FII Derivative Data Analysis for 21June trade in Nifty Future

All eyes will be on US Fed announcement at 11:45 PM IST Will he extend monetary easing of Operation Twist which expires in June 2012. Well situation in US is similar to India, US government is not taking any steps to improve the fiscal situation and reforms which can spur it with lot of political bickering and heavily dependent on Fed to print more money and bring back economy on track. As this is Presidential year in US so fed might be under political compulsion to announce more QE which we will come to know tonight. US stocks has been rising from past 12 days and S&P has moved above 50 SMA also which is bullish. Now if Fed do announce a which markets has priced in already we can see a sell off in tune which we saw on Nifty when RBI disappointed market.Any surprise can further lead to continuation of rally.

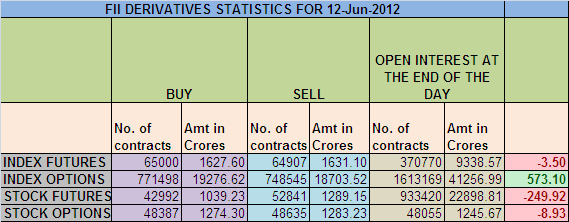

Food for thought:When last 2 QE were not able to spur growth will another QE can do ?1. FII bought 8320 Contracts of NF ,worth 186 cores with net OI increasing by 15226 contracts.

2. As Nifty Future was up by 11 points and OI has increased by 15226 contracts means FII have initiated fresh longs in Index futures.

3. Nifty is still Buy on Dip till ...

Read the Full Story