Nifty Technical forecast for July Month

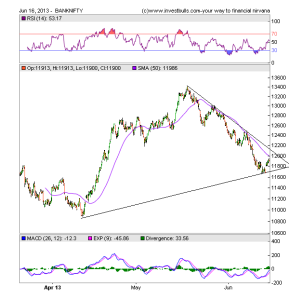

Nifty Hourly Chart

Nifty Hourly charts is now trading in a trendline crossover zone..

Continue Reading

Bharti

Airtel is trading in a downtrending channel and yesterday closed at

higher end of channel,able to trade and close above 298 will open gates

till 308.Unable to cross 298 stock can pullback to lower end of channel

till 264 odd levels in medium term.

Bharti

Airtel is trading in a downtrending channel and yesterday closed at

higher end of channel,able to trade and close above 298 will open gates

till 308.Unable to cross 298 stock can pullback to lower end of channel

till 264 odd levels in medium term.

LT

is trading in small trading range of 1440-1375. Break of range will

take the stock lower, Positional traders can short LT below 1364 for

target of 1320.Intra/Swing traders use the below levels

LT

is trading in small trading range of 1440-1375. Break of range will

take the stock lower, Positional traders can short LT below 1364 for

target of 1320.Intra/Swing traders use the below levels

Idea

is falling a rising wedge pattern which is bearish in nature and also

formed a topping tail candlestick pattern which again is bearish

pattern, both pattern needs follow up price action to get confirmation.

Close above 144 will invalidate both the pattern and target of 152 can

be seen in short term.Pullback till 132 is on cards if we do not see a

closing above 143 is next 2 days. These levels are for positional

traders, Intraday can use the below mentioned levels.

Idea

is falling a rising wedge pattern which is bearish in nature and also

formed a topping tail candlestick pattern which again is bearish

pattern, both pattern needs follow up price action to get confirmation.

Close above 144 will invalidate both the pattern and target of 152 can

be seen in short term.Pullback till 132 is on cards if we do not see a

closing above 143 is next 2 days. These levels are for positional

traders, Intraday can use the below mentioned levels.

Titan

stock has fallen like 9 Pins after RBI declaration on Gold came, Stock

has fallen and touched its medium term trendline on weekly charts.

Holding 201 the pullback will continue further.

Titan

stock has fallen like 9 Pins after RBI declaration on Gold came, Stock

has fallen and touched its medium term trendline on weekly charts.

Holding 201 the pullback will continue further.

SBI

has been falling like pins after making high of 2472 and is now

approaching its medium term trendline support. SBI can give a whipsaw by

trading below the trendline traders do remember range of 1974-1980 is

very important support as per Gann and Fibo Spiral number and

positional shorts can be booked in this range. Positive divergence is

also seen in daily charts.

SBI

has been falling like pins after making high of 2472 and is now

approaching its medium term trendline support. SBI can give a whipsaw by

trading below the trendline traders do remember range of 1974-1980 is

very important support as per Gann and Fibo Spiral number and

positional shorts can be booked in this range. Positive divergence is

also seen in daily charts.

"My work has gotten better due to simplifying my approach," John J. Murphy