Saturday, April 30

As discussed in last analysis High

made today was 17023 bank nifty unable to scale above the supply zone

level of 17067 and also the gann resistance line and bears got active

below 16800 and saw the decline till 200 DMA, Break of 16700 can again

see a quick fall till 16500, Bank Nifty made low of 16527 near

our target of 16500 once 16800 was broken,and closed below 16800 but

again held on to 200 DMA, so bulls are bears both are in dilemma.

Volatility which we are seeing in market was due to Weekly and Monthly

closing we had yesterday.Bulls need to close above 16800 and bears below

16500 for next 300-400 points move. Are You a Carrot, Egg, or Coffee Bean?

Continue Reading

Friday, April 29

Are You a Carrot, Egg, or Coffee Bean?

A

young woman went to her mother and told her about her life and how

things were so hard for her. She did not know how she was going to make

it and wanted to give up. She was tired of fighting and struggling.

It seemed as one problem was solved a new one arose.

Her mother took her to the kitchen. She filled three pots with water. In the first, she placed carrots, in the second she placed eggs, and the last she placed ground coffee beans.

She let them sit and boil without saying a word. In about twenty minute she turned off the burners. She fished the carrots out and placed them in a bowl. She pulled the eggs out and placed them in a bowl. Then she ladled the coffee into a bowl. Turning to her daughter, she asked, “Tell me what you see?”

“Carrots, eggs, and coffee,” she replied.

Continue Reading

Her mother took her to the kitchen. She filled three pots with water. In the first, she placed carrots, in the second she placed eggs, and the last she placed ground coffee beans.

She let them sit and boil without saying a word. In about twenty minute she turned off the burners. She fished the carrots out and placed them in a bowl. She pulled the eggs out and placed them in a bowl. Then she ladled the coffee into a bowl. Turning to her daughter, she asked, “Tell me what you see?”

“Carrots, eggs, and coffee,” she replied.

Continue Reading

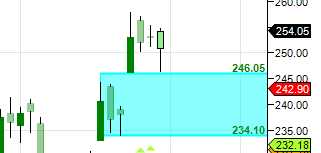

HDIL Lupin and ACC Harmonic Study

HDIL

Positional/Swing Traders can use the below mentioned levels

Close above 86.5 Tgt 89/91

Intraday Traders can use the below mentioned levels

Buy above 86.5 Tgt

Continue Reading

Thursday, April 28

Bank Nifty holds its 200 DMA,EOD Analysis

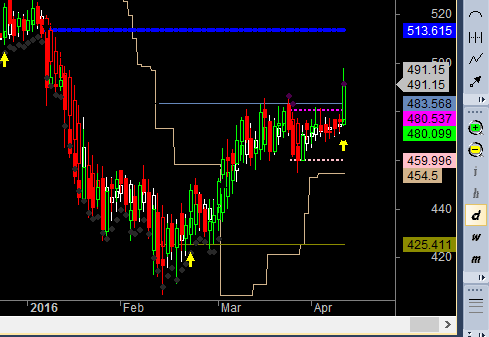

As discussed in last analysis Bulls

need a close above 17100 which is supply zone and also gann resistance

line as shown in below 2 chart, for next move till 17400, Strong support

around 16800 zone, Bears will be active only on close below 16800 for a

quick move till 16500 . High made today was 17023 bank nifty unable to scale above the supply zone level of 17067 and also the gann

Continue Reading

Nifty holds its 200 DMA,EOD Analysis

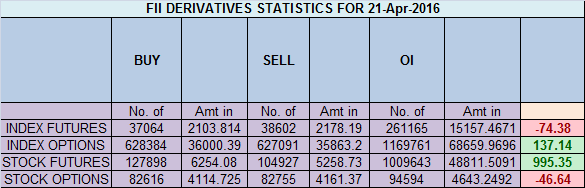

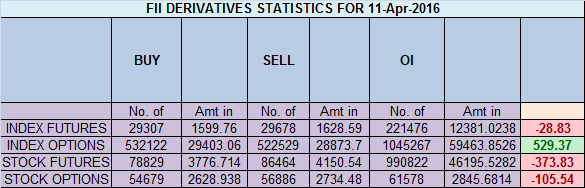

- FII's

bought 1.7 K contract of Index Future worth 103 cores ,37.5 K Long

contract were liquidated by FII's and 55.6 K short contracts were

liquidated by FII's. Net Open Interest decreased by 93.1 K contract, so

fall in market was used by FII's to exit both long and shorts in

Index futures. Patience Is A Trader's Virtue

Who is in Control When You Trade?

We cannot control the market but we can control our trades and many aspects of our trading mindset.

When you go through a trading loss do you ever find yourself blaming something outside yourself? Today Nifty had a decent fall and if you made loss today You can Blame Bank of Japan, "the system" - the system is rigged against me etc..

When you blame an external situation, you are giving up control, and instead letting yourself be controlled by outside events. This converts you from a proactive trader into a reactive trader. When your emotions rule over you, You become SLAVE of market end results is you lose badly.

Continue Reading

When you go through a trading loss do you ever find yourself blaming something outside yourself? Today Nifty had a decent fall and if you made loss today You can Blame Bank of Japan, "the system" - the system is rigged against me etc..

When you blame an external situation, you are giving up control, and instead letting yourself be controlled by outside events. This converts you from a proactive trader into a reactive trader. When your emotions rule over you, You become SLAVE of market end results is you lose badly.

Continue Reading

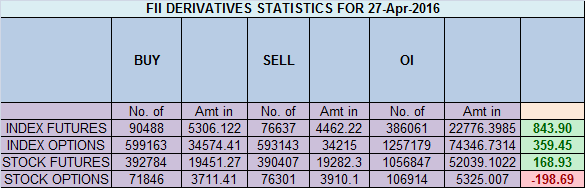

Wednesday, April 27

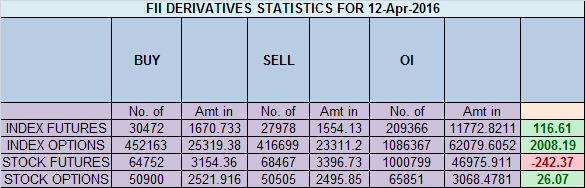

Nifty close above 7972, EOD Analysis

- FII's

bought 13.8 K contract of Index Future worth 843 cores ,26.6 K Long

contract were added by FII's and 12.8 K short contracts were added by

FII's. Net Open Interest increased by 39.4 K contract, so rise in

market was used by FII's to enter long and enter shorts in Index

futures. Patience Is A Trader's Virtue

Will Bank Nifty close above 17067 on Expiry day, EOD Analysis

- Bank Nifty closed above 200 DMA for 2 day in a row, Bulls need a close above 17100 which is supply zone and also gann resistance line as shown in below 2 chart, for next move till 17400, Strong support around 16800 zone, Bears will be active only on close below 16800 for a quick move till 16500 . Patience Is A Trader's Virtue

Continue Reading

Patience Is A Trader's Virtue

The money's made in the sitting and the waiting, not the trading… Jesse Livermore

“The snake which cannot cast its skin has to die.”- Friedrich Nietzsche

“There are a lot of shoes on the shelf; wear only the ones that fit. If you're extremely confident, taking a loss doesn't bother you." – George Soros

Do you go through any of the below thoughts when you are trading

No time to wait for the right signal, You Buy

Continue Reading

“The snake which cannot cast its skin has to die.”- Friedrich Nietzsche

“There are a lot of shoes on the shelf; wear only the ones that fit. If you're extremely confident, taking a loss doesn't bother you." – George Soros

Do you go through any of the below thoughts when you are trading

No time to wait for the right signal, You Buy

Bank Nifty close above 200 DMA,EOD Analysis

As discussed in last analysis

Now for coming week Only close above 16800 can fuel the expiry rally

towards 17000, else any close below 16500 can see move towards

16350/16300. High made 17029 and low made 16572 so Bank Nifty

broke 16800 and saw an impulsive rise towards 17000 as we have

anticipated. Hope trades were able to capitalize over the move. Bank

Nifty has closed above 200 DMA first time after 20 August, also we have

broken the gann arc so if we move above 17100 we can see fast move

towards 17500/17800. The Recency Effect - How it affects Trading

Continue Reading

Nifty rally above 7850,Will it close above 7972 ?

- FII's

bought 16 K contract of Index Future worth 994 cores ,45 K Long

contract were added by FII's and 28.9 K short contracts were added by

FII's. Net Open Interest increased by 73.9 K contract, so rise in

market was used by FII's to enter long and enter shorts in Index

futures. The Recency Effect - How it affects Trading

Tuesday, April 26

The Recency Effect - How it affects Trading

Raj had been watching the Nifty futures all morning, waiting

patiently for a trade. Finally,Nifty came near His entry levels based on

his trading system. He looked carefully at the price action he used

to qualify his trades. Everything met his criteria. Price had turned

bullish and signaling long should be taken. “There’s no flaw in the

setup,” he thought.

The trade started working almost immediately. The market moved up smartly, breaking a nearby resistance level and then moved in his direction. The Nifty rallied almost 60 points from the trade entry—an excellent intraday run for this market. But, Alas!! Raj was not on board.

He didn’t take the trade. Why ??

Continue Reading

The trade started working almost immediately. The market moved up smartly, breaking a nearby resistance level and then moved in his direction. The Nifty rallied almost 60 points from the trade entry—an excellent intraday run for this market. But, Alas!! Raj was not on board.

He didn’t take the trade. Why ??

Continue Reading

Nifty holds on 7850 on closing basis,EOD Analysis

- FII's

bought 0.04 K contract of Index Future worth 12 cores ,4.4 K Long

contract were added by FII's and 4.9 K short contracts were added by

FII's. Net Open Interest increased by 9.4 K contract, so fall in market

was used by FII's to enter long and enter shorts in Index futures. How to preserve Mental Capital for Trading

Monday, April 25

Bank Nifty does time correction,EOD Analysis

- As discussed in last analysis Now for coming week Only close above 16800 can fuel the expiry rally towards 17000, else any close below 16500 can see move towards 16350/16300. High made 16767 and low made 16605 so trading in a range and doing time correction. How to preserve Mental Capital for Trading

Continue Reading

How to preserve Mental Capital for Trading

What have been said many time as a trader you need to preserve your

trading capital.But trading is not just about managing your trading

capital, but also about keeping your emotional and psychological capital

intact. Today we will discuss how you can preserve your Mental capital

and why this is more important than trading capital

If you have been an trader you will have experienced a loss. While experiencing a loss is less than enjoyable, the real danger of a losing trade is the threat it poses to your confidence and your mental approach.

Here are some ground rules to keep in mind for trades which do not turn out to be profitable and drain you from Mental capital also when loss becomes TOO BIG.

1. Understand the Every trade will not be a Success

Continue Reading

If you have been an trader you will have experienced a loss. While experiencing a loss is less than enjoyable, the real danger of a losing trade is the threat it poses to your confidence and your mental approach.

Here are some ground rules to keep in mind for trades which do not turn out to be profitable and drain you from Mental capital also when loss becomes TOO BIG.

1. Understand the Every trade will not be a Success

Continue Reading

Saturday, April 23

Bank Nifty struggling near supply zone,EOD Analysis

As discussed in last analysis

As per gann arcs, Support is in range of 16400-16500 and resistance at

16800. Breakout above 16800 for a move towards 17000,Breakdown below

16500 for a move towards 16300-16250. High made 16755 and Low

16549, Now for coming week Only close above 16800 can fuel the expiry

rally towards 17000, else any close below 16500 can see move towards

16350/16300. If only our mind is like a plain mirror

Continue Reading

Friday, April 22

Bank Nifty does 16700, EOD Analyiss

- As discussed in last analysis Till 16000 is held bulls hope are alive for a move till 16500/16700 zone. Bank Nifty made high of 16770 but closed below 16700. As per gann arcs, Support is in range of 16400-16500 and resistance at 16800. Breakout above 16800 for a move towards 17000,Breakdown below 16500 for a move towards 16300-16250. How Fear and Greed affects trading

Continue Reading

Nifty unable to close above 7972,EOD Analysis

- FII's

sold 1.5 K contract of Index Future worth 74 cores ,2.7 K Long

contract were added by FII's and 4.3 K short contracts were added by

FII's. Net Open Interest increased by 7.1 K contract, so fall in market

was used by FII's to enter long and enter shorts in Index futures.How Fear and Greed affects trading

Ashok Leyland PNB and BPCL Technical Levels

Ashok Leyland

Intraday Traders can use the below mentioned levels

Buy above 107.2 Tgt

Continue Reading

Thursday, April 21

How Fear and Greed affects trading

The most difficult aspect of trading is "handling your own emotions"as

a Human Being we are emotional and if emotions are removed out of us

there will not be difference between Robot and Humans. As a trader its

always good to be MINDFUL about our emotions and this is what a great

trader have done, They have not removed emotions but they have becomes MINDFUL about their emotions and handled them.

A loss is a tough thing to get over, and the bigger the loss, the tougher it gets.Almost all professional traders have a short-term memory, for them each trade is a random walk,hence they will mostly not have a overhang of a loss making trade they just did. In other words, the best traders only

Continue Reading

A loss is a tough thing to get over, and the bigger the loss, the tougher it gets.Almost all professional traders have a short-term memory, for them each trade is a random walk,hence they will mostly not have a overhang of a loss making trade they just did. In other words, the best traders only

Grasim Indusind and ONGC Darvas Box Analysis

Grasim

Positional/Swing Traders can use the below mentioned levels

Close above 4094 Tgt 4181/4270

Intraday Traders can use the below mentioned levels

Buy above 4100 Tgt...

Continue Reading

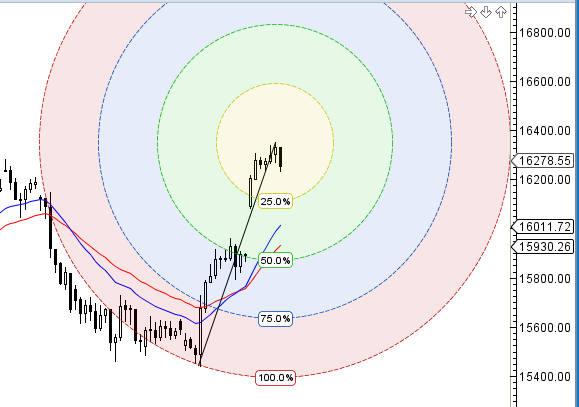

Nifty gets resisted at gann arc, EOD Analysis

- FII's

bought 22.5 K contract of Index Future worth 1328 cores ,17.4 K Long

contract were added by FII's and 5.1 K short contracts were liquidated

by FII's. Net Open Interest increased by 12.3 K contract, so rise in

Nifty market was used by FII's to enter long and exit shorts in Index

futures.Why Retail Traders lose money in Stock market

Wednesday, April 20

Bank Nifty continue with uptrend,EOD Analysis

- As discussed in last analysis Till 16000 is held bulls hope are alive for a move till 16500/16700 zone. Bank Nifty made high of 16386 and low of 16160. Till 16000 is held we can move towards 16500/16700. Why Retail Traders lose money in Stock market

Continue Reading

Why Retail Traders lose money in Stock market

Most of Retail traders tend to think that the FII's have some sort of

secret knowledge/system/Inside News that enables them to make huge

profit in trading. However, the difference between a retail traders

trying to make consistent profit doubling tripling their money in matter

of months and most of them are underfunded and a professional traders

zeros down to the trading mindset and trading psychology. They work more

on mastering their skills instead of focusing on making money.The

difference between success and failure for a trader is wafer thin, Lets

elaborate with an example

A relatively new retail trader is given a profitable trading system having a trading strategy with proper stop loss and target and the trading system delivers an average success rate of 60%. The retail trader is exited that he has finally found something that will ensure his success. Over the course

Continue Reading

A relatively new retail trader is given a profitable trading system having a trading strategy with proper stop loss and target and the trading system delivers an average success rate of 60%. The retail trader is exited that he has finally found something that will ensure his success. Over the course

Adani SKS Micro and Biocon Swing Trading Analysis

Adani

Positional/Swing Traders can use the below mentioned levels

Close above 87 Tgt 87/89

Intraday Traders can use the below mentioned levels

Buy above 84.1 Tgt

Continue Reading

Nifty Bulls held on 7850, EOD Analysis

- FII's

bought 10.6 K contract of Index Future worth 631 cores ,3.6 Long

contract were added by FII's and 7 K short contracts were liquidated by

FII's. Net Open Interest decreased by 3.4 K contract, so rise in Nifty

market was used by FII's to enter long and exit shorts in Index

futures.Do You Fear Missing Out?

Tuesday, April 19

Bank Nifty held on 16000,EOD Analysis

As discussed in last analysis we

had a 3 straight rising day so price will now move and touch the upper

gann arc which comes in range of 16600-16700, Bulls should book some

profit in range of 16650-16700 in coming week. Support is at 16000. Low made was 16011 and high made 16330. Till 16000 is held bulls hope are alive for a move till 16500/16700 zone. Do You Fear Missing Out?

Continue Reading

Monday, April 18

Do You Fear Missing Out?

Regular readers are emailing me lately about the change to a

longer-term Bull trend potentially, as Indian markets are rallying hard

from the low made on 29 Feb at 6825 we almost have seen a 1000 point

rise. The biggest aspect of trading is keeping your mindset stable so as

not to Buy at the Top due to greed and not to Sell at the bottom due to

fear. Today we discuss how to manage the feeling of missing out.

Continue Reading

Developing Self-Discipline in Trading

Having self-discipline in trading is the ability to follow through

your trading plan effortlessly without getting swayed away by news and

views of other traders.

In the trading game, you must have self-discipline.

Continue Reading

“The path of least resistance is what makes all rivers and some men crooked.” – Napoleon HillSelf-discipline is the ability to make the conscious choice (ultimately it becomes a habit) of doing the thing that will move you towards your trading goal – and sometimes it’s the hard or unnatural or unpopular thing to do.

In the trading game, you must have self-discipline.

Arvind SRF and Voltas Trendline Analysis

Arvind

Positional/Swing Traders can use the below mentioned levels

Close above 280 Tgt 288/297

Intraday Traders can use the below mentioned levels

Buy above 277.5 Tgt

Continue Reading

Sunday, April 17

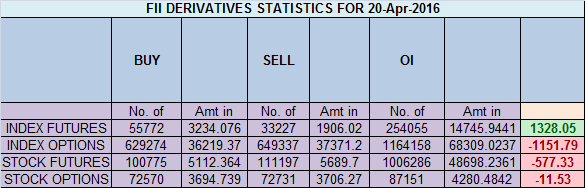

Bank Nifty close above 16188 ,Weekly Forecast

Last Week we gave Chopad Level 15600

Bank Nifty gave Short Entry on Monday did 1 target on downside low

made was 15440 which was near our 1 Target of 15450, again gave long

entry on Monday mid session and did all 3 target on upside by Monday, Lets analyze how to trade Bank Nifty in coming Week as we have only 4 trading days as 19 April is trading Holiday.

As discussed last week Turned from channel resistance and did 16000. Now for coming week break of 15450 will see bank nifty going to 15250/15000 levels. Holding 15450 can lead to fast move till 15700/16000

Gann Circle is drawn above which suggests support

Continue Reading

Bank Nifty Hourly

As discussed last week Turned from channel resistance and did 16000. Now for coming week break of 15450 will see bank nifty going to 15250/15000 levels. Holding 15450 can lead to fast move till 15700/16000

Gann Circle is drawn above which suggests support

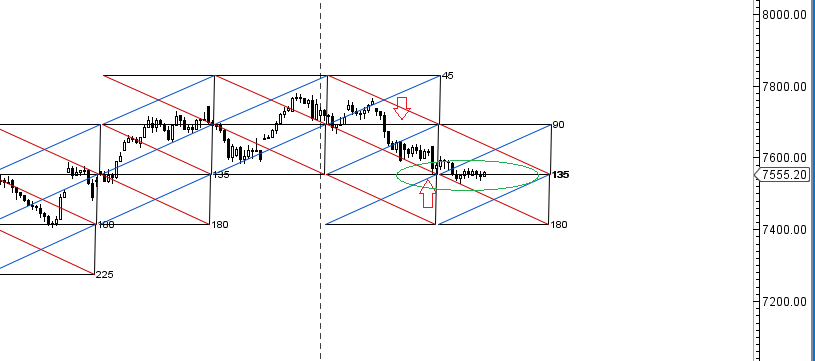

Nifty near crucial gann price and time level of 7850,Weekly Forecast

Last Week we gave Chopad Levels of 7546 ,

Nifty gave Short entry on Monday and got Stopped out on Monday and

again gave Long Entry on Monday which did all 3 target by Wednesday.

Last Week close was at a very crucial gann level of 7850 where we have

price and time sqaure so if 7850 is held we can see a move towards

8100/8250 in coming weeks. Lets analyses how to trade nifty in coming

week as we have only 4 trading days as 19 April is trading Holidays.

Nifty hourly broke 135 degree on 11 April after giving whipsaw and than saw a quick move towards 45 degree as shown above, Holding 7850 on Upside will

Continue Reading

Nifty Hourly Chart

Nifty hourly broke 135 degree on 11 April after giving whipsaw and than saw a quick move towards 45 degree as shown above, Holding 7850 on Upside will

Saturday, April 16

Will Nifty break 7950/7972 resistance zone, EOD Analysis

- FII's

bought 29.3 K contract of Index Future worth 1679 cores ,32.5 Long

contract were added by FII's and 3.2 K short contracts were added by

FII's. Net Open Interest increased by 35.8 K contract, so rise in Nifty

market was used by FII's to enter long and enter small shorts in

Index futures.RICH DENNIS: A GUNSLINGER NO MORE

Bank Nifty gives breakout above 16000,EOD Analysis

As discussed in last analysis Till 15700 is held move towards 16100-16130 is very much possible, bearish only on close below 15500.

Bank Nifty touched the gann arc on 11 April where we have gann time

analysis also suggesting big move possible and we had a 3 straight

rising day so price will now move and touch the upper gann arc which

comes

Continue Reading

Friday, April 15

RICH DENNIS: A GUNSLINGER NO MORE

The 1980s' superstar commodities trader, is now doing what his computer tells him

For years, Richard J. Dennis lived by his wits in the commodity markets--and quite a living it was. His knack for the quick kill made him an estimated $200 million in the 1980s and brought him fame unmatched by any other futures trader. Then his instincts failed him. By the early 1990s, having lost tens of millions for his customers, he quit the business. Now, he's trading again, with a difference.

Instead of acting directly on his thoughts, theories, and impulses, Dennis translates them into computer programs. When those bits and bytes align with market prices, the computer orders a trade. Under an agreement with a third-party broker who controls most of his customer funds, Dennis must follow the system. No matter what his gut tells him, discretion isn't allowed. So far, the deal has paid off: With a 111% gain in 1996, Dennis once again ranked among the world's top-performing commodity traders. ''The left side of my brain has put the right side out of business,'' the soft-spoken 48-year-old explains.

HUGE LOSSES. Dennis' transformation

Continue Reading

For years, Richard J. Dennis lived by his wits in the commodity markets--and quite a living it was. His knack for the quick kill made him an estimated $200 million in the 1980s and brought him fame unmatched by any other futures trader. Then his instincts failed him. By the early 1990s, having lost tens of millions for his customers, he quit the business. Now, he's trading again, with a difference.

Instead of acting directly on his thoughts, theories, and impulses, Dennis translates them into computer programs. When those bits and bytes align with market prices, the computer orders a trade. Under an agreement with a third-party broker who controls most of his customer funds, Dennis must follow the system. No matter what his gut tells him, discretion isn't allowed. So far, the deal has paid off: With a 111% gain in 1996, Dennis once again ranked among the world's top-performing commodity traders. ''The left side of my brain has put the right side out of business,'' the soft-spoken 48-year-old explains.

HUGE LOSSES. Dennis' transformation

Do you know your Risk of Ruin in trading ?

As traders one of the most important but neglected topic is Risk

Management. If you want to become a consistent profitable trader risk

management needs to be mastered upon. It is what keeps us in the game

as traders.

During my interaction with traders I am often surprised to find that many traders have no idea of what their Risks are. This involves Risk per trade, per day, per week/month and overall Risk of Ruin. Most traders are aware of Risk per trade or per day, however very few are familiar with Risk of Ruin.

In Trading it refers to the amount of

Continue Reading

During my interaction with traders I am often surprised to find that many traders have no idea of what their Risks are. This involves Risk per trade, per day, per week/month and overall Risk of Ruin. Most traders are aware of Risk per trade or per day, however very few are familiar with Risk of Ruin.

What is Risk of Ruin?

Risk of ruin is a concept in gambling, insurance, and finance relating to the likelihood of losing all one's capital or impacting one's bankroll to the point that it cannot be recovered. For instance, if someone bets all their money on a simple coin toss, the risk of ruin is 50%. In a multiple-bet scenario, risk of ruin correlates with the number of bets, in which risk increases the longer one plays.In Trading it refers to the amount of

Thursday, April 14

How to trade the Pin Bar Trade Set up

Technical analysis includes a broad array of technical indicators and

ways to analyze price history, but one of the best kept secrets of

technical analysis is a rather simple, but extremely powerful price

action signal called the pin bar. The pin bar was first coined by

Martin Pring, a famous technician in his own right. In the mid-2000’s,

Pring wrote an excellent book entitled, Pring on Price Patterns, and in

it Pring discusses the pin bar.

The pin bar formation is a price action reversal pattern that shows that a certain level or price point in the market was rejected.

The Pin Bar

Before we delve into discussion on how to trade a pin bar, let’s take a look at one:

Continue Reading

The pin bar formation is a price action reversal pattern that shows that a certain level or price point in the market was rejected.

The Pin Bar

Before we delve into discussion on how to trade a pin bar, let’s take a look at one:

Continue Reading

Wednesday, April 13

Secrets of Highly Profitable Traders Part-1

Highly profitable traders are not born, they are made.

They do not rely on pure luck to make consistent earnings but on their

calculated moves when trading in stocks/Forex/commodities.

Today lets discuss the Qualities of Top trader.

1. Discipline

Without discipline, none of the other qualities matter. It is possible for any trader to invest some money in a account, enter their very first trade and make a high profit and repeat the process and make profits for a short duration of time.The story of most of retail trader, but what differentiate professional from retail trade is:

However, it is only a

Continue Reading

Today lets discuss the Qualities of Top trader.

1. Discipline

Without discipline, none of the other qualities matter. It is possible for any trader to invest some money in a account, enter their very first trade and make a high profit and repeat the process and make profits for a short duration of time.The story of most of retail trader, but what differentiate professional from retail trade is:

However, it is only a

Breakout Stocks: CESC SHRIRAM and Wockphamra

CESC

Positional/Swing Traders can use the below mentioned levels

Close above 500 Tgt 521

Intraday Traders can use the below mentioned levels

Buy above 494 Tgt

Continue Reading

Will Nifty break 7740 and close above it,EOD Analysis

- FII's

bought 2.4 K contract of Index Future worth 116 cores ,4.8 Long

contract were liquidated by FII's and 7.3 K short contracts were

liquidated by FII's. Net Open Interest increased by 12.1 contract, so

rise in Nifty market was used by FII's to exit long and exit shorts in

Index futures.Build your Trading Confidence

Will Bank Nifty break 16000,EOD Analysis

As discussed in last analysis Closing above 15704 suggesting we can see move towards 16100-16130 zone.

Low made today was 15794 and bank nifty continue to move higher. Till

15700 is held move towards 16100-16130 is very much possible, bearish

only on close below 15500. We have 2 trading holidays after tomorrow

close. Developing Self-Discipline in Trading

Continue Reading

Continue Reading

Tuesday, April 12

Developing Self-Discipline in Trading

Having self-discipline in trading is the ability to follow through

your trading plan effortlessly without getting swayed away by news and

views of other traders.

In the trading game, you must have self-discipline.

Continue Reading

“The path of least resistance is what makes all rivers and some men crooked.” – Napoleon HillSelf-discipline is the ability to make the conscious choice (ultimately it becomes a habit) of doing the thing that will move you towards your trading goal – and sometimes it’s the hard or unnatural or unpopular thing to do.

In the trading game, you must have self-discipline.

VEDL UPL and Ashok Harmonic Analysis

VEDL

Positional/Swing Traders can use the below mentioned levels

Close above 91 Tgt 94/97

Intraday Traders can use the below mentioned levels

Buy above 91.2 Tgt

Continue Reading

Monday, April 11

Nifty bounces from demand zone,EOD Analysis

- FII's

sold 371 contract of Index Future worth 28 cores ,685 Long

contract were added by FII's and 1 K short contracts were added by

FII's. Net Open Interest increased by 371 contract, so rise in Nifty

market was used by FII's to enter long and enter shorts in Index

futures.Build your Trading Confidence

Bank Nifty bounces from gann arc,EOD Analysis

- As discussed in last analysis Breakout above 15650 and breakdown below 15450, in between will remain choppy. Low made today 15440 near gann arc, as soon as its touched Bank Nifty reacted violently moving almost 200 points in matter of minutes and bank nifty broke above 15650, and closing above 15704 suggesting we can see move towards 16100-16130 zone. Build your Trading Confidence

Continue Reading

Build your Trading Confidence

Confidence can be an important psychological tool for the trader –

important enough to make the difference between a winning trade and a

losing trade. When you develop your trading plan, it is obviously

important that you have confidence in its accuracy and usefulness and in

your belief that you can follow your plan closely and execute it

successfully. To explain the same let me give a recent example where we have been discussing on the importance of 7546 on

Continue Reading

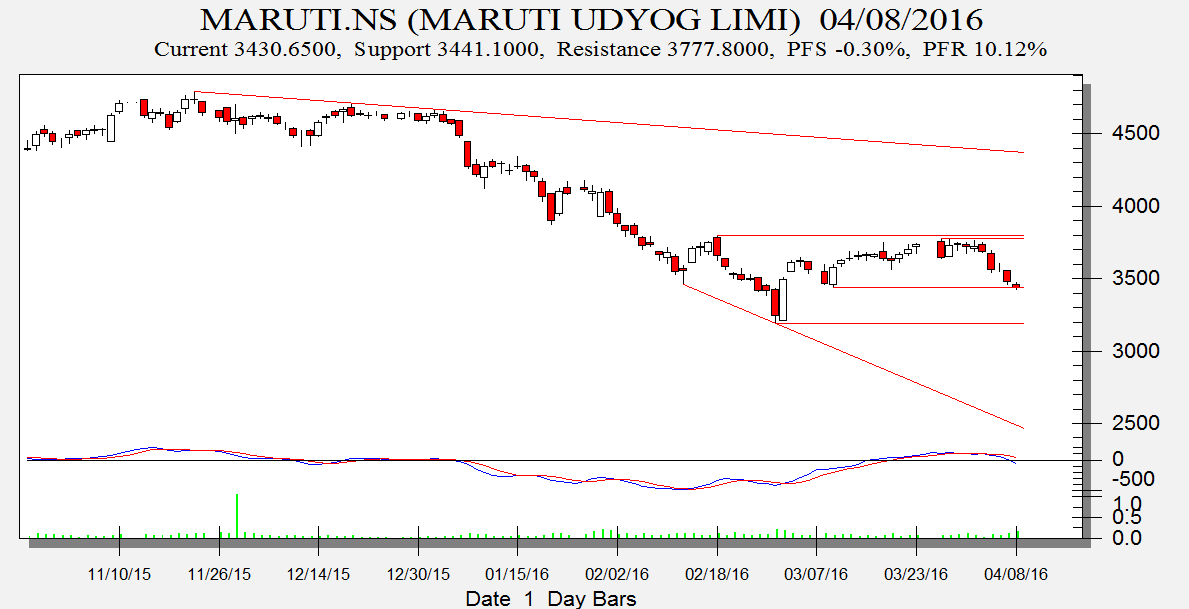

Maruti Axis Bank and Just Dial Trendline Technical Analysis

Maruti

Positional/Swing Traders can use the below mentioned levels

Close above 3445 Tgt 3571

Intraday Traders can use the below mentioned levels

Buy above 3445 Tgt..

Continue Reading

Sunday, April 10

Bank Nifty Weekly Forecast for 11-13 April

Last Week we gave Chopad Level 16200 Bank Nifty gave Short Entry on Monday as close below chopad level of 16200 and did all 3 target on downside by Thuesday, Lets analyze how to trade Bank Nifty in coming Week as we have only 3 trading days as 14 and 15 are trading Holidays.

As discussed last week Now for coming week 16350 needs to be watched as its channel top, crossing the same we are heading towards 16500/16900, else we will go down till 16000.

Turned from channel resistance

Continue Reading

Bank Nifty Hourly

As discussed last week Now for coming week 16350 needs to be watched as its channel top, crossing the same we are heading towards 16500/16900, else we will go down till 16000.

Turned from channel resistance

Nifty Weekly Forecast for 11-13 April

Last Week we gave Chopad Levels of 7740 ,

Nifty gave Long entry on Monday and got Stopped out on Tuesday at

opening but gave Short entry as Open was 7736 below chopad levels and

did all 3 target by Tuesday hence rewarding disciplined chopad levels .

Lets analyses how to trade nifty in coming week as we have only 3 trading days as 14 and 15 are trading Holidays.

Nifty hourly broke 90 degree on RBI day saw a quick move twoards 135 degree as shown with arrows, Now consolidating around 135 degree, Break of 7570 on Upside

Continue Reading

Nifty Hourly Chart

Nifty hourly broke 90 degree on RBI day saw a quick move twoards 135 degree as shown with arrows, Now consolidating around 135 degree, Break of 7570 on Upside

Saturday, April 9

Nifty Holds 7546 on Weekly Basis,EOD Analysis

- FII's

sold 15.3 K contract of Index Future worth 897 cores ,6.2 K Long

contract were liquidated by FII's and 9 K short contracts were added by

FII's. Net Open Interest increased by 2.8 K contract, so rise in Nifty

market was used by FII's to exit long and enter shorts in Index

futures.Safest place for a ship is the harbour but it was never built to stay there....

Bank Nifty continue to struggles in Gann Arc,EOD Analysis

- Bank Nifty today closed above 15550 but took support and resistance at gann arc as shown below, suggesting both bull and bears are in dilemma, Breakout above 15650 and breakdown below 15450, in between will remain choppy. Safest place for a ship is the harbour but it was never built to stay there....

Continue Reading

Thursday, April 7

Do you want to be "Perfect" in Trading

Raj puts many hours into his trading in more ways than one. He

studies the charts. He has his trading Journal and has all data a trader

need to analyze . He’s glued to the screen during market hours and

analyzing his traders after market hours and doing proper homework.

Raj is a hard worker; working hard is second nature to him. He worked hard to get into the right college, earned a degree in engineering from IIT and IIM and got his dream job.

The freedom to be his own boss is what brought Raj into trading. Master of his own destiny.

With all his hard work, Raj is..

Continue Reading

Raj is a hard worker; working hard is second nature to him. He worked hard to get into the right college, earned a degree in engineering from IIT and IIM and got his dream job.

The freedom to be his own boss is what brought Raj into trading. Master of his own destiny.

With all his hard work, Raj is..

JSW Steel REC and LUPIN Darvas Box Analysis

JSW Steel

Positional/Swing Traders can use the below mentioned levels

Close above 1300 Tgt 1340/1364

Intraday Traders can use the below mentioned levels

Buy above 1300 Tgt..

Continue Reading

Will Nifty Hold support of 7582-7545,EOD Analysis

- FII's

sold 13.1 K contract of Index Future worth 769 cores ,8.9 K Long

contract were liquidated by FII's and 4.1 K short contracts were added

by FII's. Net Open Interest decreased by 4.7 K contract, so fall in

Nifty market was used by FII's to exit long and enter shorts in Index

futures.The Confident Trader

Wednesday, April 6

Will Bank Nifty hold gann arc for next 2 days,EOD Analysis

As discussed in Last Analysis We

are at a very crucial junction for next 2 days, as we are near supply

zone of 15700 and also near gann arc, Holding the same we will again

bounce towards 16000/16300, break of same we will be going back towards

15300. Bank Nifty today closed below the demand zone of 15700

but took support at gann arc as shown below, If we close below todays

low of 15550 we can see fast move towards 15300/15250, else can see fast

up move above 15700 towards 15950/16000. The Confident Trader

Continue Reading