? Well, Obama loves Indian food, that’s about all we know for sure right now! This win does not change anything overnight for India or the Indian companies. H1B visa’s and outsourcing are too micro issues and do not make sense in the whole macro picture. Once the sentiments improve and only when the economy picks up can we start talking about these issues again. Improvement in sentiments would mean that FIIs would once again start looking at emerging markets and that is what India needs the most. Right now, the whole world needs a change; a change from recession and slowdown; a change from the constant pallor of gloom to an air of optimism. And this is the hope of change that America and the world expect’s from Obama. The Dow closed up 300 points and that alone is enough for India and the world markets – rising US markets would bolster markets world over. That’s the biggest change – a change in sentiments, which the winning of Obama would bring about for India.

Bush is one President, which Americans would like to forget about as soon as possible. Under Bush, all that could go wrong has gone wrong; this is the lowest point. So for Obama, whatever he does now, which if different from what Bush has done so far, would make him a hero. Its like he now has a huge white canvas and he can decide what to paint – the picture could turn either very beautiful or ugly.

It was a taken that Obama would be the next President of USA but after the debacle of Florida during Bush’s time, there was still a glimmer of doubt, one never knew for sure till it happened.

Call it the smartest advertising and PR blitzkrieg of the decade or the need for a ‘Change”, its indeed a momentous victory. Obama has shown the world how to win elections and by using the internet as a medium of communication, he has shown how it is today the best mode of communicating with the youth.

The editorial in New York Times states - Mr. Obama won the election because he saw what is wrong with this country: the utter failure of government to protect its citizens. He promised to lead a government that does not try to solve every problem but will do those things beyond the power of individual citizens: to regulate the economy fairly, keep the air clean and the food safe, ensure that the sick have access to health care, and educate children to compete in a globalized world.

Obama is coming into the Office at a time when America and the whole world is going through the worst possible crisis. Call him a good orator or his charisma, after a long time, we saw how a leader can inspire people and how much hope he ignites if the priorities are clear. He now has the huge task of first setting the economics right, take a long and hard look at the various “war” decisions of America and more importantly, bring back the respect to the American passport and its citizens world over.

More than anything else, the winning of Obama brings back optimism and hope onto Wall Street and hence all over. Obama has no magic wand, which he can wave and miraculously set everything right. So what exactly does the winning of Obama mean? It has brought about a wave of hope, his winning has unleashed optimism which had become extinct. Markets are all about sentiments and right now, the sentiments are buoyed and that will help the overall psyche.

What does the winning mean for India? Well, Obama loves Indian food, that’s about all we know for sure right now! This win does not change anything overnight for India or the Indian companies. H1B visa’s and outsourcing are too micro issues and do not make sense in the whole macro picture. Once the sentiments improve and only when the economy picks up can we start talking about these issues again. Improvement in sentiments would mean that FIIs would once again start looking at emerging markets and that is what India needs the most. Right now, the whole world needs a change; a change from recession and slowdown; a change from the constant pallor of gloom to an air of optimism. And this is the hope of change that America and the world expect’s from Obama. The Dow closed up 300 points and that alone is enough for India and the world markets – rising US markets would bolster markets world over. That’s the biggest change – a change in sentiments, which the winning of Obama would bring about for India.

Bush is one President, which Americans would like to forget about as soon as possible. Under Bush, all that could go wrong has gone wrong; this is the lowest point. So for Obama, whatever he does now, which if different from what Bush has done so far, would make him a hero. Its like he now has a huge white canvas and he can decide what to paint – the picture could turn either very beautiful or ugly.

Tuesday, November 4

India:In A Drunken Stupor

Use the RBI sponsored rally to sell all interest rate sensitive stocks-Real Estate, Infrastructure and Banks.

The guys at North Block and the Central Bank remind me of two drunks trying to support each other. Rightly so, their action on Mint Street reflect the pre-occupation with massive Forex Outflows, Sinking Stock markets, an Economy going downhill, huge Trade Deficit and net portfolio outflows which have cost the country atleast $ 65 bn in the last few months.

The series of CRR, SLR and Repo cuts announced on Saturday last are perhaps the last salvos, that the Duvuuri Suba Rao-Finance Minister combine can fire at the markets for now.

The liquidity that the Central Bank and the Finance Ministry has been throwing at the Economy through most of October 2008, is unlikely to end in jump starting the economic wheels stuck in mud. The only thing, "the cut", may do in the short term is to bring down PSU bank PLRs a notch, release some money to industry but will not be enough to ratchet up Asset prices. On the flip side, throwing money at the wind will result in increased NPAs for Banks which will become visible in a year from now.

This so called Government largesse is only covering up the gap in Bank funding, caused by Dollar buying from the RBI. In what way the liquidity so released can be considered as extra resources for financing growth beats me.

Mr. Rao should have looked at the US and Japan, both nations are now at almost zero per cent rates and yet neither stocks nor the economies seem to grow.

The lesson? No one — not even the government — is more powerful than the market ...

For more than a year now, the Fed has bombarded the Wall Street with government bailout packages. We have seen interest rate cut after interest rate cut.

The elected officials (and the unelected policymakers at the Fed) have seen fit to spend hundreds of billions of dollars in taxpayer money — to save Fannie Mae, Freddie Mac, AIG, and Bear Stearns.

They are handing out $250 billion to everyone from Citigroup to SunTrust, even helping banks merge in transactions partially funded with public money. And yet, by this one crucial gauge — the cost of a 30-year fixed mortgage — the government and the Fed have failed to achieve much of anything. The lesson is simple: No one ... not even the government ... is more powerful than the market.

Worst yet, the fear is spreading throughout the world ...

Market players — mortgage bond buyers — are worried about the direction of house prices. They're concerned about the credit quality of U.S. borrowers. This is filtering into the price of mortgage bonds, and keeping yields elevated.

Foreign investors, who used to snap up every last mortgage backed security and corporate debt security sold by Fannie Mae and Freddie Mac, appear to be backing away somewhat.

Concerns about the precise nature of the government's support of Fannie and Freddie are also driving the two agencies' borrowing costs up. That, in turn, puts upward pressure on mortgage rates.

Another reason for higher rates overall: Concern about the long-term fiscal position of the U.S. The government has committed more than $1 trillion to all of its various bailouts — and the list of companies begging for taxpayer money gets longer every day.

Insurers want the same kinds of government-funded capital injections that banks are getting. GM and Chrysler want government money to help them merge, close factories, and fire thousands of workers. Home builders want fresh tax credits to spur purchases.

You'd think at some point that officials in Washington and investors on Wall Street would get it. You'd think that they'd understand the only solutions to the credit mess, the deleveraging, and the real estate bust are simple: Time and price.

You simply can't cure the popping of a multi-year debt and housing bubble by waving a magic wand — not even a $1 trillion one.

For stock investors, my prescription remains the same: When you get government-fueled, short-term rallies, you should look at them as opportunities to SELL.

At some point — once the unwinding is complete, once the recession has run its course, and so on — THEN I think you can start to bargain-hunt and bottom fish. But now is not that time, in my opinion. The conundrum is still very much with us.

The guys at North Block and the Central Bank remind me of two drunks trying to support each other. Rightly so, their action on Mint Street reflect the pre-occupation with massive Forex Outflows, Sinking Stock markets, an Economy going downhill, huge Trade Deficit and net portfolio outflows which have cost the country atleast $ 65 bn in the last few months.

The series of CRR, SLR and Repo cuts announced on Saturday last are perhaps the last salvos, that the Duvuuri Suba Rao-Finance Minister combine can fire at the markets for now.

The liquidity that the Central Bank and the Finance Ministry has been throwing at the Economy through most of October 2008, is unlikely to end in jump starting the economic wheels stuck in mud. The only thing, "the cut", may do in the short term is to bring down PSU bank PLRs a notch, release some money to industry but will not be enough to ratchet up Asset prices. On the flip side, throwing money at the wind will result in increased NPAs for Banks which will become visible in a year from now.

This so called Government largesse is only covering up the gap in Bank funding, caused by Dollar buying from the RBI. In what way the liquidity so released can be considered as extra resources for financing growth beats me.

Mr. Rao should have looked at the US and Japan, both nations are now at almost zero per cent rates and yet neither stocks nor the economies seem to grow.

The lesson? No one — not even the government — is more powerful than the market ...

For more than a year now, the Fed has bombarded the Wall Street with government bailout packages. We have seen interest rate cut after interest rate cut.

The elected officials (and the unelected policymakers at the Fed) have seen fit to spend hundreds of billions of dollars in taxpayer money — to save Fannie Mae, Freddie Mac, AIG, and Bear Stearns.

They are handing out $250 billion to everyone from Citigroup to SunTrust, even helping banks merge in transactions partially funded with public money. And yet, by this one crucial gauge — the cost of a 30-year fixed mortgage — the government and the Fed have failed to achieve much of anything. The lesson is simple: No one ... not even the government ... is more powerful than the market.

Worst yet, the fear is spreading throughout the world ...

Market players — mortgage bond buyers — are worried about the direction of house prices. They're concerned about the credit quality of U.S. borrowers. This is filtering into the price of mortgage bonds, and keeping yields elevated.

Foreign investors, who used to snap up every last mortgage backed security and corporate debt security sold by Fannie Mae and Freddie Mac, appear to be backing away somewhat.

Concerns about the precise nature of the government's support of Fannie and Freddie are also driving the two agencies' borrowing costs up. That, in turn, puts upward pressure on mortgage rates.

Another reason for higher rates overall: Concern about the long-term fiscal position of the U.S. The government has committed more than $1 trillion to all of its various bailouts — and the list of companies begging for taxpayer money gets longer every day.

Insurers want the same kinds of government-funded capital injections that banks are getting. GM and Chrysler want government money to help them merge, close factories, and fire thousands of workers. Home builders want fresh tax credits to spur purchases.

You'd think at some point that officials in Washington and investors on Wall Street would get it. You'd think that they'd understand the only solutions to the credit mess, the deleveraging, and the real estate bust are simple: Time and price.

You simply can't cure the popping of a multi-year debt and housing bubble by waving a magic wand — not even a $1 trillion one.

For stock investors, my prescription remains the same: When you get government-fueled, short-term rallies, you should look at them as opportunities to SELL.

At some point — once the unwinding is complete, once the recession has run its course, and so on — THEN I think you can start to bargain-hunt and bottom fish. But now is not that time, in my opinion. The conundrum is still very much with us.

Monday, November 3

Infaltion:The Magic of Base Effect

Yet another logical and mathematical fiction which actually needs lots of calculations which some economist may come out in the future with a detailed report on .

I have taken a simplistic view!! Whereas its one of the complicated calculations. If there is something wrong people can please bring it to my notice.

INFLATION:

In simpler words Inflation rate is the % rise in prices corresponding to the same week in previous year.

Lets see a simple example of how this calculation works .

First an index is taken by giving different weightage to different commodities etc.

Simple example with Base effect implications:

Week1 - 07= 200

Week2 -07= 195

Week1- 08 = 224

Inflation Week1- 08 = 224-200 / 200 = 12 % .

Week2- 08 =224

Inflation Week2-08= 224-195/195 = 14.87 % .

This in turn leads to a higher spurt in inflation even though when the Index has not moved.

Now taking the next scenario.

Week1-08 = 224.

Week2-08= 228.

Week1-09 = 250.

Inflation = 11.61 %

Week2-09 = 250.

Inflation = 9.65 % .

This scenario will lead to a quick drop in inflation although when the index doesnt fall.

NOW WHY ARE WE DISCUSSING SUCH Mathematics and calculations. Lets c why.

For last many months we have seen inflation zoom away coz of the price moves in commodities which was also accentuated by the lower base last year. Also crude oil impact lead to the next jump in inflation. This impact of lower base can stay for another couple of weeks or months is a guess.

Now in the current period of 8-13 % inflation in the period of March - September or even later it may happen that its creating a higher base for the INDEX.

So in the mid of next year onwards this impact could slowly start coming into play if prices just remain stable !!!!. Also if commodities and index constituents take a good drop inflation could also plummet quickly. !!! Also lot of monetary actions are being taken and Rupee is at lows a bounce in it in coming months could also effect.

One needs to see exact values for particular periods to know about which periods would see major impacts.

If possible will try to gather exact data and calculate which would be a difficult task but the simple mathematical logic seems much more easier n effective although how big an impact it can be needs calculation.

Well as a matter of fact such a BASE effect in Year on Year results may also make lot of results next year to be more better then they are.

Example:

Q2- 07 - profits = 100 crores

Q2-08 profits = 60 crores.

Drop of 40 % in profits Q-o-Q .

Q2-09 profits = 90 crores .

Q-0-Q growth now is 50 % . Which would still be lower then the best times of 100 crores.

I have taken a simplistic view!! Whereas its one of the complicated calculations. If there is something wrong people can please bring it to my notice.

INFLATION:

In simpler words Inflation rate is the % rise in prices corresponding to the same week in previous year.

Lets see a simple example of how this calculation works .

First an index is taken by giving different weightage to different commodities etc.

Simple example with Base effect implications:

Week1 - 07= 200

Week2 -07= 195

Week1- 08 = 224

Inflation Week1- 08 = 224-200 / 200 = 12 % .

Week2- 08 =224

Inflation Week2-08= 224-195/195 = 14.87 % .

This in turn leads to a higher spurt in inflation even though when the Index has not moved.

Now taking the next scenario.

Week1-08 = 224.

Week2-08= 228.

Week1-09 = 250.

Inflation = 11.61 %

Week2-09 = 250.

Inflation = 9.65 % .

This scenario will lead to a quick drop in inflation although when the index doesnt fall.

NOW WHY ARE WE DISCUSSING SUCH Mathematics and calculations. Lets c why.

For last many months we have seen inflation zoom away coz of the price moves in commodities which was also accentuated by the lower base last year. Also crude oil impact lead to the next jump in inflation. This impact of lower base can stay for another couple of weeks or months is a guess.

Now in the current period of 8-13 % inflation in the period of March - September or even later it may happen that its creating a higher base for the INDEX.

So in the mid of next year onwards this impact could slowly start coming into play if prices just remain stable !!!!. Also if commodities and index constituents take a good drop inflation could also plummet quickly. !!! Also lot of monetary actions are being taken and Rupee is at lows a bounce in it in coming months could also effect.

One needs to see exact values for particular periods to know about which periods would see major impacts.

If possible will try to gather exact data and calculate which would be a difficult task but the simple mathematical logic seems much more easier n effective although how big an impact it can be needs calculation.

Well as a matter of fact such a BASE effect in Year on Year results may also make lot of results next year to be more better then they are.

Example:

Q2- 07 - profits = 100 crores

Q2-08 profits = 60 crores.

Drop of 40 % in profits Q-o-Q .

Q2-09 profits = 90 crores .

Q-0-Q growth now is 50 % . Which would still be lower then the best times of 100 crores.

Sunday, November 2

Weekly Outlook for 03-08 November

Hi All

RBI Rate Cut decision will lokely to have a Bull Dominance in Coming Days.

Technically speaKing MACD is now in Buy MOde Nifty will face resistance at 3200

SO lighten up ur position in Rally as we may see new lows coming.

Stock Specific Trading Ideas

Buy PTC 52 tgt 58,63 SL 50

REl Infra tgt 503 545 sl 437

Rolta TGt 201,215 SL 179

Voltas tgt 80 86 SL 71

IDFC Buy around 52-54 tgt of 75

Stocks Rumuors

Pennar Industries is now eyeing orders from Indian railways

Micro Technologies has recently launched Micro Wi-Fi security system which works on Radio frequency technology. At current levels, it is a steal.

Promoters of Man Industries are constantly buying shares from the open market. The scrip seems to have bottomed out and may shoot up sharply in the near future. Keep a close watch.

RBI Rate Cut decision will lokely to have a Bull Dominance in Coming Days.

Technically speaKing MACD is now in Buy MOde Nifty will face resistance at 3200

SO lighten up ur position in Rally as we may see new lows coming.

Stock Specific Trading Ideas

Buy PTC 52 tgt 58,63 SL 50

REl Infra tgt 503 545 sl 437

Rolta TGt 201,215 SL 179

Voltas tgt 80 86 SL 71

IDFC Buy around 52-54 tgt of 75

Stocks Rumuors

Pennar Industries is now eyeing orders from Indian railways

Micro Technologies has recently launched Micro Wi-Fi security system which works on Radio frequency technology. At current levels, it is a steal.

Promoters of Man Industries are constantly buying shares from the open market. The scrip seems to have bottomed out and may shoot up sharply in the near future. Keep a close watch.