You might have heard the saying

"The Trend Is Your Friend" and that you should

"Trade The Trend."

But sometimes this is easier said than done. In this article I will show you an easy easy to identify and trade the trend.

How To Identify A Trend

Way back in the 90s I used fundamental analysis to try and predict the market. Long story short, it didn't work for me.

Since the mid 90s I have been using

technical analysis in my trading. When using technical analysis, there are two different approaches:

- Chart Patterns and

- Indicators

Examples

of chart patterns are flags, pennants, triangles, double bottoms and

tops, etc. Candlestick formations are chart patterns, too.

Examples of indicators are moving averages, Bollinger Bands, MACD, RSI, etc.

So which approach is "better"? Should you use chart patterns or indicators to identify the direction of the market?

Easy

answer: Use the approach that works for YOU. I personally use

indicators. I like the black-and-white approach of indicators. As an

example, the RSI is either above 70 or it is not. There's no grey area. I

openly admit that I struggle identifying chart patterns while they are

forming. Don't get me wrong: I am an expert showing you every single

chart pattern there is at the end of the day. But I can't identify them

with certainty while they are forming. But hey,..

You might have heard the saying

"The Trend Is Your Friend" and that you should

"Trade The Trend."

But sometimes this is easier said than done. In this article I will show you an easy easy to identify and trade the trend.

How To Identify A Trend

Way back in the 90s I used fundamental analysis to try and predict the market. Long story short, it didn't work for me.

Since the mid 90s I have been using

technical analysis in my trading. When using technical analysis, there are two different approaches:

- Chart Patterns and

- Indicators

Examples

of chart patterns are flags, pennants, triangles, double bottoms and

tops, etc. Candlestick formations are chart patterns, too.

Examples of indicators are moving averages, Bollinger Bands, MACD, RSI, etc.

So which approach is "better"? Should you use chart patterns or indicators to identify the direction of the market?

Easy

answer: Use the approach that works for YOU. I personally use

indicators. I like the black-and-white approach of indicators. As an

example, the RSI is either above 70 or it is not. There's no grey area. I

openly admit that I struggle identifying chart patterns while they are

forming. Don't get me wrong: I am an expert showing you every single

chart pattern there is at the end of the day. But I can't identify them

with certainty while they are forming. But hey,..

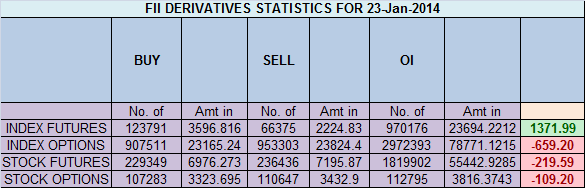

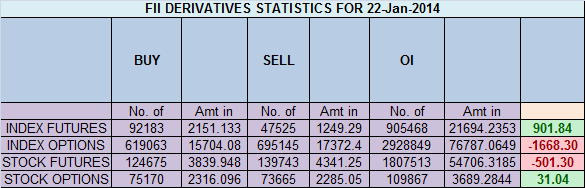

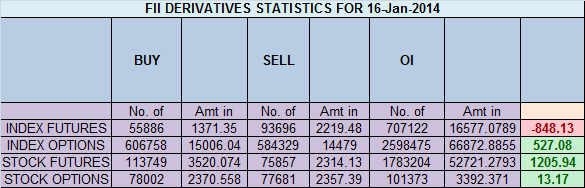

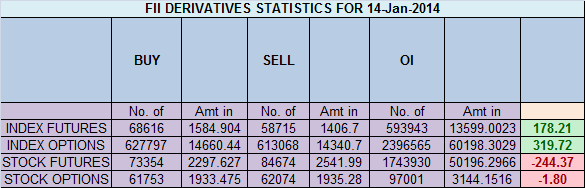

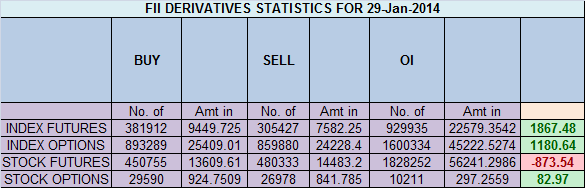

555 is trend changer level, closing above 557 stock is heading back to 576. Any close below 555, short term target 540/521.

555 is trend changer level, closing above 557 stock is heading back to 576. Any close below 555, short term target 540/521.