Nifty break 7000, Will it close below 200 WSMA,EOD Analysis

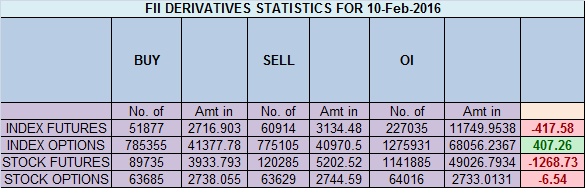

- FII's

bought 8.5 K contract of Index Future worth 415 cores ,10.4 K Long

contract were added by FII's and 1.8 K short contracts were added by

FII's. Net Open Interest increased by 12.2 K contract, so fall in

market was used by FII's to enter long and enter shorts in Index

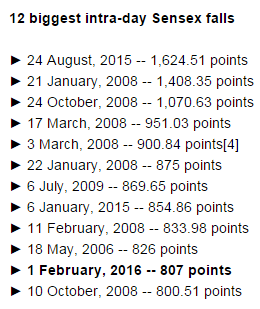

futures. Nifty Crashes 1000 Points in 2016 :Reason for sharp fall